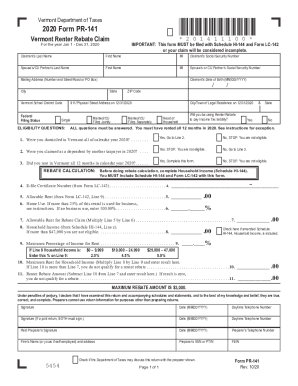

VT DoT PR-141 2007 free printable template

Show details

Preparer s signature Preparer s Use Only Check if self-employed Firm s name or yours if self-employed and address Preparer s SSN or PTIN EIN Preparer s Telephone Number MAIL TO VT Department of Taxes PO Box 1881 Montpelier VT 05601-1881 Form PR-141 Instructions for Form PR-141 Renter Rebate Claim The Renter Rebate Program assists eligible renters by refunding the portion of rent paid that exceeds the established percentage of household income. DUE DATE April 15 2008 Claims allowed up to Sept....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign vermont renter rebate claim

Edit your vermont renter rebate claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vermont renter rebate claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vermont renter rebate claim online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit vermont renter rebate claim. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT DoT PR-141 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out vermont renter rebate claim

How to fill out VT DoT PR-141

01

Obtain the VT DoT PR-141 form from the Vermont Department of Transportation website or office.

02

Fill in the personal information section, including your name, address, and contact details.

03

Provide the vehicle information such as make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the purpose of the form, such as a registration, title transfer, or other request.

05

Review the form for completeness and accuracy.

06

Sign and date the form where indicated.

07

Submit the completed form either online, by mail, or in person at your local DMV office.

Who needs VT DoT PR-141?

01

Anyone looking to register a vehicle, transfer a title, or make necessary vehicle updates in Vermont.

02

Individuals who are involved in vehicle sales or purchases in Vermont.

Fill

form

: Try Risk Free

People Also Ask about

What is the first time homebuyer tax credit in Vermont?

In Vermont, first-time homebuyers, qualifying veterans and those purchasing in specific target areas are eligible for a mortgage credit certificate (MCC), a tax credit on their mortgage interest equal to up to $2,000 per year.

What is renters credit?

The Nonrefundable Renter's Credit is a credit for California residents who: paid rent for their main residence at least 6 months in 2022, had adjusted gross income (AGI) under the limit for their filing status.

What is a Vermont Form LC 142?

The Vermont Department of Taxes has released guidance for Landlords on how to report any Rental Housing Stablization Program (RHSP) funds received.

Who is eligible for the Vermont property tax credit?

In order to file a Vermont Property Tax Credit Claim, you must meet ALL of the following eligibility requirements: Your property qualifies as a homestead, and you have filed a Homestead Declaration for the 2022 grand list. You were domiciled* in Vermont for the entire 2021 calendar year.

How do I claim my renters rebate in Vermont?

Online: The Renter Credit Claim can be filed electronically through your tax software or directly in myVTax. Paper Returns: To file a paper claim, download a copy of form RCC-146, Renter Credit Claim or you may request paper forms be mailed to you.

Do seniors get property tax break in Vermont?

Vermont Property Tax Breaks for Retirees For 2022, senior homeowners with 2021 household income of $136,900 or less may qualify for a property tax credit of up to $8,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete vermont renter rebate claim online?

Completing and signing vermont renter rebate claim online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for the vermont renter rebate claim in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your vermont renter rebate claim.

How do I edit vermont renter rebate claim on an iOS device?

You certainly can. You can quickly edit, distribute, and sign vermont renter rebate claim on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is VT DoT PR-141?

VT DoT PR-141 is a form used by the Vermont Department of Transportation (DoT) to report vehicle miles traveled (VMT) and related information for transportation planning and funding purposes.

Who is required to file VT DoT PR-141?

Individuals or organizations that operate commercial motor vehicles in Vermont may be required to file the VT DoT PR-141, particularly if they are subject to state or federal reporting regulations.

How to fill out VT DoT PR-141?

To fill out VT DoT PR-141, provide the requested information regarding vehicle operations, including total miles traveled, types of vehicles, and any relevant identification numbers as specified in the form's instructions.

What is the purpose of VT DoT PR-141?

The purpose of VT DoT PR-141 is to collect data on vehicle usage to support infrastructure planning, road maintenance funding, and to promote efficient transportation systems within Vermont.

What information must be reported on VT DoT PR-141?

VT DoT PR-141 requires reporting on details such as the total number of miles driven by the reporting entity, types of vehicles operated, and registration or identification details as prescribed in the form.

Fill out your vermont renter rebate claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vermont Renter Rebate Claim is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.