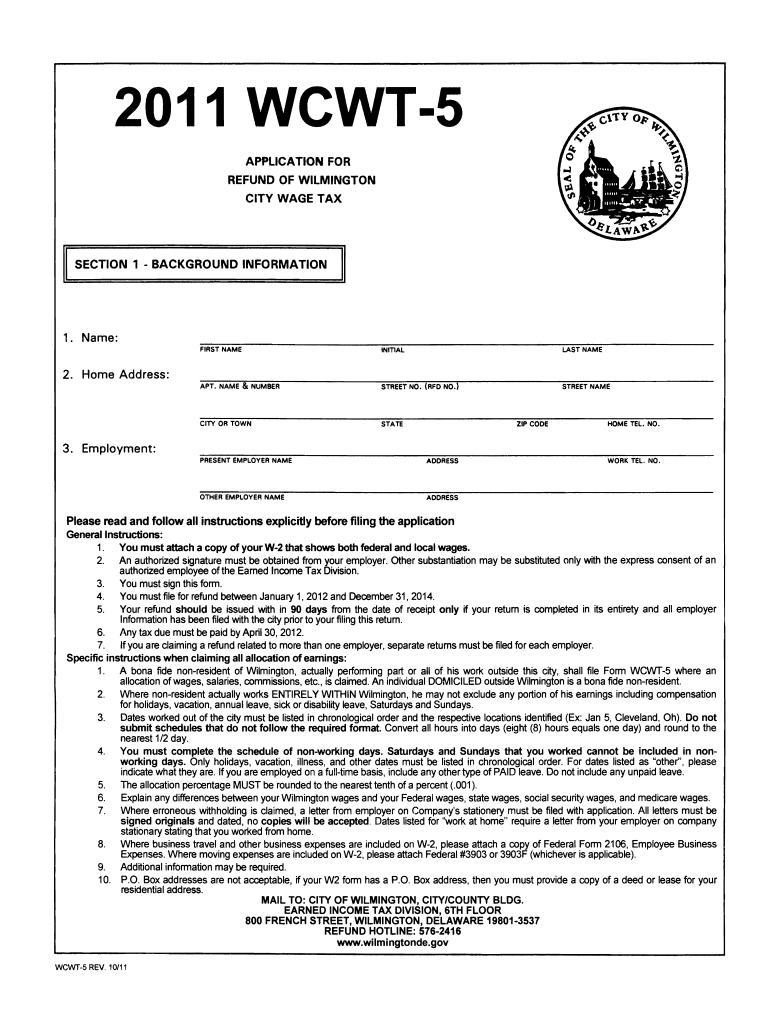

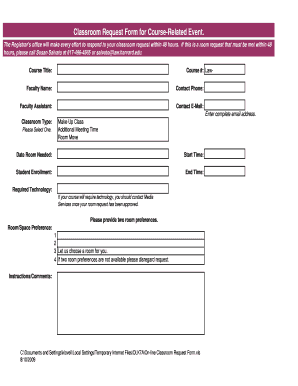

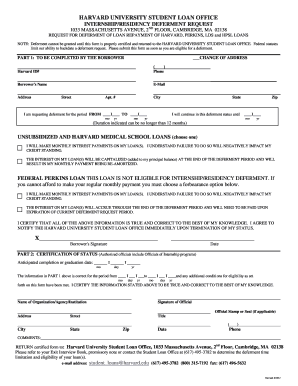

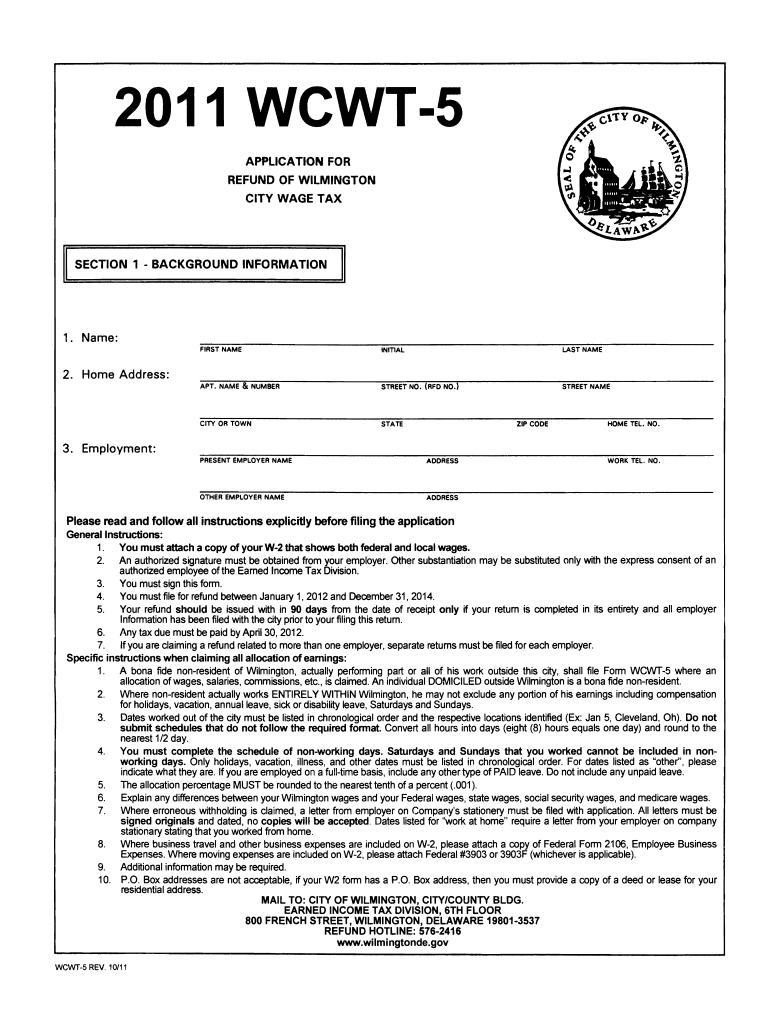

DE WCWT-5 - Wilmington 2011 free printable template

Get, Create, Make and Sign

How to edit claiming earned income tax online

DE WCWT-5 - Wilmington Form Versions

How to fill out claiming earned income tax

How to fill out claiming earned income tax:

Who needs claiming earned income tax:

Instructions and Help about claiming earned income tax

A while back I was eating lunch with some co-workers, and we were debating about just how far you would sink if you jumped into a pool of these water balls For example would it go up to your calf or to like your waist or all the way above your head Everyone seemed to have a different theory in fact I asked about a hundred people, and you can see how much the guess is varied so as a firm believer in the scientific method I decided to test our hypotheses So I'm here today in the backyard of the backyard scientist so for the past six months we've been stockpiling these water balls in Kevin's backyard, and today it's finally the moment of truth all right you ready for this let's do it so take a moment to guess in the comments below of how far you think we'll sink, and then we'll see if you're right For the record I think I will sink to about here okay we go This Feels so crazy This feels like compressed on all sides but it's so smooth and like slippery So it looks like I was wrong by quite a bit, and we have to reject the null hypothesis So now what I decided to call up my nephews you guys want to come swimming at my friend's house in my ongoing quest to be the favorite uncle only I might have forgotten to tell them there'd be no water in the pool also that Kevin was right there You guys ready to go swimming in this But before we go swimming in 25 million been let's talk about why I was wrong It has to do with buoyancy so here's a riddle when this ice melts will the water level go up or down as you can see here it actually doesn't change at all Archimedes taught us that you displace your weight in water, so this baseball weighs about 135 grams and when I put it in water it will sink until it is pushed out 135 grams worth of water at which point it's in equilibrium, and it floats and since the waterline is about halfway up the baseball you know it's about half as dense as water and this is why Scooby-Doo quicksand is pure lies you sink until you've displaced your weight in quicksand and since it's about twice as dense as a person you Bob like a cork about halfway down, and it's impossible to sink, so Areas relax your horse is going to float So I will keep sinking in Been until I have displaced my weight in Been and since they're a little denser than me and taking account the packing efficiency of a sphere surrounded by water the fact that about 85 percent of me sank makes sense I thought the friction between the balls would play a bigger role which is why I guessed halfway, so I was wrong but a lot of times that's more fun because that means the result was unexpected, and you learn something okay back to the pool Guess where my foot is So a huge thanks to Kevin for letting us use his pool he actually also made a video we did eight crazy experiments with a pool full of water balls so go check that out because his footage is amazing as always I also want to thank Squarespace for helping to make this video possible you guys know I've been using them...

Fill form : Try Risk Free

People Also Ask about claiming earned income tax

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your claiming earned income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.