DE WCWT-5 - Wilmington 2010 free printable template

Show details

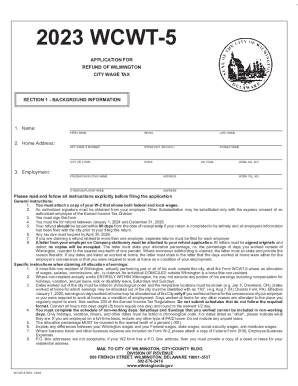

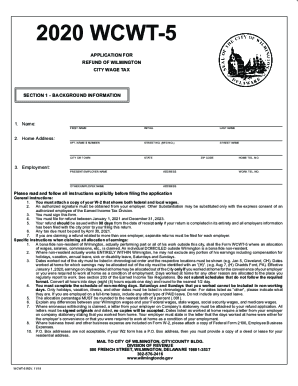

2010 WCWT-5 APPLICATION FOR REFUND OF WILMINGTON CITY WAGE TAX SECTION 1 - BACKGROUND INFORMATION 1. Specific instructions when claiming all allocation of earnings A bona fide non-resident of Wilmington actually performing part or all of his work outside the city shall file Form WCWT-5 when an allocation of wages salaries commissions etc. is claimed. An individual DOMICILED outside Wilmington is a bona fide non-resident. Name FIRST NAME INITIAL LAST NAME APT. NAME NUMBER STREET NO. RFD NO....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your wilmington city wage tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wilmington city wage tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wilmington city wage tax refund form 2020 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit wilmington city tax refund form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

DE WCWT-5 - Wilmington Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out wilmington city wage tax

How to fill out Wilmington City Wage Tax:

01

Obtain the necessary forms from the City of Wilmington website or local tax office.

02

Fill out your personal information, including your name, address, and Social Security number.

03

Provide information about your employer, including their name, address, and employer identification number.

04

Calculate your total wages earned within the city of Wilmington during the specified tax period.

05

Determine any exemptions or deductions that may apply to you and subtract them from your total wages.

06

Calculate the amount of tax owed based on the current tax rate.

07

Complete any additional sections or schedules required by the City of Wilmington.

08

Double-check your forms and calculations for accuracy.

09

Sign and date the forms before submitting them to the appropriate tax office.

Who needs Wilmington City Wage Tax:

01

Individuals who live or work within the city limits of Wilmington, Delaware.

02

Employees whose employers are located within the city of Wilmington.

03

Self-employed individuals who conduct business activities within the city of Wilmington.

Fill form : Try Risk Free

People Also Ask about wilmington city wage tax refund form 2020

Do I need to file a Wilmington tax return?

Who pays Wilmington City tax?

What is the city of Wilmington wage tax area?

Who is required to file a Delaware tax return?

Does Wilmington Delaware have a wage tax?

How do I file my Philly wage tax refund?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is wilmington city wage tax?

The Wilmington City Wage Tax is a tax imposed on the earned income of individuals who work in the city of Wilmington, Delaware. It is a local tax that is separate from state and federal income taxes. The current rate of the Wilmington City Wage Tax is 1.25% of an individual's gross earned income. This tax is collected by the city government and used to fund various public services and programs in the city.

Who is required to file wilmington city wage tax?

Residents and non-residents who work in Wilmington, Delaware are required to file the Wilmington City Wage Tax. This tax is a local income tax imposed on individuals who earn income within the city limits.

How to fill out wilmington city wage tax?

To fill out the Wilmington city wage tax, you will need to follow these steps:

1. Obtain the necessary forms: Visit the official website of the City of Wilmington or contact the City to obtain the appropriate forms for filing the city wage tax. The forms may include the Annual Reconciliation of Employee Earnings Tax Withheld (Form W-3), Employee Earnings Tax Coupons (Form W-4), and instructions.

2. Gather required information: Collect all the relevant information needed to complete the forms. This includes the employer identification number (EIN), employee information (name, address, social security number), and details of wages earned and city wage taxes withheld during the tax period.

3. Complete the Annual Reconciliation form: Fill out the Annual Reconciliation of Employee Earnings Tax Withheld (Form W-3) by providing the requested information for each employee. This includes their name, social security number, total wages earned, city wage tax withheld, and any adjustments or exemptions applicable.

4. Complete the Employee Earnings Tax Coupons: Use the Employee Earnings Tax Coupons (Form W-4) to calculate the total amount of city wage tax withheld for each individual employee. Ensure accuracy and legibility while completing these coupons.

5. Retain copies and submit: Make copies of all the completed forms for your records. Depending on the instructions provided by the City of Wilmington, submit the original forms, along with any required payment, to the designated address. It is crucial to meet the deadline for filing to avoid penalties.

6. Seek assistance if needed: If you encounter any difficulties or have questions while filling out the forms, reach out to the City of Wilmington's Department of Finance or consult a tax professional for guidance.

Remember, since tax laws and regulations may change, it's essential to refer to the official guidelines and instructions provided by the City of Wilmington or consult with a tax professional to ensure accurate and compliant filing.

What is the purpose of wilmington city wage tax?

The purpose of the Wilmington city wage tax is to generate revenue for the city of Wilmington, Delaware. This tax is levied on individuals who earn an income within the city limits, whether they live within the city or not. The revenue generated from this tax helps fund various city services and infrastructure, such as public safety, education, healthcare, transportation, and other municipal functions. It is a way for the city government to finance its operations and provide essential services to residents and businesses within the city.

What information must be reported on wilmington city wage tax?

The specific information that must be reported on Wilmington city wage tax may vary based on the specific rules and regulations of the city. However, generally, the following information may need to be reported:

1. Employee Information: This includes the name, address, social security number, and any other relevant employee identification details.

2. Wage and Earnings Information: The amount of wages, salaries, tips, commissions, bonuses, and any other forms of compensation earned by each employee during the tax period.

3. Taxable Income: The taxable income, which is determined by subtracting any applicable deductions and exemptions from the gross wages.

4. Withheld Tax Amount: The amount of city wage tax withheld from the employee's wages during the period.

5. Employer Information: The name, address, and any other relevant identification details of the employer.

6. Pay Period Details: The dates covered by the pay period for which the tax is being reported.

7. Tax Calculation: The calculation method used to determine the amount of tax withheld from the employee's wages, including any applicable tax rates.

It's important to note that the exact reporting requirements and forms may differ based on the specific regulations and guidelines of the Wilmington city wage tax authorities. Therefore, it is advisable to consult the relevant tax authority or a tax professional for accurate and up-to-date information.

When is the deadline to file wilmington city wage tax in 2023?

The specific deadline to file the Wilmington city wage tax in 2023 may vary depending on the city's regulations and any potential changes to tax laws. It is recommended to consult the official website of the Wilmington city government or contact the local tax authorities for the most accurate and up-to-date information regarding tax filing deadlines.

What is the penalty for the late filing of wilmington city wage tax?

The penalty for late filing of the Wilmington city wage tax is 5% of the unpaid tax due per month, or fraction thereof, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax balance at a rate of 1% per month, or fraction thereof.

Can I create an eSignature for the wilmington city wage tax refund form 2020 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your wilmington city tax refund form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the wcwt 5 form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign 2020 wcwt 5. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit wcwt 5 instructions on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign wilmington city wage tax refund form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your wilmington city wage tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wcwt 5 Form is not the form you're looking for?Search for another form here.

Keywords relevant to city of wilmington tax refund form

Related to application for refund of wilmington city wage tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.