NY C-11 2011 free printable template

Show details

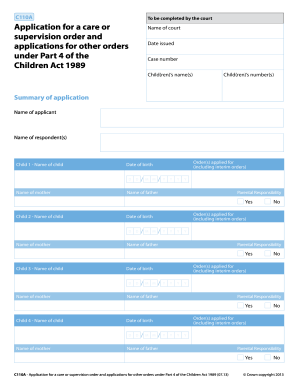

Date of first full day employee lost from work C-11/EC-11 11. Nature of Injury 12. Date employee returned to work 13. STATE OF NEW YORK WORKERS COMPENSATION BOARD EMPLOYER S REPORT OF INJURED EMPLOYEE S CHANGE IN EMPLOYMENT STATUS RESULTING FROM INJURY This report is to be filed directly with the Chair Workers Compensation Board at the address shown on reverse side as soon as the employment status of an injured employee as reported on First Report of Injury or on a previous Form C-11 or EC-11...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY C-11

Edit your NY C-11 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY C-11 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY C-11 online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY C-11. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY C-11 Form Versions

Version

Form Popularity

Fillable & printabley

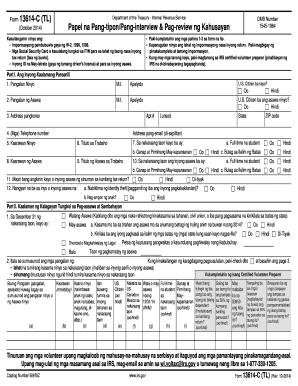

How to fill out NY C-11

How to fill out NY C-11

01

Obtain the NY C-11 form from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill in your personal information including your name, address, and contact details at the top of the form.

03

Enter the reason for submitting the NY C-11 form in the designated section, providing a clear and concise explanation.

04

Complete any applicable sections related to your business or entity, including tax ID numbers or other relevant identifiers.

05

Double-check the form for any missing information or errors before submitting.

06

Sign and date the form to validate your submission.

07

Make a copy of the completed form for your records.

08

Submit the form to the appropriate New York State tax office either by mail or through online options if available.

Who needs NY C-11?

01

Individuals or businesses that are required to adjust or amend their tax filings in New York State.

02

Taxpayers who need to report a change in their business status or address.

03

Those who have received communication from the New York State tax office regarding discrepancies in their filings.

Fill

form

: Try Risk Free

People Also Ask about

How long does employee have to report injury in NY?

Notify Your Supervisor of Your Injury Written notification should be provided to your employer as soon as possible, but within 30 days. If you fail to notify your employer, within 30 days after the date of injury, you may lose your rights to workers' compensation benefits.

Who is exempt from workers compensation in NY?

Workers' Compensation coverage is not required if the business is a one or two person owned corporation, with those individuals owning all of the stock and holding all offices of the corporation (each individual must hold an office and own at least one share of stock).

Do members of an LLC need workers comp in NY?

Workers' compensation coverage IS NOT required for partnerships, LLCs, and LLPs that do not have employees. Members and partners are not considered employees for the purposes of obtaining workers' compensation insurance, but may voluntarily cover themselves under a workers' compensation policy.

Do I need workers comp insurance for myself in NY?

Workers' compensation coverage is required for sole proprietors with employees, including part-time employees, borrowed employees, leased employees, family members, and volunteers (WCL §3 Groups 1-14-a).

What is Section 11 of the New York Workers Compensation Law?

Section 11 of the New York Workers' Compensation Law also bars third parties from suing an injured worker's employer for contribution or contractual indemnification unless the employee has sustained a “grave injury” as defined by law.

Who is exempt from workers compensation insurance in NY?

Exceptions to NYS Workers' Compensation Requirements Sole proprietors. A partnership under the laws of New York State. A one- or two-person owned company with those individuals owning all the stock and holding offices of the corporation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NY C-11?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific NY C-11 and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an eSignature for the NY C-11 in Gmail?

Create your eSignature using pdfFiller and then eSign your NY C-11 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out the NY C-11 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign NY C-11. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is NY C-11?

NY C-11 is a form used by New York State for reporting certain tax-related information, typically related to the income tax of businesses.

Who is required to file NY C-11?

Businesses operating in New York State that meet specific income criteria or have certain tax obligations are required to file NY C-11.

How to fill out NY C-11?

To fill out NY C-11, you need to provide information about your business income, deductions, and any applicable tax credits. Accurate financial records should be used to complete the form.

What is the purpose of NY C-11?

The purpose of NY C-11 is to collect information from businesses for tax assessment and compliance, ensuring that they meet their tax obligations under New York State law.

What information must be reported on NY C-11?

NY C-11 requires reporting business income, expenses, deductions, tax credits, and other financial data pertinent to calculating taxes owed to New York State.

Fill out your NY C-11 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY C-11 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.