Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

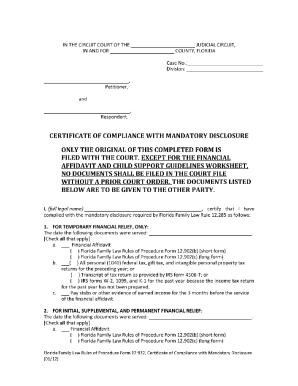

What is florida mandatory disclosure form?

The Florida Mandatory Disclosure Form is a document that sellers of residential properties in the state of Florida are required by law to provide to potential buyers. The form serves to disclose certain material facts and conditions about the property, including any known defects, hazards, or legal issues that may affect its value or desirability. It covers various aspects such as the property's physical condition, structural and mechanical systems, plumbing and electrical systems, environmental concerns, any ongoing litigation or pending permits affecting the property, and other relevant information. The purpose of the form is to ensure transparency and protect buyers from unknowingly purchasing properties with undisclosed problems or issues.

Who is required to file florida mandatory disclosure form?

In Florida, both parties in a divorce or paternity case are required to file a mandatory disclosure form. This form includes financial documents and information that must be exchanged between the parties, in order to ensure transparency and fairness during the legal process.

How to fill out florida mandatory disclosure form?

To fill out the Florida mandatory disclosure form, follow these steps:

1. Download the Florida mandatory disclosure form from the Florida Courts website or obtain a copy from your attorney.

2. Begin by filling out the header section of the form, which includes the names of the parties involved in the case, the case number, and the name of the court where the case is being heard.

3. Read the instructions carefully before proceeding to ensure you understand each section and requirement.

4. Start with Section I: Financial Affidavit. Provide accurate and complete information about your income, expenses, assets, liabilities, and any other financial information requested in this section. Fill out all applicable fields, providing supporting documentation where required.

5. Proceed to Section II: Child Support Guidelines Worksheet. If your case involves child support, complete this section by entering income information, child care expenses, and any other relevant details. Use the Florida Child Support Guidelines to calculate the appropriate child support amount.

6. Move on to Section III: Mandatory Disclosure. This section requires disclosure of certain documents and information that is necessary for the court to make fair decisions. Provide the necessary details and attach the requested documents as indicated in the form instructions.

7. Continue to Section IV: Other Matters. This section covers additional information required for specific cases, such as alimony, parenting plans, or child custody matters. Complete this section according to your specific circumstances.

8. Once you have completed all sections of the form, carefully review the information provided to ensure its accuracy and completeness. Make sure you have attached all required documents as stated in the form instructions.

9. Sign and date the form in the designated areas. If you have an attorney representing you, they will also need to sign the form.

10. Make copies of the completed form and all attached documents for your records.

11. Submit the original form and copies to the court as instructed by the specific court guidelines or your attorney.

It is advisable to consult with an attorney before filling out the Florida mandatory disclosure form to ensure compliance with the law and to address any specific legal concerns related to your case.

What is the purpose of florida mandatory disclosure form?

The purpose of the Florida mandatory disclosure form is to provide potential buyers of residential properties in the state of Florida with important information about the property they are purchasing. The form is designed to ensure that buyers are aware of any known defects or issues with the property before making a purchase. This helps to protect buyers from potential fraud and allows them to make informed decisions. The form covers various aspects of the property, such as its condition, past repairs or improvements, presence of hazardous substances, and other factors that may affect the value or desirability of the property.

What information must be reported on florida mandatory disclosure form?

Under Florida law, certain information must be reported on the mandatory disclosure form in a family law case. The specific information that needs to be included may vary depending on the circumstances, but generally, the following information must be disclosed:

1. Gross income: Each party must disclose their gross income from all sources, including employment, self-employment, bonuses, commissions, rental income, retirement benefits, and any other income.

2. Tax returns: Individuals must provide copies of their federal income tax returns for the past three years.

3. Pay stubs: The most recent pay stubs showing year-to-date earnings from employment should be submitted.

4. Bank statements: Individuals must provide bank statements from the past three months for all accounts they own or have an interest in.

5. Retirement accounts: Statements for all retirement accounts, such as 401(k), IRAs, pensions, or other similar accounts, must be disclosed.

6. Debts: Parties must list all liabilities and debts they currently owe, including mortgages, loans, credit card debts, and other outstanding debts.

7. Assets: Each party must disclose all assets they own, including real estate, vehicles, investments, businesses, and personal property.

8. Health insurance: Information about available health insurance coverage and the cost of coverage for the children must be provided.

9. Childcare costs: Parties need to report the monthly expenses related to childcare, including daycare, after-school care, babysitting, or any other child-related care.

It is important to note that this list is not exhaustive, and additional information may be required depending on the specific case and circumstances involved. Parties should consult with an attorney or review the Florida family law statutes to ensure compliance with all disclosure requirements.

What is the penalty for the late filing of florida mandatory disclosure form?

The penalty for the late filing of the Florida mandatory disclosure form may vary depending on the specific circumstances and the discretion of the court. However, generally, the court has the authority to impose sanctions or penalties for failing to comply with mandatory disclosure requirements. These penalties can include fines, attorney's fees, and other costs associated with the non-compliance. Additionally, the court may also take into consideration the reasons for the late filing and whether there was any willful or intentional disregard of the requirements. It is best to consult with a legal professional to understand the specific consequences in your case.

How can I send florida mandatory disclosure form to be eSigned by others?

Once your florida mandatory disclosure form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find florida mandatory disclosure form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the florida mandatory disclosure form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an eSignature for the florida mandatory disclosure form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your florida mandatory disclosure form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.