Ecobank Account Opening Form - Entities 2015-2024 free printable template

Show details

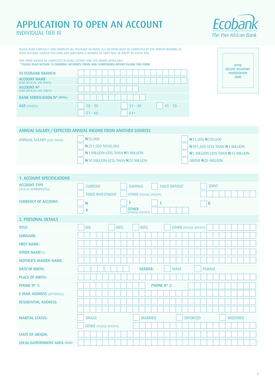

ACCOUNT OPENING FORMALITIES (INCORPORATED AND UNINCORPORATED) TO EMBANK BRANCH: ACCOUNT N (FOR OFFICIAL USE ONLY): PLEASE READ CAREFULLY AND COMPLETE ALL RELEVANT SECTIONS. ALL SECTIONS MUST BE COMPLETED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ecobank corporate account opening form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ecobank corporate account opening form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ecobank corporate account opening form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ecobank account opening form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out ecobank corporate account opening

How to fill out ecobank corporate account opening:

01

Gather all required documents such as valid identification, proof of address, business registration documents, and any additional documentation as specified by Ecobank.

02

Visit the nearest Ecobank branch or access their online banking platform.

03

Fill out the account opening application form accurately and completely. Provide all requested information including company details, authorized signatories, and account signatory details.

04

Submit the completed application form along with the required supporting documents to the Ecobank representative.

05

Wait for the account opening process to be completed. This may involve a verification process and may take some time depending on the complexity of your business structure.

06

Once the account is successfully opened, you will receive the account details and other relevant information from Ecobank.

07

Now, you can start using your Ecobank corporate account for various banking transactions.

Who needs ecobank corporate account opening:

01

Businesses and companies of all sizes and types, including sole proprietorships, partnerships, and corporations, can benefit from opening an Ecobank corporate account.

02

Professionals such as lawyers, doctors, and consultants who operate as a business entity may also require an Ecobank corporate account.

03

Non-profit organizations, charities, and NGOs that require a separate bank account for their operations can also consider opening an Ecobank corporate account.

Fill ecobank account opening form : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the penalty for the late filing of ecobank corporate account opening?

The penalty for the late filing of an Ecobank corporate account opening is a fine of up to $500. Additionally, the account may be closed and any funds in the account may be subject to seizure.

What is ecobank corporate account opening?

Ecobank corporate account opening refers to the process of establishing a bank account specifically designed for companies and other types of corporate entities. It allows businesses to securely deposit funds, make transactions, receive payments, and access a range of banking services tailored to their specific needs.

When opening a corporate account with Ecobank, businesses typically have to provide relevant documentation such as their company registration certificate, tax identification number, memorandum and articles of association, director's passport photos, and proof of address. The account opening process may also involve fulfilling certain regulatory requirements, such as completing Know Your Customer (KYC) procedures.

Once the account is opened, companies can benefit from various services and features offered by Ecobank, including online banking, mobile banking, cash management solutions, foreign exchange services, trade finance, and account reporting. These services can help enhance financial management, streamline operations, and support business growth.

Who is required to file ecobank corporate account opening?

The person or entity required to file an Ecobank corporate account opening would be any business or corporate entity that wants to open a corporate account with Ecobank. This can include but is not limited to:

1. Limited Liability Companies (LLCs)

2. Partnerships

3. Sole Proprietorships

4. Non-Profit Organizations

5. Government Agencies

6. Trusts and Estate Settlements

7. Investment Funds

8. Associations and Societies

Each type of business or entity may have specific requirements and documentation needed to open a corporate account with Ecobank. The required documents typically include identification documents of the account signatories, proof of address, copies of incorporation documents, board resolutions, and other relevant legal and financial documents.

How to fill out ecobank corporate account opening?

To fill out the Ecobank corporate account opening form, follow these steps:

1. Obtain the corporate account opening form: Visit your nearest Ecobank branch or download the form from the Ecobank website.

2. Provide company details: Fill in the necessary details about your company, such as the full legal name, address, telephone number, and email address.

3. Company registration information: Enter the company's registration number, date of incorporation, and country of incorporation.

4. Directors and signatories: List the names, positions, nationalities, and addresses of all directors and signatories of the account.

5. Shareholders and ownership structure: Provide information about all the shareholders of the company, including their names, nationalities, addresses, and percentage of ownership.

6. Business activities: Describe the nature of your business activities and provide supporting documents such as business licenses or permits.

7. Tax identification number: Enter the company's tax identification number, if applicable.

8. Source of funds: Specify the source of funds used to establish and operate the account.

9. Regulatory compliance: Declare and confirm compliance with all applicable laws and regulations.

10. Supporting documents: Attach all requested supporting documents, such as certified copies of the memorandum and articles of association, valid identification documents of directors and signatories, and proof of address.

11. Customer due diligence: Provide additional information and documents required for customer due diligence purposes, according to Ecobank's requirements.

12. Specimen signatures: Provide specimen signatures of all authorized signatories.

13. Date and sign: Sign and date the form to indicate your acceptance and agreement with the terms and conditions.

14. Submit the form: Visit your nearest Ecobank branch and submit the completed form along with all the required supporting documents. Alternatively, if applying online, follow the instructions provided.

Note: It is recommended to contact Ecobank or visit their website for any specific guidance or updates related to filling out the corporate account opening form.

What is the purpose of ecobank corporate account opening?

The purpose of Ecobank corporate account opening is to provide businesses, organizations, and entities with a dedicated bank account specifically designed to meet their financial needs. A corporate account allows companies to conduct various financial transactions, such as receiving and making payments, managing cash flow, accessing trade financing, and effectively organizing their financial activities. It also provides a platform for businesses to easily monitor their financial transactions, track expenses, and facilitate smoother financial operations. Additionally, Ecobank corporate accounts offer various features and services tailored to the specific requirements of corporate customers, including dedicated relationship managers, advanced online banking platforms, and specialized corporate banking solutions.

What information must be reported on ecobank corporate account opening?

The information that must be reported on Ecobank corporate account opening includes:

1. Company details: This includes the legal name, registered address, business registration number, and a description of the nature of the business.

2. Shareholding and ownership structure: The details of the shareholders or partners of the company, including their names, nationalities, addresses, and percentage ownership in the company.

3. Authorized signatories: The names, titles, and identification details of the individuals authorized to sign on behalf of the company.

4. Ultimate beneficial owners (UBOs): Information on the natural persons who ultimately own or control the company, including their names, nationalities, addresses, and percentage ownership or control.

5. Financial information: The company's financial statements, including balance sheets, income statements, and cash flow statements, to assess the financial position of the company.

6. Business operations: Details of the geographical locations where the company operates, its main business activities, and any subsidiary companies or associated entities.

7. Regulatory compliance: Verification of the company's compliance with applicable laws and regulations, including anti-money laundering (AML) and know your customer (KYC) requirements.

8. Supporting documentation: Various supporting documents may be required, such as the company's articles of incorporation, memorandum of association, board resolutions, and identification documents of the authorized signatories, shareholders, and UBOs.

It is important to note that the specific requirements may vary based on the jurisdiction and internal policies of Ecobank or any changes in regulatory requirements.

How can I manage my ecobank corporate account opening form directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ecobank account opening form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I get ecobank deposit slip?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the ecobank transfer form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an eSignature for the ecco bnk in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your ecobank nigeria incorporated business account form pdf and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your ecobank corporate account opening online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ecobank Deposit Slip is not the form you're looking for?Search for another form here.

Keywords relevant to ecobank bank entity account opening form download pdf nigeria

Related to ecobank savings account opening form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.