Free Bank Organizational Chart Word Templates

What are Bank Organizational Chart Templates?

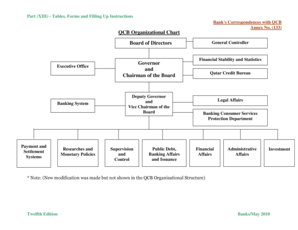

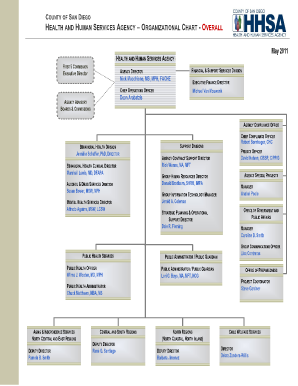

Bank Organizational Chart Templates are visual representations of a bank's hierarchy and structure. These templates help employees understand the chain of command, reporting relationships, and team members' roles within the organization.

What are the types of Bank Organizational Chart Templates?

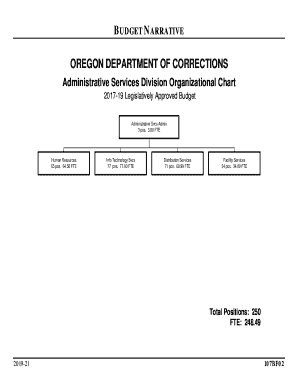

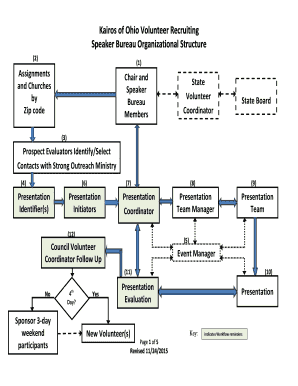

There are several types of Bank Organizational Chart Templates, including: 1. Hierarchical Organizational Chart - showing a top-down structure with executives at the top and employees at the bottom. 2. Matrix Organizational Chart - illustrating cross-functional teams and reporting relationships. 3. Divisional Organizational Chart - dividing the organization into different divisions such as retail, commercial, and operations.

How to complete Bank Organizational Chart Templates

Completing Bank Organizational Chart Templates is a straightforward process that involves the following steps: 1. Identify key positions - determine the roles and responsibilities of each position within the organization. 2. Map reporting relationships - show the hierarchy and reporting structure accurately. 3. Customize the template - add the names and titles of team members to create a personalized organizational chart.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.