Get the free 9211 form irs

Show details

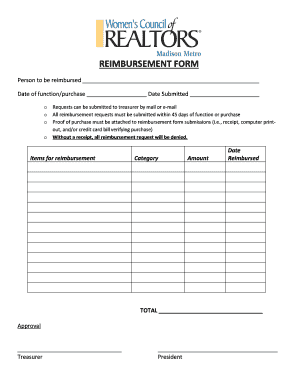

9211 F1/page 1 of 1 BANK RECONCILIATION School: For the month of: BALANCE PER BANK STATEMENT $ ADD: Total Deposits in Transit (Itemize Below) Deposit Date Amount Deposit Date Amount Bank Charges (Service

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 9211 form irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 9211 form irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 9211 form irs online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 9211. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

How to fill out 9211 form irs

How to fill out 9211 form IRS:

01

Gather all the necessary information and documentation required to complete the form. This may include personal identification information, income statements, and any relevant tax documents.

02

Start by entering your personal information, such as your name, social security number, and address, in the designated fields on the form.

03

Carefully read each section of the form and provide accurate answers or information as requested. Pay close attention to any specific instructions or guidelines provided.

04

If you are unsure about how to answer a particular question, consult the IRS instructions for Form 9211 or seek professional assistance to ensure accuracy.

05

Double-check all the information you have entered on the form to avoid any errors or discrepancies. Make sure all calculations are correct and that you have signed and dated the form.

06

Submit the completed 9211 form IRS either by mail or electronically, depending on the instructions provided by the IRS or your tax advisor.

Who needs 9211 form IRS:

01

Individuals or households who have made mortgage payments and want to request a copy of their Form 1098, Mortgage Interest Statement, from their mortgage servicer.

02

Those who need to provide proof of mortgage interest paid for their tax filing purposes.

03

Individuals who want to review the amount of interest they have paid on their mortgage during a specific tax year.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 9211 form irs?

Form 9211 is not a form that currently exists in the Internal Revenue Service (IRS) forms library. It is possible that you may have encountered an incorrect form number or a form that is no longer in use. It is always recommended to double-check the form number and information with the official IRS website or consult with a tax professional for accurate information.

Who is required to file 9211 form irs?

The 9211 form is not an official IRS form. Therefore, there is no specific group of individuals or entities required to file this form with the IRS. It is possible that you may have made a mistake or are referring to a different form number. If you can provide more specific information, I can try to assist you further.

What is the purpose of 9211 form irs?

The purpose of Form 9211 from the IRS (Internal Revenue Service) is to request a transcript of an individual or business tax return.

What is the penalty for the late filing of 9211 form irs?

The penalty for the late filing of Form 9211 with the IRS could vary depending on the specific circumstances. It's important to note that Form 9211 is not a standard IRS form and does not have established penalties like other tax forms.

Form 9211 is used by taxpayers to request a Taxpayer Assistance Order (TAO) from the Taxpayer Advocate Service (TAS). The TAS is an independent organization within the IRS that helps taxpayers who are experiencing significant hardship or are dealing with ongoing tax issues that have not been resolved through normal IRS channels.

If you are referring to the late filing of other IRS tax forms, such as income tax returns or quarterly estimated tax payments, there are penalties associated with those specific forms. For example, the penalty for the late filing of an individual income tax return (Form 1040) could be 5% of the unpaid tax amount per month, up to a maximum of 25% of the unpaid tax.

It's always best to ensure timely filing of all required tax forms to avoid penalties and interest charges. If you have questions about penalties for specific IRS forms or situations, it's recommended to consult with a tax professional or contact the IRS directly.

Can I create an electronic signature for the 9211 form irs in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your form 9211 in seconds.

How do I edit grammar on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute irs 9211 pdf form million to each gaurdian 33911 pdf form form us treasury note 33911 irs form pdf from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete irs form 9211 on an Android device?

Use the pdfFiller mobile app to complete your 9211 form irs on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your 9211 form irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Grammar is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.