Get the free Attachment 10 Monthly Invoice 8-2008 - Bidsync.com

Show details

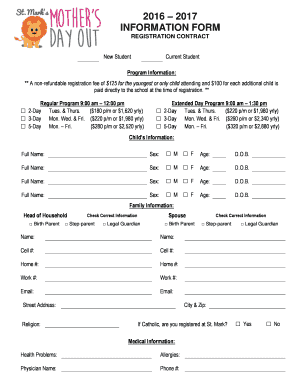

Agreement No. 5600000961 Attachment 10 PROGRAM DEVELOPMENT UNIT/PAROLEE SERVICE CENTERS Invoice Date Tax Identification Number MONTHLY INVOICE Official Name of Contractor and Remit To Address To:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your attachment 10 monthly invoice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your attachment 10 monthly invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing attachment 10 monthly invoice online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit attachment 10 monthly invoice. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

How to fill out attachment 10 monthly invoice

How to fill out attachment 10 monthly invoice:

01

Gather all necessary information for the invoice, such as the invoice number, date, and billing details.

02

Fill in the recipient's information accurately, including their name, address, and contact information.

03

Provide a detailed description of the goods or services provided, including the quantity, unit price, and total cost for each item.

04

Calculate the subtotal by adding up the total costs of all items.

05

Include any applicable taxes or fees, such as sales tax or shipping charges.

06

Add any discounts or deductions, if applicable, and subtract them from the subtotal to calculate the total amount due.

07

Include any additional notes or special instructions, if necessary.

08

Double-check all the information entered to ensure accuracy and clarity.

09

Save or print the completed attachment 10 monthly invoice for record-keeping purposes.

Who needs attachment 10 monthly invoice?

01

Businesses or individuals who provide goods or services on a monthly basis.

02

Customers or clients who need a record of their monthly expenses or purchases.

03

Accounting departments or financial professionals who require accurate documentation for bookkeeping and financial reporting.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is attachment 10 monthly invoice?

Attachment 10 monthly invoice is a document that outlines the monthly financial transactions of a business or individual.

Who is required to file attachment 10 monthly invoice?

Businesses or individuals that are required to report their financial transactions on a monthly basis are required to file attachment 10 monthly invoice.

How to fill out attachment 10 monthly invoice?

To fill out attachment 10 monthly invoice, one needs to provide accurate and complete information about their financial transactions for the specified month. This may include details of income, expenses, taxes, and any other relevant financial information.

What is the purpose of attachment 10 monthly invoice?

The purpose of attachment 10 monthly invoice is to provide a detailed record of financial transactions for a specific month. It helps businesses and individuals to monitor their income, expenses, and taxes, and enables accurate financial reporting and analysis.

What information must be reported on attachment 10 monthly invoice?

The information that must be reported on attachment 10 monthly invoice includes details of income, expenses, taxes, and any other relevant financial information for the specified month.

When is the deadline to file attachment 10 monthly invoice in 2023?

The deadline to file attachment 10 monthly invoice in 2023 may vary depending on the regulations and requirements of the specific jurisdiction. It is advisable to consult the relevant authorities or a tax professional to determine the specific deadline.

What is the penalty for the late filing of attachment 10 monthly invoice?

The penalty for the late filing of attachment 10 monthly invoice may vary depending on the regulations and requirements of the specific jurisdiction. It is advisable to consult the relevant authorities or a tax professional to determine the specific penalty.

Can I sign the attachment 10 monthly invoice electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your attachment 10 monthly invoice and you'll be done in minutes.

Can I create an electronic signature for signing my attachment 10 monthly invoice in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your attachment 10 monthly invoice and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I fill out attachment 10 monthly invoice on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your attachment 10 monthly invoice. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your attachment 10 monthly invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.