What is Monthly Budget Excel Spreadsheet?

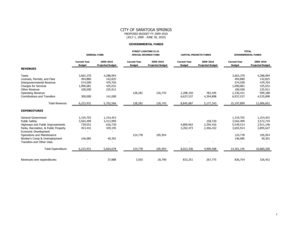

A Monthly Budget Excel Spreadsheet is a tool that helps individuals or businesses track their income and expenses on a monthly basis. It is a highly useful tool for managing personal finances and maintaining budgetary discipline. By using an Excel spreadsheet, users can easily input their income and expenses and calculate their monthly savings or deficits.

What are the types of Monthly Budget Excel Spreadsheets?

There are various types of Monthly Budget Excel Spreadsheets available to cater to different needs and preferences. Some of the common types include:

Basic Monthly Budget Spreadsheet: This type of spreadsheet provides a simple layout for tracking income and expenses without any extra features.

Detailed Monthly Budget Spreadsheet: This type of spreadsheet offers more comprehensive features and allows users to categorize their income and expenses for better analysis.

Family Monthly Budget Spreadsheet: Designed specifically for families, this spreadsheet includes sections to track individual family members' income, expenses, and savings.

Business Monthly Budget Spreadsheet: This type of spreadsheet is tailored for businesses and includes features like profit and loss statements, cash flow management, and budget forecasting.

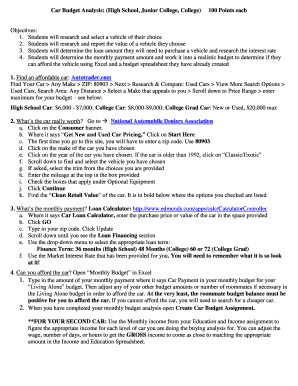

How to complete Monthly Budget Excel Spreadsheet

Completing a Monthly Budget Excel Spreadsheet is a straightforward process. Here are the steps you can follow:

01

Open the Monthly Budget Excel Spreadsheet using Microsoft Excel or a similar spreadsheet software.

02

Enter your sources of income in the designated income column.

03

Input your expenses in the corresponding expense categories. It is recommended to categorize your expenses for better analysis.

04

Calculate your monthly savings or deficits by subtracting your total expenses from your total income.

05

Review and analyze your budget to identify areas where you can reduce expenses or increase savings.

06

Make necessary adjustments to your budget and track your progress on a regular basis.

07

Save and backup your Monthly Budget Excel Spreadsheet.

By following these steps, you will be able to effectively complete your Monthly Budget Excel Spreadsheet and gain better control over your finances. Remember, using an online service like pdfFiller can make the process easier by providing access to fillable templates and powerful editing tools.