Get the free Self-Employment Worksheet - Hawkins Accounting Inc

Show details

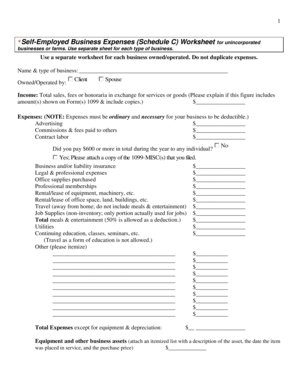

Reemployment Worksheet Name Business Name EIN Address (if different from home address) Total Business Mileage Total miles driven Gross Income $ Business Expenses Advertising Supplies Commissions &

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your self-employment worksheet - hawkins form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self-employment worksheet - hawkins form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self-employment worksheet - hawkins online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit self-employment worksheet - hawkins. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out self-employment worksheet - hawkins

How to fill out self-employment worksheet - hawkins:

01

Start by gathering all necessary information related to your self-employment income and expenses. This may include your business income statements, receipts, invoices, and other relevant financial documents.

02

Begin filling out the worksheet by entering your personal information, such as your name, address, and social security number.

03

Next, input the details of your self-employment income. This can include the total amount earned from your business, as well as any additional income sources related to your self-employment.

04

Proceed to report your self-employment expenses. This may consist of various categories such as office supplies, advertising costs, travel expenses, and business insurance premiums. Be sure to include all applicable expenses to properly calculate your net profit or loss.

05

Once all the income and expenses have been entered, carefully review the worksheet for any errors or omissions.

06

Finally, calculate your net profit or loss by subtracting your total expenses from your total income. This figure will be used to determine the amount of self-employment tax you owe, if applicable.

Who needs self-employment worksheet - hawkins?

01

Individuals who are self-employed or have a sole proprietorship

02

Freelancers or independent contractors

03

Small business owners

04

Anyone who earns income from a business or trade they operate themselves

Remember, it is always advisable to consult with a tax professional or accountant to ensure accuracy when filling out the self-employment worksheet and to address any specific questions or concerns related to your individual situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is self-employment worksheet - hawkins?

Self-employment worksheet - hawkins is a document used to report income and expenses for individuals who are self-employed.

Who is required to file self-employment worksheet - hawkins?

Individuals who are self-employed are required to file the self-employment worksheet - hawkins.

How to fill out self-employment worksheet - hawkins?

To fill out the self-employment worksheet - hawkins, you need to report all income and expenses related to your self-employment activities.

What is the purpose of self-employment worksheet - hawkins?

The purpose of the self-employment worksheet - hawkins is to accurately report self-employment income and expenses for tax purposes.

What information must be reported on self-employment worksheet - hawkins?

On the self-employment worksheet - hawkins, you must report all income received and expenses incurred from your self-employment activities.

When is the deadline to file self-employment worksheet - hawkins in 2024?

The deadline to file the self-employment worksheet - hawkins in 2024 is April 15th.

What is the penalty for the late filing of self-employment worksheet - hawkins?

The penalty for the late filing of the self-employment worksheet - hawkins is $50 per month, up to a maximum of $500.

How can I send self-employment worksheet - hawkins for eSignature?

When you're ready to share your self-employment worksheet - hawkins, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I fill out self-employment worksheet - hawkins on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your self-employment worksheet - hawkins by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I fill out self-employment worksheet - hawkins on an Android device?

On Android, use the pdfFiller mobile app to finish your self-employment worksheet - hawkins. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your self-employment worksheet - hawkins online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.