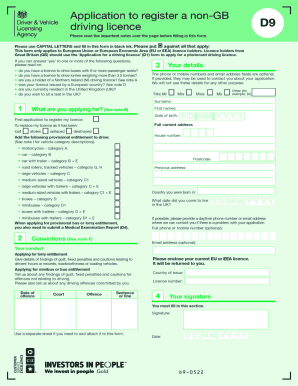

UK DVLA D9 2009 free printable template

Show details

Application for a driving license D9 counterpart for nonGB license holders Please read the important notes over the page before filling in this form. Please use CAPITAL LETTERS and fill this form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your d9 form 2009 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your d9 form 2009 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit d9 form online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form d9. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

UK DVLA D9 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out d9 form 2009

How to fill out d9 form:

01

Gather all necessary information and documentation such as your personal information, income details, and any supporting documents required by the form.

02

Carefully read the instructions provided with the d9 form to ensure you understand each section and requirement.

03

Start filling out the form by entering your personal information accurately, such as your name, address, contact details, and social security number if applicable.

04

Move on to the income section where you will need to provide details about your sources of income, including employment, self-employment, investments, and any other relevant income streams.

05

If there are specific sections or questions that you are unsure about, seek clarification from the relevant authorities or consult a tax professional.

06

Complete any additional sections or questions that are relevant to your circumstances, such as deductions, exemptions, or credits.

07

Double-check all the information you have entered before submitting the form to make sure it is accurate and error-free.

08

Sign and date the form as required, and attach any supporting documentation as instructed.

09

Keep a copy of the completed form and supporting documents for your records.

Who needs d9 form:

01

Individuals who have certain types of income, such as rental income from real estate properties, partnerships, or S corporations, may need to fill out a d9 form.

02

Self-employed individuals or freelancers who earn income from various sources may also need to complete this form.

03

Those who have received certain types of income, such as royalties or dividends, may be required to report them using a d9 form.

Fill d 9 form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is d9 form?

The phrase "D9 form" does not correspond to any commonly known or recognizable form. It is possible that it could be a specific governmental, organizational, or financial form used in a particular context or jurisdiction. Without further context or information, it is difficult to provide a specific answer.

Who is required to file d9 form?

The D9 form appears to be specific to the United States Postal Service (USPS) and is used for international mail and parcel shipments. As per the USPS guidelines, individuals or businesses shipping items internationally are required to complete the D9 form. This form provides crucial information about the contents of the shipment, helping in customs clearance and adherence to international regulations. However, it is advisable to consult with USPS or a shipping professional for specific requirements and guidelines.

How to fill out d9 form?

To correctly fill out a D9 form, you will need to follow these steps:

1. Obtain the D9 form: Obtain the form from the appropriate source. It can usually be downloaded from the respective government or organizational website.

2. Provide personal information: Fill in your personal information at the top of the form, including your full name, address, contact number, and email address.

3. Select the appropriate category: Determine the category that applies to the purpose of the form. For example, if you are filling out a tax-related form, check the appropriate box indicating the reason for submitting the form.

4. Enter the relevant details: The form will have different sections, depending on its purpose. Fill in all the required details accurately. This may include information such as income, expenses, deductions, or other financial data.

5. Attach supporting documents: Check if any supporting documents or evidence are required to be attached to the form. This could include receipts, invoices, or any other relevant documentation. Ensure that you organize and attach them appropriately.

6. Review and sign: Carefully review all the information provided to make sure it is accurate and complete. Once satisfied, sign and date the form in the designated area.

7. Submit the form: Determine where and how to submit the form. This may vary depending on the organization or government body. Follow the instructions provided by the form issuer for submission, such as mailing the form or submitting it online.

Note: The instructions may differ depending on the specific D9 form you are referring to. It is important to carefully read the instructions provided with the form before filling it out to ensure accuracy.

What is the purpose of d9 form?

The D9 form is a document that is used for the registration of motor vehicles in certain countries. It is typically filled out by the buyer/seller of a vehicle, along with the necessary supporting documents, and submitted to the appropriate government authority. The purpose of the D9 form is to facilitate the legal transfer of ownership of a motor vehicle and to ensure that it is properly registered and licensed for use on public roads.

What information must be reported on d9 form?

The D9 form is commonly used for reporting employment, income, and other tax-related information. The specific information that must be reported on the D9 form may vary depending on the jurisdiction and the purpose for which the form is being used. In general, the following information may be required on the D9 form:

1. Employee Information: This includes the employee's full name, address, social security number, and other details as required.

2. Employer Information: This includes the employer's name, address, tax identification number, and other relevant details.

3. Employment Details: The D9 form may require information regarding the employee's job title or position, employment start and end dates, and any changes to employment status during the reporting period.

4. Income Details: This includes reporting the employee's gross wages, salary, bonuses, commissions, tips, and other forms of compensation received during the reporting period.

5. Tax Withholding Information: The D9 form may require reporting information related to the employee's tax withholding, including federal, state, and local income tax deductions, Social Security, Medicare, and other applicable taxes.

6. Deductions and Benefits: Various deductions or benefits provided to the employee, such as retirement contributions, health insurance premiums, and other pre-tax deductions, may need to be reported.

7. Other Compensation Information: Any other forms of compensation received by the employee, such as reimbursements for travel expenses or allowances, may need to be reported.

8. Certification: The form may include a certification section where the employer verifies the accuracy of the information provided and acknowledges any penalties for false or incomplete information.

It is essential to consult the specific instructions and guidelines provided by the relevant tax authority or organization to accurately complete the D9 form.

How can I edit d9 form from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your form d9 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send dvla d9 form for eSignature?

d9 form dvla is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I edit what is a d9 form on an Android device?

You can make any changes to PDF files, such as d9 application form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your d9 form 2009 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dvla d9 Form is not the form you're looking for?Search for another form here.

Keywords relevant to what is a d9 form

Related to form d9

If you believe that this page should be taken down, please follow our DMCA take down process

here

.