Get the free new bookkeeping client intake form pdf

Show details

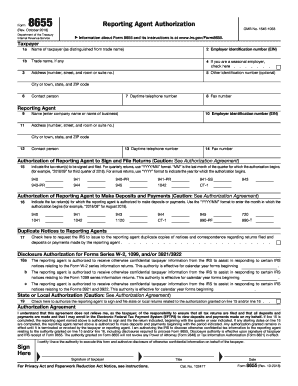

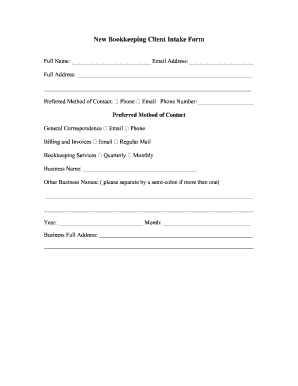

New Client Intake Form General Data: Name(s): Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new bookkeeping client intake

Edit your new bookkeeping client intake form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new bookkeeping client intake form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new bookkeeping client intake online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new bookkeeping client intake. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new bookkeeping client intake

01

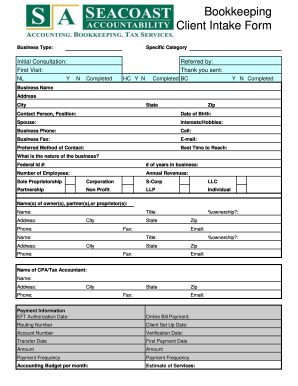

The first step in filling out a new bookkeeping client intake is to gather all the necessary information from the client. This includes their contact details, business name, and any other relevant information.

02

Next, it is important to ask the client about their specific accounting needs. This could include questions about their industry, the size of their business, and any unique challenges or requirements they have.

03

After gathering this information, it is important to document it accurately in the client intake form. This may involve entering the information into a digital form or filling out a physical form.

04

It is crucial to review the completed client intake form for any missing or inconsistent information. This step ensures that all the necessary details are provided and can help avoid any issues or misunderstandings later on.

05

Finally, it is important to securely store and maintain the client intake form. This could involve filing it electronically or physically in a safe and organized manner.

New bookkeeping client intake is needed by accounting firms or bookkeepers who are taking on new clients. It allows them to gather all the necessary information about the client and their accounting needs, which is crucial for providing the best possible service and meeting the client's expectations.

Fill

form

: Try Risk Free

People Also Ask about

What does a bookkeeper need from their clients?

Your bookkeeper will need all of your business receipts. If you're questioning why receipts are important, here is an explanation of their importance to your money and your business financial records.

What questions should a bookkeeper ask a new client?

Here's what to include in your questionnaire: Is the client currently using bookkeeping software? How many employees do they have? Do they have inventory? What is their sales volume? Are they reporting sales or use tax? How many vendors do they pay each month? How many bank accounts do they have?

What questions should I ask a potential bookkeeper?

General Icebreaker Bookkeeper Interview Questions Tell me about your previous work experience as a bookkeeper. What were your primary responsibilities? How much interaction did you have with vendors and clients? Tell me about your computer skills in general. What do you know about this company and our services?

How do I onboard a new bookkeeping client?

Sample Accounting Client Onboarding Checklist Get agreement signed in Corvee. Follow client on social media. Add client email to newsletter. Add client birthday to calendar. Add passwords to an app like 1password. Schedule follow up monthly meeting. Get bank access.

How do I create a client intake form?

Here's a look at how to create a simple client intake form. Step 1: Choose a client intake form tool. Step 2: Decide when you need to use it. Step 3: Ask the right questions. Step 4: Include other elements in your form. Step 5: Share the client intake form.

What does a bookkeeper do for their clients?

Bookkeepers are responsible for providing accurate, up-to-date financial information about a business. They're always taking the pulse of a business. Most often, their reports go to business owners and managers to help them make decisions. Some bookkeepers, however, are actually involved in strategy development.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in new bookkeeping client intake?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your new bookkeeping client intake and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for signing my new bookkeeping client intake in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your new bookkeeping client intake right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the new bookkeeping client intake form on my smartphone?

Use the pdfFiller mobile app to fill out and sign new bookkeeping client intake. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is new bookkeeping client intake?

New bookkeeping client intake refers to the process of gathering essential information from a new client to set them up for bookkeeping services. This includes collecting contact details, financial information, and specific requirements for their bookkeeping.

Who is required to file new bookkeeping client intake?

New clients who wish to engage bookkeeping services are required to complete the new bookkeeping client intake. This process is necessary for both individual and business clients seeking assistance with their financial records.

How to fill out new bookkeeping client intake?

To fill out the new bookkeeping client intake, clients should provide accurate and complete information as requested in the form. This typically includes personal or business information, financial details, and any specific requirements or preferences related to bookkeeping.

What is the purpose of new bookkeeping client intake?

The purpose of new bookkeeping client intake is to ensure that the bookkeeping service understands the client's needs and requirements, allowing for tailored services and efficient management of their financial records.

What information must be reported on new bookkeeping client intake?

The information that must be reported on new bookkeeping client intake includes client name, contact information, business structure (if applicable), financial account details, specific bookkeeping needs, and any other pertinent financial information required for the services.

Fill out your new bookkeeping client intake online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Bookkeeping Client Intake is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.