Get the free Credit Application and Guaranty Agreement

Show details

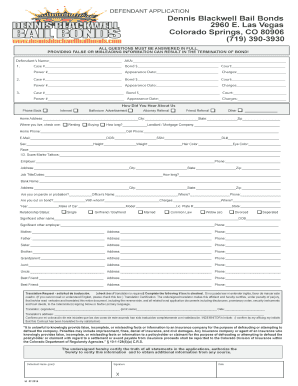

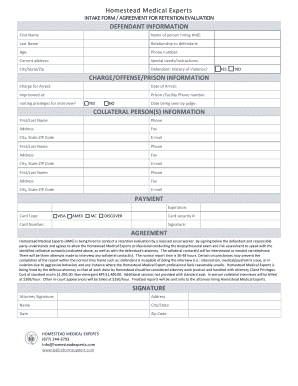

Credit Application and Guaranty Agreement APPLICANT Legal Business Name: Date: VEIN# Tax Exempt Corporation Partnership No Yes ID# Individual /Sole Proprietorship Annual Revenue Years in Business:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your credit application and guaranty form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application and guaranty form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit application and guaranty online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit application and guaranty. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out credit application and guaranty

How to fill out credit application and guaranty?

01

Start by gathering all the required information and documents. The credit application will typically ask for personal details such as your name, address, contact information, employment history, and annual income. Additionally, you may need to provide documentation such as recent pay stubs, bank statements, and identification proof.

02

Carefully read the credit application form, ensuring that you understand each section and its requirements. Make sure to provide accurate and up-to-date information to avoid any delays or issues in the application process.

03

Fill out the credit application form accurately and legibly. Double-check your entries for any errors or missing information. In case you are unsure about any question or section, seek clarification from the creditor or financial institution.

04

If you are applying for credit jointly, ensure that both parties involved are providing their complete personal details and signatures where required. Take note of any specific instructions the application may have regarding joint applicants.

05

When filling out the guaranty section of the application, carefully review the terms and conditions of the guarantee agreement. Understand your responsibilities and obligations as a guarantor, as this involves taking on the financial liability for the loan if the borrower defaults. Consider seeking legal advice if you have any concerns or questions regarding the guaranty agreement.

Who needs credit application and guaranty?

01

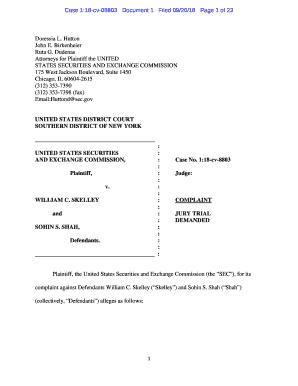

Individuals applying for a loan or credit from a financial institution, such as a bank or credit union, would typically need to fill out a credit application and guaranty. This can include applications for personal loans, mortgages, credit cards, or business loans.

02

Businesses or companies seeking credit or loans may also be required to submit a credit application and guaranty. This is often the case for small businesses or startups that are applying for financing to support their operations or growth.

03

In some cases, landlords or property management companies may request potential tenants to fill out a credit application and guaranty. This helps evaluate the tenant's financial stability and ability to fulfill their rental obligations.

Overall, the need for a credit application and guaranty is primarily for individuals or entities seeking credit or loans, where the creditor needs to assess the borrower's financial information and evaluate the risk involved.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit application and guaranty on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing credit application and guaranty.

Can I edit credit application and guaranty on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share credit application and guaranty from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete credit application and guaranty on an Android device?

Complete credit application and guaranty and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your credit application and guaranty online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.