Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is schedule k 1 form?

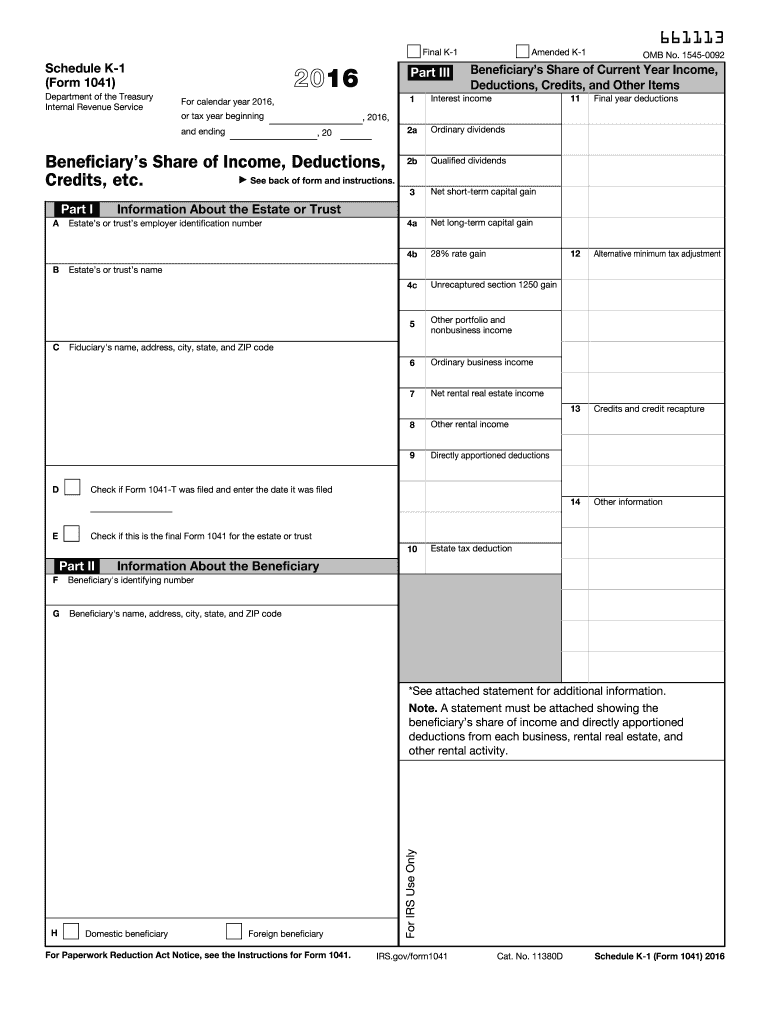

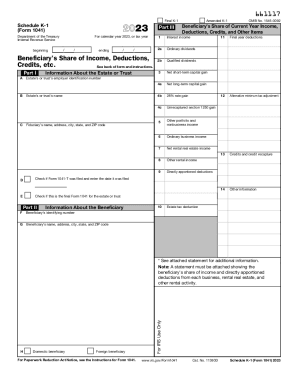

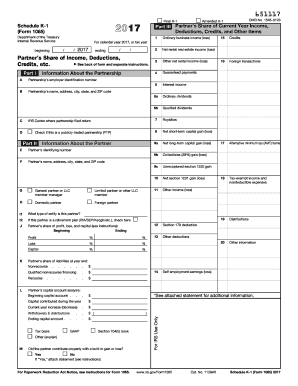

Schedule K-1 is a tax document used to report the income, deductions, and credits that are allocated to partners or shareholders in a partnership, S-corporation, estate, or trust. It is filed along with the annual tax return of the entity. The purpose of Schedule K-1 is to distribute the taxable income or loss to the individual recipients and provide them with the necessary information to report that income on their personal tax returns.

Who is required to file schedule k 1 form?

A Schedule K-1 form, also known as Form 1065, is a tax document used to report a partner's share of income, deductions, and credits for a partnership. It is required to be filed by individuals who are partners in a partnership or members of a limited liability company (LLC) that is treated as a partnership for tax purposes. Each partner or member will receive a Schedule K-1 to report their respective share of the partnership's income or loss on their personal tax return.

How to fill out schedule k 1 form?

To fill out Schedule K-1 form, you will need to follow these steps:

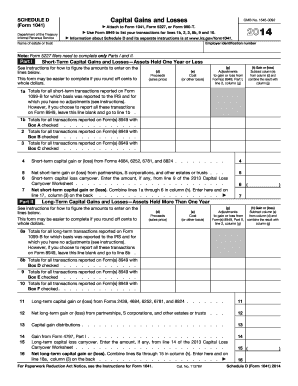

1. Obtain the correct version of Schedule K-1 form for the applicable tax year and the type of entity (e.g., partnership, limited liability company, S corporation) from the Internal Revenue Service (IRS) website.

2. Gather all the necessary information related to your ownership or investment in the partnership, limited liability company, or S corporation. This may include your share of income, losses, credits, deductions, and other financial information.

3. Review the instructions provided with the Schedule K-1 form carefully to understand the specific requirements for reporting various types of income, deductions, and credits.

4. Complete the identification information at the top of the form, including your name, Social Security number or taxpayer identification number, and the entity's name and employer identification number.

5. Move on to Part I, which includes information about the entity providing the Schedule K-1 form. Fill in the entity's name, address, and other relevant details.

6. Proceed to Part II, which outlines the information concerning your share of the entity's income, deductions, credits, and other items. Fill in the appropriate boxes and provide the necessary amounts as per your ownership or investment percentage.

7. Attach any additional schedules or statements required by the instructions to fully disclose all the information related to your share. This may include forms indicating your share of the entity's various activities, such as rental income, interest, or capital gains.

8. Review the completed form and all the accompanying schedules and statements to ensure accuracy and completeness.

9. Keep a copy of the completed Schedule K-1 form for your records and submit the original to the intended recipient, such as your tax preparer or the entity's tax advisor.

Note: It is advisable to consult with a tax professional or certified public accountant if you are unsure about any aspects of filling out Schedule K-1 form to ensure compliance with applicable tax laws and regulations.

What is the purpose of schedule k 1 form?

The purpose of Schedule K-1 form is to report a partner's share of income, deductions, credits, and other relevant information from a partnership or S corporation. It is used by partners or shareholders to report their share of the entity's income on their individual tax returns. The form provides a breakdown of the partner's or shareholder's portion of the entity's taxable income, deductions, and other items that affect their individual tax liability.

What information must be reported on schedule k 1 form?

The Schedule K-1 form is used to report a partner's share of income, deductions, credits, and other tax information from the partnership. The following information must be reported on Schedule K-1:

1. Partner’s identifying information: This includes the partner's name, address, and tax identification number.

2. Share of profit or loss: The Schedule K-1 reports the partner's share of the partnership's income or loss for the tax year.

3. Partner's capital account: The partner's beginning and ending capital account balance is reported on Schedule K-1.

4. Self-employment earnings: If the partner is subject to self-employment tax on their share of income, it will be reported on Schedule K-1.

5. Share of partnership liabilities: The partner's share of partnership debts or liabilities is reported on Schedule K-1.

6. Distributions and guaranteed payments: Schedule K-1 reports any distributions or guaranteed payments received by the partner during the tax year.

7. Other income, deductions, and credits: Any other income, deductions, or credits allocated to the partner by the partnership will be reported on Schedule K-1.

It's worth noting that the specific requirements and reporting items on Schedule K-1 can vary depending on the type of partnership (e.g., general partnership, limited partnership, etc.) and the partnership agreement.

When is the deadline to file schedule k 1 form in 2023?

The deadline to file Schedule K-1 form in 2023 is typically the same as the deadline to file your personal income tax return. For most individuals, the deadline to file tax returns is April 15th each year. However, if April 15th falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to note that tax deadlines can change, so it is always recommended to check with the Internal Revenue Service (IRS) or consult a tax professional for the most up-to-date information.

What is the penalty for the late filing of schedule k 1 form?

The penalty for late filing of Schedule K-1 form can vary depending on the specific circumstances. Generally, if a partnership or an S corporation fails to provide a Schedule K-1 to the IRS and to the recipient by the due date, a penalty of $270 per Schedule K-1 may apply. However, if there is reasonable cause for the delay, the penalty may be waived or reduced. It is advisable to consult with a tax professional or refer to the IRS guidelines for more precise information based on your situation.

Where do I find 2016 schedule k 1?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific 2016 schedule k 1 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I execute 2016 schedule k 1 online?

pdfFiller makes it easy to finish and sign 2016 schedule k 1 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an eSignature for the 2016 schedule k 1 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your 2016 schedule k 1 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.