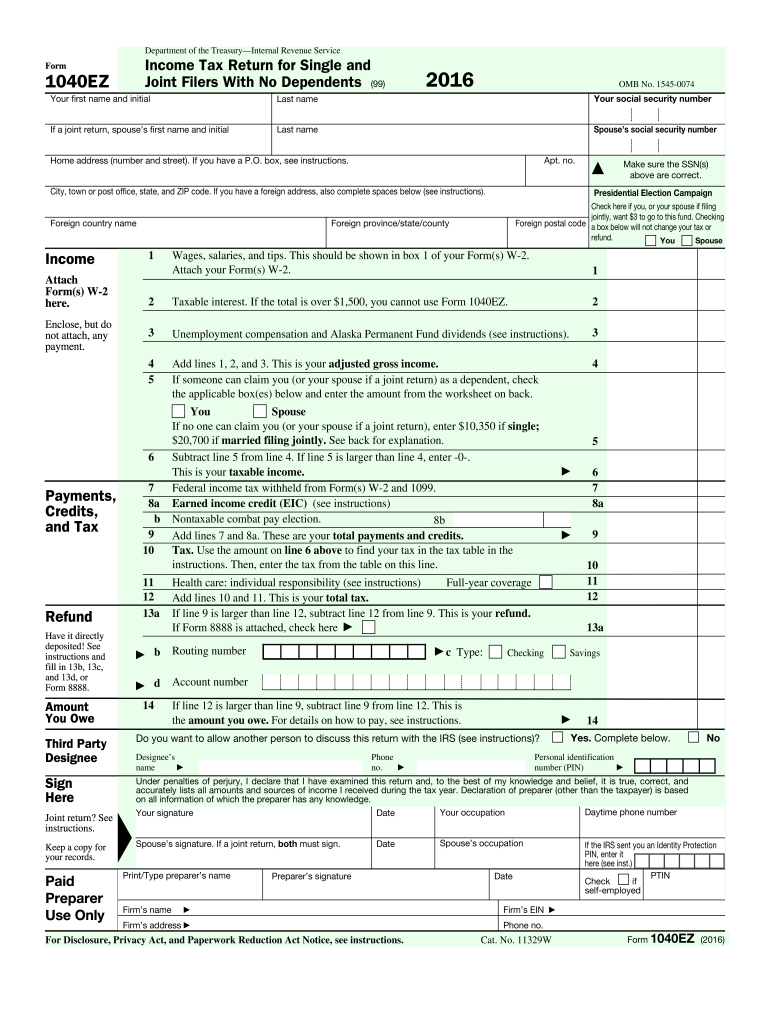

Who Needs Form 1040EZ?

Form 1040EZ is one of the shortest forms out of the myriad of tax returns. However, there are some things that need to be clarified. Form 1040EZ is designed for:

- Single and married individuals who want to file jointly

- People with no dependents

- Taxpayers with the income less than $100,000 and interest income less than $1,500

If you fall within any of the categories, you may fill out form 1040EZ.

What is Form 1040EZ for?

Form 1040EZ is for taxpayers with a straightforward situation. The form allows them to report their annual income fast. The form includes only basic information, so it eliminates confusion about calculating a refund or the amount a person might owe the IRS.

Is Form 1040EZ Accompanied by Other Forms?

Form 1040EZ requires only Form W-2 to be attached.

When is Form 1040EZ Due?

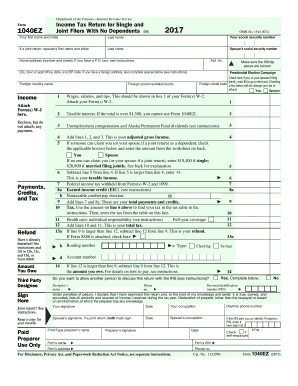

The Income Tax return for Single and Joint Filers with no Dependents is due on April, 18th 2017.

How do I Fill out Form 1040EZ?

Form 1040EZ is a one-page form with only 14 fields. The form requires such information as:

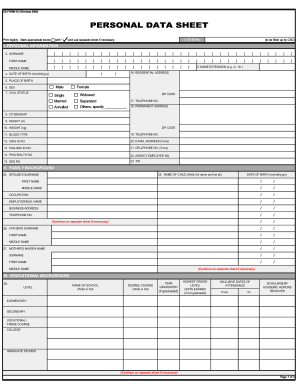

- Common information identification information

- The income section includes wages, taxable interest, unemployment compensation, etc

- Payments, credits and tax that consists of federal income tax, earned income credit

- Refund

- The amount owed

- Signature

The return may be filed jointly. If this is the case, fill out the special field with the information about the third party. There is also a section for tax consultants who help a taxpayer complete the form. This is an optional line.

Where do I Send Form 1040EZ?

Form 1040EZ must be mailed to the IRS. The address is shown on the last page of the instructions for the form.