NY DTF-17.1 2016-2024 free printable template

Show details

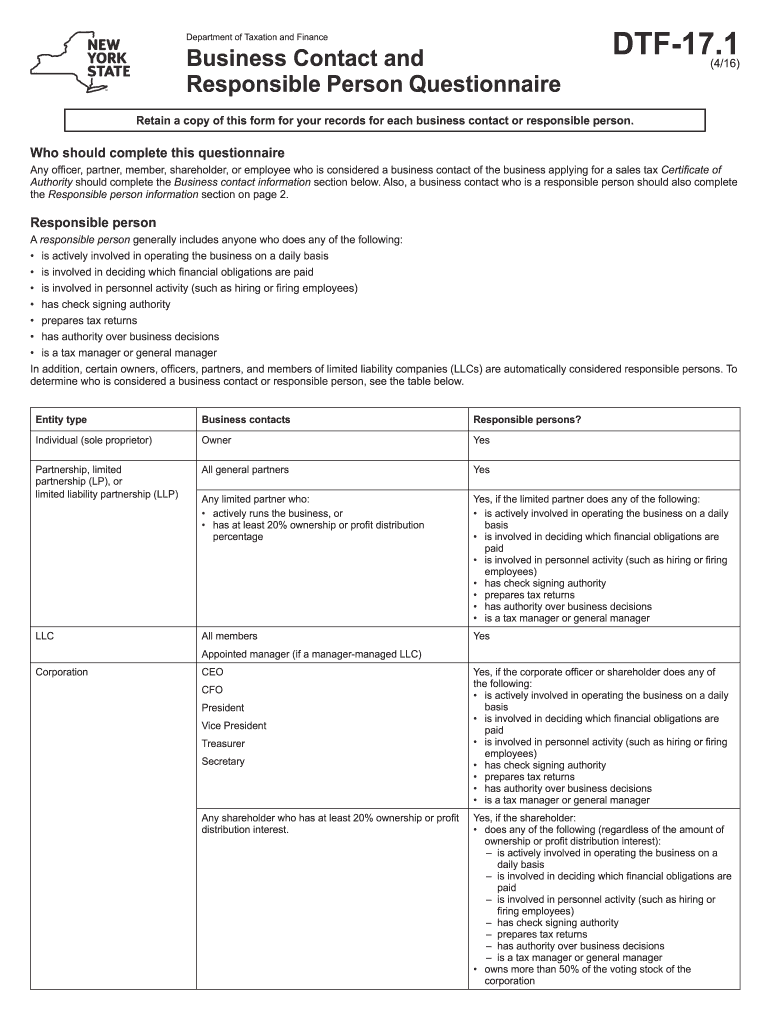

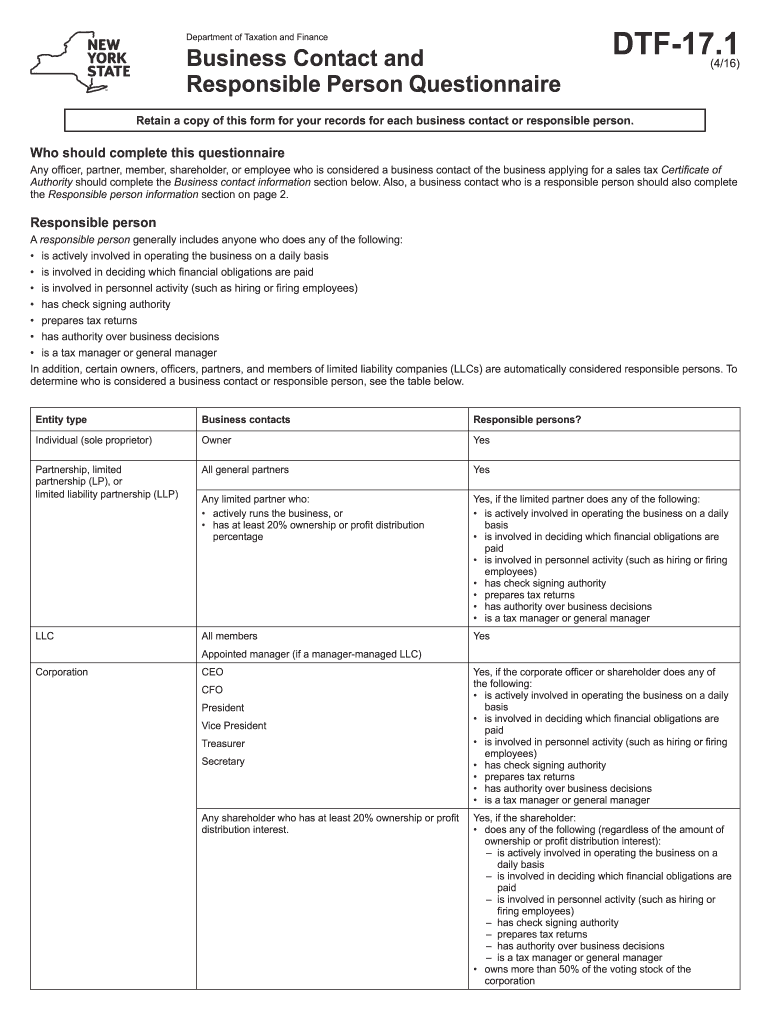

Department of Taxation and Finance Business Contact and Responsible Person Questionnaire DTF17.1 (4/16) Retain a copy of this form for your records for each business contact or responsible person.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your dtf 17 1 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dtf 17 1 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dtf 17 1 form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ny contact questionnaire form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

NY DTF-17.1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out dtf 17 1 form

How to fill out dtf 17 1 form?

01

Begin by carefully reading the instructions provided with the form. It will provide you with valuable information on how to correctly fill out each section of the form.

02

Start by entering your personal information in the appropriate fields. This may include your name, address, social security number, and contact information.

03

Next, provide the necessary details regarding your income and deductions. This may involve including information about your employment, self-employment, rental income, investments, and any other sources of income you may have.

04

Fill out the sections related to credits and taxes. This may include details on any tax credits you are eligible for, as well as information on any taxes you have paid throughout the year.

05

Double-check all the information you have entered to ensure accuracy. Take the time to review your form and make any necessary corrections before submitting it.

06

Sign and date the form to certify its accuracy and completeness. Be sure to keep a copy of the form for your records.

Who needs dtf 17 1 form?

01

Individuals who are required to file a New York State personal income tax return may need to fill out dtf 17 1 form.

02

This form is specifically designed for taxpayers who have claimed itemized deductions on their federal income tax return.

03

In addition, taxpayers who have to report certain adjustments, modifications, or credits on their New York State income tax return may also need to fill out dtf 17 1 form.

Fill new york person form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is dtf 17 1 form?

The term "DTF 17 1 form" is not recognized as a specific form or document. It could be a reference to something that is not widely known or specific to a particular organization or context. More information is needed to provide a detailed answer.

Who is required to file dtf 17 1 form?

The DTF-17.1 form, known as the Application for Extension of Time for Filing Sales and Use Tax Returns, is typically filed by businesses who are unable to file their sales and use tax returns by the original due date and need an extension.

How to fill out dtf 17 1 form?

The DTF-17 form is used to request a Certificate of Authority to collect sales tax in New York State. To fill out the DTF-17 form, follow these steps:

1. Download the DTF-17 form from the New York State Department of Taxation and Finance website or obtain a physical copy from a local office.

2. Start by filling out the basic information at the top of the form, including your name, trade name (if applicable), address, and your Federal Employer Identification Number (FEIN) or Social Security Number (SSN).

3. Indicate the type of business you are operating by checking the appropriate box in question 1.

4. In question 2, provide the date you will begin to collect sales tax in New York State.

5. Provide a detailed description of your business activities in question 3, including the type of products or services you offer.

6. Supply the names, titles, and addresses of any corporate officers, owners, or partners in question 4.

7. Indicate whether you are the agent for the service of process in question 5.

8. Complete question 6 by specifying any exemptions you are claiming from collecting sales tax.

9. If you are required to hold a Certificate of Authority for another reason, check the applicable box in question 7 and provide the necessary information.

10. Provide the anticipated monthly sales and taxable sales within New York State in question 8.

11. In question 9, indicate whether you are handling sales only by mail or internet.

12. Sign and date the form in the designated sections.

13. If you have a preparer or consultant assisting you with this form, provide their information in the preparation section.

14. Review the completed form for accuracy and make sure you haven't missed any required information.

15. Send the completed DTF-17 form to the New York State Department of Taxation and Finance along with any other required documentation and fees as outlined in the instructions.

It's important to note that the above steps provide a general overview of how to fill out the DTF-17 form. Always refer to the specific instructions provided with the form and consult with a tax professional or the New York State Department of Taxation and Finance if you have any specific questions or concerns.

What is the purpose of dtf 17 1 form?

The DTF-17.1 form is used for requesting a Certificate of Authority for a New Home Improvement Contractor (HIC) Business. This form is filed with the New York State Department of Taxation and Finance to apply for registration as a Home Improvement Contractor in the state. The purpose of this form is to gather necessary information about the business and its owners to determine if the applicant meets the legal requirements and qualifies for the necessary certification to operate as a home improvement contractor in New York.

What information must be reported on dtf 17 1 form?

DTF-17.1 form, also known as a New York State withholding tax return, must include the following information:

1. Employer information: The employer's name, address, and employer identification number (EIN).

2. Employee information: The employee's name, address, and social security number or individual taxpayer identification number (ITIN).

3. Payroll period: The specific period for which the withholding tax return is being filed (e.g., monthly, quarterly).

4. Total wages paid: The total amount of wages paid to the employee during the reporting period.

5. Tax withheld: The amount of New York State withholding tax withheld from the employee's wages.

6. Other deductions: Any other deductions made from the employee's wages, such as local taxes or voluntary deductions.

7. Employer contributions: Any employer contributions made on behalf of the employee, such as pension contributions.

8. Total amount due: The total amount of New York State withholding tax due for the reporting period, calculated by subtracting the withholding tax from the total wages paid.

9. Payment information: The payment method for the amount due, including check or electronic payment details.

10. Certification: The employer or authorized representative must sign and certify the accuracy of the information provided.

It is important to note that specific requirements and instructions may vary depending on the state and the tax year. Therefore, it is advisable to consult the official instructions and guidelines provided by the New York State Department of Taxation and Finance when completing the DTF-17.1 form.

What is the penalty for the late filing of dtf 17 1 form?

The penalty for the late filing of DTF-17-1 form depends on the specific regulations and laws of the taxing authority in question. It is advised to consult the relevant tax authority or seek advice from a tax professional to determine the specific penalty for late filing of this form.

How can I send dtf 17 1 form to be eSigned by others?

Once you are ready to share your ny contact questionnaire form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete dtf171 online?

Easy online responsible form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit responsible person on an Android device?

You can edit, sign, and distribute dtf 171 form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your dtf 17 1 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

dtf171 is not the form you're looking for?Search for another form here.

Keywords relevant to ny responsible form

Related to form dtf 16

If you believe that this page should be taken down, please follow our DMCA take down process

here

.