CA DE 926C 2015-2024 free printable template

Show details

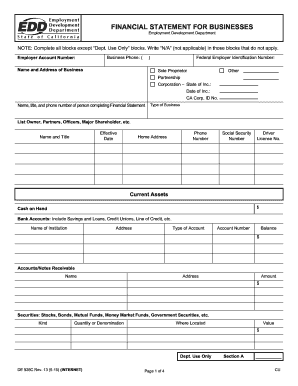

FINANCIAL STATEMENT FOR BUSINESSES Employment Development DepartmentNOTE: Complete all blocks except Dept. Use Only blocks. Write N/A (not applicable) in those blocks that do not apply. Employer Account

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your 926c 2015-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 926c 2015-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 926c online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financial statement edd form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

CA DE 926C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 926c 2015-2024 form

How to fill out 926c:

01

Gather all relevant information needed for filling out Form 926c, such as personal details, financial information, and any supporting documentation.

02

Begin by accurately completing the first section of the form, which usually includes providing your name, address, and social security number.

03

Proceed to fill in the required information in the subsequent sections, carefully following the instructions provided on the form or any accompanying guidance.

04

Ensure that all the information provided is accurate and up to date, as any errors or discrepancies may delay the processing of the form.

05

Double-check the completed form thoroughly to avoid any mistakes, missing information, or omissions before submitting it.

Who needs 926c:

01

Individuals or entities who are transferring property to a foreign corporation may be required to fill out Form 926c.

02

It is typically filed by U.S. citizens or residents who are contributing money or other property to a foreign corporation in exchange for stock or other ownership interests.

03

The form provides the Internal Revenue Service (IRS) with information regarding the transfer of assets to a foreign corporation, allowing them to monitor and track these transactions for tax purposes.

Fill statement de : Try Risk Free

People Also Ask about 926c

What is a financial statement for a business?

What are the four financial statements usually prepared for a business?

What are the 5 components of the financial statements?

How do you fill out a business financial statement?

How do I get a business financial statement?

What is a financial statement for a business form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 926c?

926c is a code used in the medical coding system to identify a type of medical procedure. It is used to indicate a subcutaneous injection of a therapeutic agent.

What is the purpose of 926c?

926C is an IRS form used to report the amount of interest income that is being reported on a tax return. This form is used to report the amount of interest income that is not reported on other forms, such as Form 1099-INT or Form 1099-OID.

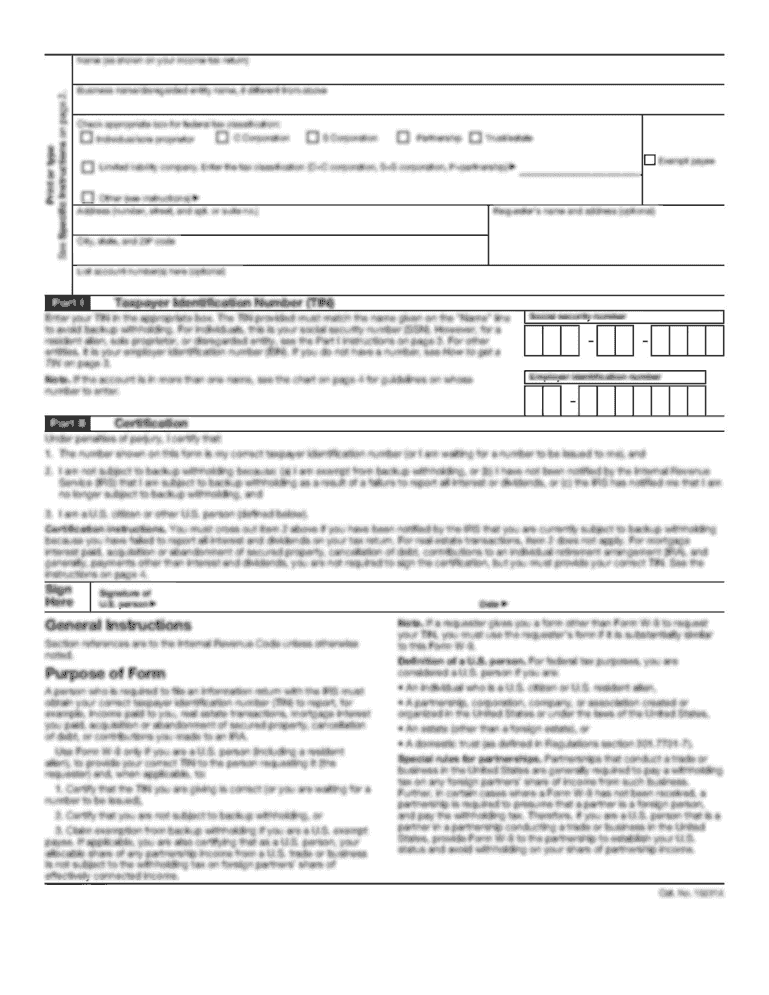

What information must be reported on 926c?

Form 926C requires the filer to provide the name and address of the foreign corporation, the date on which the reportable transaction occurred, a description of the nature of the transaction, the date on which the transaction was reported to the IRS, the amount of the transaction, and the amount of any gain or loss realized from the transaction.

When is the deadline to file 926c in 2023?

The deadline to file Form 926C for calendar year 2023 is April 15, 2024.

What is the penalty for the late filing of 926c?

The penalty for failing to file Form 926C can be up to $10,000 per transaction or 10% of the value of the property transferred, whichever is greater.

Who is required to file 926c?

Form 926 is required to be filed by a U.S. person (individual or corporation) who transfers certain property to a foreign corporation, directly or indirectly, and satisfies the reporting threshold.

How to fill out 926c?

Form 926C is used to report the cancellation or non-renewal of an insurance policy. Here is a step-by-step guide on how to fill out Form 926C:

1. Download Form 926C from the official website of the entity requiring the form (e.g., insurance company, government agency).

2. Read through the instructions provided with the form to ensure you understand the requirements and the information to be provided.

3. Begin the form by entering your contact information in the designated fields, such as your name, address, phone number, and email address.

4. Enter the policy number or identification number associated with the insurance policy that is being canceled or not renewed.

5. Specify the type of insurance policy that is being canceled or not renewed, such as auto insurance, health insurance, property insurance, etc.

6. Indicate the effective date of the cancellation or non-renewal of the insurance policy. This is the date from which the policy will no longer be in effect.

7. Provide a brief explanation or reason for canceling or not renewing the policy. This explanation may be required to satisfy regulatory or reporting obligations.

8. Include any additional information or documentation that may be required by the entity receiving the form. This could include supporting documents, letters, or any other relevant information.

9. Review the completed form to ensure accuracy and legibility. Make any necessary revisions or corrections before submitting it.

10. Finally, sign and date the form to certify the information provided is accurate and complete.

11. Keep a copy of the completed and signed Form 926C for your records.

12. Submit the form as instructed by the entity requiring the form. This may involve mailing it, submitting it online, or delivering it in person.

Note: It is essential to consult the specific instructions provided with Form 926C and reach out to the relevant entity if you have any questions or doubts while completing the form.

How do I execute 926c online?

Completing and signing financial statement edd form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for signing my 926c edd in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your de 1446 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit ca edd department form de926c on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as edd form de926c printable. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your 926c 2015-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

926c Edd is not the form you're looking for?Search for another form here.

Keywords relevant to 926c application form pdf

Related to ca edd financial form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.