Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is schedule i 990 ez?

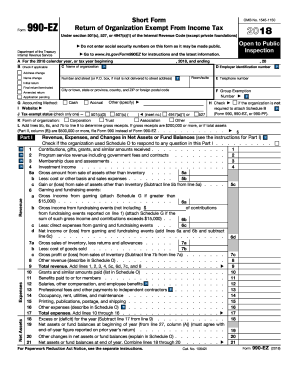

Schedule I, also known as the 990-EZ Schedule I, is an accompanying form for organizations that are filing the 990-EZ form with the Internal Revenue Service (IRS) in the United States. The 990-EZ form is a shortened version of the full 990 form, which is the annual informational tax return that tax-exempt organizations, such as nonprofits and charities, are required to file with the IRS.

Schedule I is used to report information on the organization's Grants and Other Assistance to Organizations, Governments, and Individuals in the form of financial grants, scholarships, fellowships, or similar programmatic assistance. The purpose of Schedule I is to provide transparency and accountability in how tax-exempt organizations distribute funds to various beneficiaries.

The organization must provide details on the nature of the grant or assistance, the recipient's name, taxpayer identification number, type of organization, purpose of the grant, amount disbursed, and any restrictions or conditions associated with the grant. These details help the IRS and the public understand how the organization utilizes its resources to carry out its mission and meet the requirements for maintaining tax-exempt status.

It's important for organizations to accurately complete Schedule I as part of their 990-EZ filing to ensure compliance with IRS regulations and maintain transparency with donors, regulators, and the public.

Who is required to file schedule i 990 ez?

Schedule I is required to be filed by organizations that have received contributions, grants, and other assistance that must be reported in Part VIII, line 1 of Form 990-EZ. This schedule is used to provide additional information about these contributions, grants, and assistance, including the amounts, sources, and purpose of the funds.

How to fill out schedule i 990 ez?

Filling out Schedule I on Form 990-EZ requires reporting information about grants and other assistance to individuals or organizations. Here's a step-by-step guide on how to fill it out:

1. Obtain Form 990-EZ: Start by obtaining a copy of Form 990-EZ and Schedule I. These forms are available on the IRS website or can be requested from the IRS.

2. Identify your organization: Provide the name of your organization, its Employee Identification Number (EIN), and address at the top of the form.

3. Determine the grant and assistance recipients: List the names and addresses of all individuals or organizations that received grants or assistance during the tax year. Include the amount of assistance given to each recipient.

4. Classify recipients: Classify each recipient into one of the provided categories. Check the appropriate box for each recipient to indicate whether they are an individual or an organization. If the recipient is an organization, specify the type of organization (e.g., 501(c)(3) public charity).

5. Specify the purpose of assistance: Provide a brief description of the purpose of the assistance given to each recipient. The description should provide enough detail to explain the nature and objective of the grant or assistance.

6. Report compensation and repayments: If any of the assisted individuals or organizations received compensation or made repayments related to the assistance, report the amounts in the appropriate columns.

7. Calculate total grant and assistance amounts: Add up all the amounts reported for each recipient in the "Amount of Assistance" column to calculate the total grant and assistance amounts provided during the tax year.

8. Sign and file: Once you have completed Schedule I, sign and date the form. Include it with your completed Form 990-EZ and any other required schedules or attachments. File the forms with the IRS according to the instructions provided.

It's important to note that this step-by-step guide is for informational purposes only. Tax regulations can be complex, so it is advisable to consult with a tax professional or refer to the specific instructions provided by the IRS when filling out Schedule I on Form 990-EZ.

What is the purpose of schedule i 990 ez?

Schedule I on Form 990-EZ is used to report an organization’s supplemental financial information. It provides additional details about the reconciliation of revenue and expenses that are not reported in the main form. The purpose of Schedule I is to provide a breakdown of specific types of revenue and expenses, such as fundraising events, program services, and administrative costs. This supplementary information helps provide a more detailed financial picture of the organization's activities and expenditures. It is important for organizations to accurately complete Schedule I to ensure transparency and compliance with reporting requirements.

What information must be reported on schedule i 990 ez?

Schedule I of Form 990-EZ is used to report the organization's Grants and Other Assistance to Organizations, Governments, and Individuals in the United States. The information that must be reported on Schedule I includes:

1. Name and address of each individual, organization, or government entity to which grants or assistance were made during the reporting period.

2. Purpose of the grant or assistance.

3. Dollar amount and description of each grant or assistance provided.

4. Relationship (if any) between the recipient and any officers, directors, trustees, or key employees of the organization.

5. Whether the grant or assistance is part of a collaborative arrangement.

6. If grants or assistance were made for travel, scholarships, research, or other similar purposes, a description of the purpose and the geographic areas served.

7. Whether any unrelated business income was used to fund the grants or assistance.

These details provide transparency and insight into the organization's grant-making activities and ensure compliance with tax regulations.

When is the deadline to file schedule i 990 ez in 2023?

The deadline to file Schedule I (Form 990-EZ) for tax year 2023 would typically be the 15th day of the 5th month after the end of the organization's accounting period. However, please note that tax deadlines can change, and it is always advisable to double-check with the Internal Revenue Service (IRS) for the most accurate and up-to-date information.

What is the penalty for the late filing of schedule i 990 ez?

The penalty for late filing of Schedule I on Form 990-EZ varies depending on the size of the organization. As of 2021, the penalty is generally $20 per day, with a maximum penalty of $10,000 or 5% of the organization's gross receipts (whichever is less). However, for small organizations with annual gross receipts of $1 million or less, the penalty is reduced to $10 per day, with a maximum penalty of $5,000 per return. It's important to note that these penalties may change, so it's recommended to check the latest guidelines from the Internal Revenue Service (IRS) for the most accurate information.

How can I send schedule i 990 ez 2018 for eSignature?

To distribute your form 990 schedule e, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get 2016 990 schedule e?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific 990ez schedule e and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit schedule e form 990 instructions guide online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your 990 ez schedule e form and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.