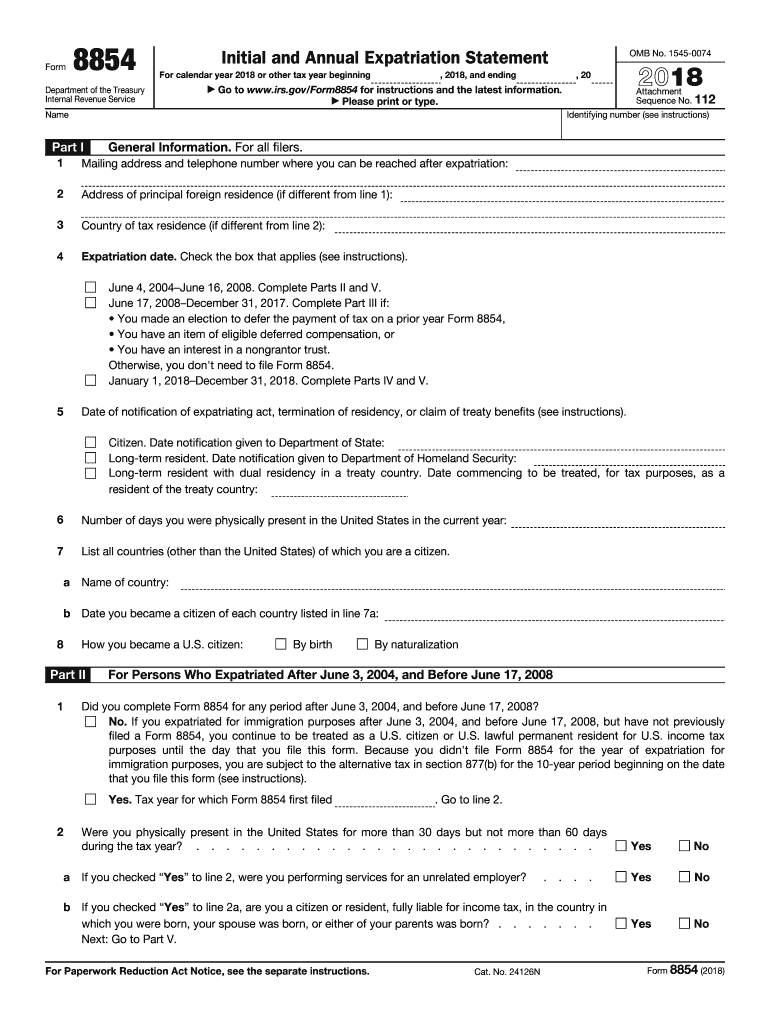

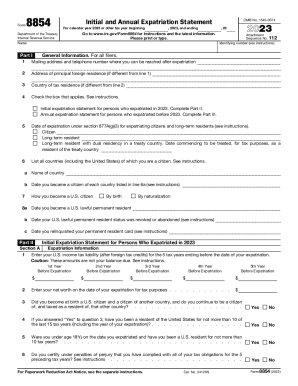

What is the target audience for Form 8854?

Individuals who have been deprived of U.S. citizenship and those who have renounced residency on purpose have a right to apply for this form. It signifies that a person particularly declines to use a green card and all its preferences as well. Unless the form is filled in and submitted, the resident is still to pay taxes as they used to. The Initial and Annual Expatriation Statement implies that the citizen completely abandons the chance to remain within the territory of the United States.

What is the purpose of Form 8854?

All these guidelines will assist in learning the purpose of the Form. Expatriation is a fundamental notion which implicates the denial of long-term citizenship and its termination. Everyone who applies for it wishes to separate and leave the state on legal grounds.

What are the time limits?

All applicants should pay attention to the dates which enable them to use the form to the utmost. All those who have expatriated themselves on the 4th of June 2004 or later are at liberty to request the statement.

What are the other forms to fill in along with Form 8854?

Before submitting Form 8854, take time to investigate one more template I-407. It is a certain supplement to the whole process of the expatriation. In the case of voluntary citizenship renouncement, get ready to initially fill this one in and then turn to 8854.

What information is given in Form 8854?

As an applicant, you have to follow the strict instructions according to the points required in the statement. Do not skip your personal details (full name, address, expatriation date, tax payments, etc.). Moreover, prepare to answer several “yes/no” questions which refer to your exact case of expatriation.

Where to submit Form 8854?

Mainly, you will be demanded to send Form 8854 to the tax office to make everything clear considering your annual payments and receive the permit to send it to the supreme bodies of the state.