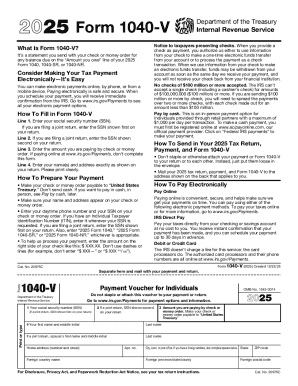

IRS 1040-V 2018 free printable template

Instructions and Help about IRS 1040-V

How to edit IRS 1040-V

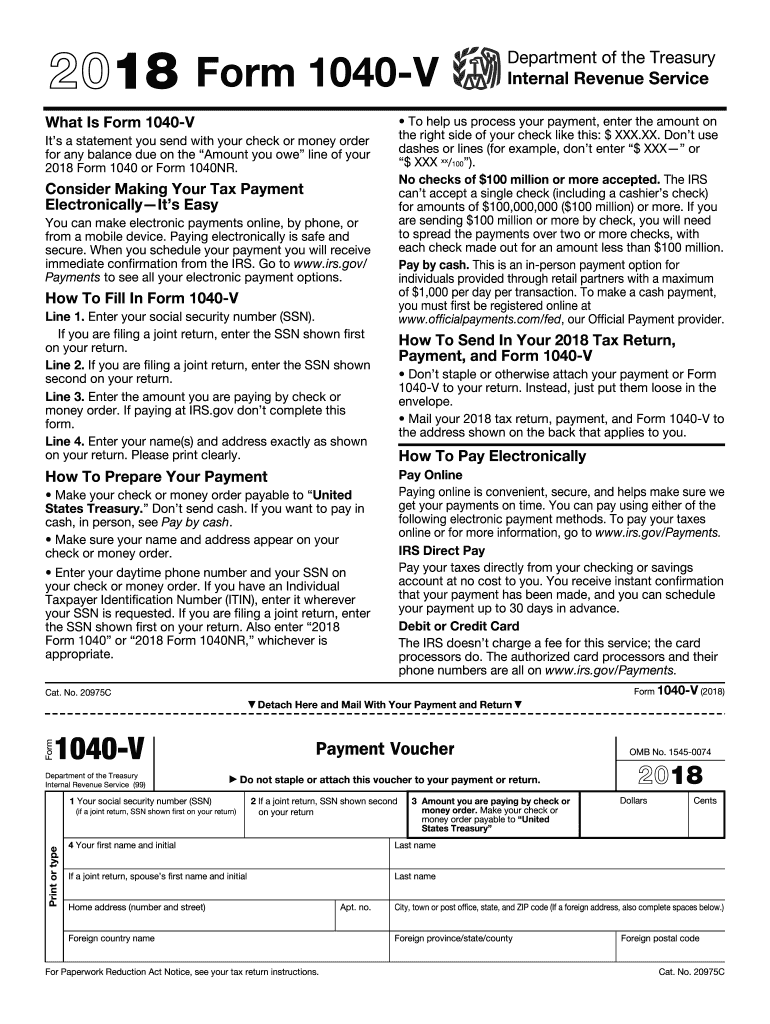

How to fill out IRS 1040-V

About IRS 1040-V 2018 previous version

What is IRS 1040-V?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1040-V

What should I do if I realize I've made a mistake after submitting my IRS 1040-V?

If you discover an error after filing your IRS 1040-V, you will need to submit an amended return using Form 1040-X. Ensure you provide clear documentation explaining the changes made. It's also advisable to keep records of your original submission and any correspondence until the IRS processes your amendment.

How can I verify if my IRS 1040-V has been received and processed by the IRS?

To check the status of your IRS 1040-V, you can use the IRS 'Where's My Refund?' tool or contact the IRS directly. Keep in mind that e-filed submissions may show processing statuses sooner than mailed forms. It's also important to be aware of common e-file rejection codes that might delay processing.

Are there any special circumstances under which someone else can file an IRS 1040-V on my behalf?

Yes, if you are unable to file your IRS 1040-V yourself, an authorized representative with a Power of Attorney (POA) can file on your behalf. Ensure that your representative has the proper documentation to act on your behalf in accordance with IRS regulations.

What if I receive a notice from the IRS after submitting my IRS 1040-V?

If you receive a notice from the IRS regarding your IRS 1040-V, read it carefully to understand the issue. Prepare any required documentation and respond promptly according to the instructions provided in the notice to avoid potential penalties.

What common errors should I avoid when submitting my IRS 1040-V?

To avoid common errors with your IRS 1040-V, double-check that all necessary information is complete and accurate, including your personal details and payment amount. Additionally, ensure that you are using the correct version of the form and adhering to any special instructions provided for your specific situation.

See what our users say