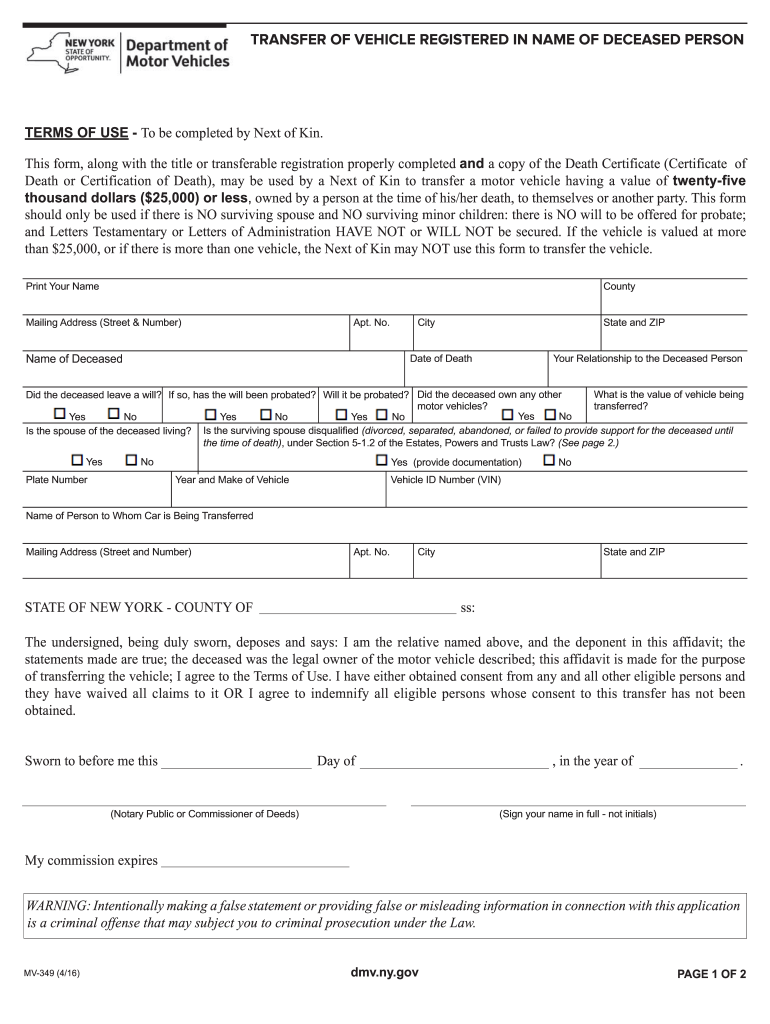

NY MV-349 2016 free printable template

Get, Create, Make and Sign

Editing 349 form online

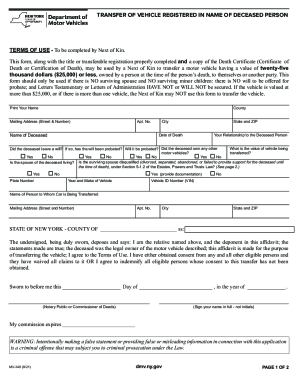

NY MV-349 Form Versions

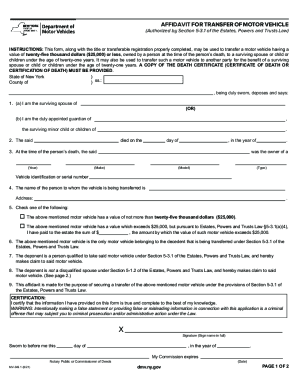

How to fill out 349 form 2016

How to fill out form 349?

Who needs form 349?

Video instructions and help with filling out and completing 349 form

Instructions and Help about nys dmv form mv 349

In North Carolina, to file an insurance claim for bodily injury or major property damage to your car, you have to prove who was at fault. But time is critical: witness memories will fade, some crash scene evidence will get swept away, and photographs need to be taken now. That's what makes the DMV- 349 crash report so important. It is THE legal record your car accident, and it contains nearly all the vital information necessary for making a claim. This video is a guide to help you understand the purpose of the DMV-349 and how we at Henson First use this report to help you. The DMV-349 is filled out at the crash scene by the responding police officer. But these reports are not filled out for every accident. In order for the police to fill out a DMV-349, the accident must involve: a fatality, a non-fatal personal injury, total property damage to a car amounting to one thousand dollars or more, or damage to any amount to a vehicle seized for illegal activity, such as a DWI. If your accident meets any of these criteria, it is important that you have our lawyers review the report right away. We can use the report to start building a case on your behalf. This DMV-349 report is full of numbers and codes that describe the police officer’s observations, findings, and conclusions about your wreck, such as: vehicle speed, names and addresses of witnesses, information about the police officer, insurance information for both drivers, factors that may have contributed to the crash, and the police officers narrative description of the accident. Now, sometimes the police actually get some facts wrong, or there are errors in the report. If that has happened in your case, don’t worry. Our lawyers and investigators may be able to gather evidence such as witness accounts, photographs, and accident reconstruction technology to prove what truly happened. The sooner you call us, the sooner we can help. I understand this report contains a great deal of information. Fortunately, you don’t have to try and make sense of it all by yourself. Contact us as soon as you can. We can review the information and talk to any witnesses before the insurance company does. If you or a loved one was injured in a car accident, acting quickly can make all the difference in proving fault in your case. Just call us at 800-4-LAWMED or complete the Get Help Now form located throughout our website to find out how our North Carolina auto accident lawyers can help you. . Because Life Doesn't’t Wait, you need HensonFuerst.

Fill mv 349 ny dmv : Try Risk Free

People Also Ask about 349 form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 349 form 2016 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.