Get the free bank of india deposit slip fillable form

Show details

FORM B (CENTRAL) FORM B (CENTRAL) (See Sub paragraph (3) of paragraph 4) (See Sub paragraph (3) of paragraph 4) PUBLIC PROVIDENT FUND SCHEME, 1968 PUBLIC PROVIDENT FUND SCHEME, 1968 COUNTERFOIL-1

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your bank of india deposit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank of india deposit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bank of india deposit slip fillable online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit bank of india deposit slip in pdf form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out bank of india deposit

How to fill out Bank of India deposit?

01

Visit the nearest Bank of India branch.

02

Collect the deposit form from the bank's customer service desk.

03

Fill in your personal information, such as name, address, and contact details, in the designated fields.

04

Provide your bank account details and mention the type of deposit you wish to make.

05

Specify the amount you want to deposit and choose the deposit term, if applicable.

06

Review the form to ensure all the information provided is accurate.

07

Sign the form to authorize the deposit.

08

Submit the filled-out form along with the amount you want to deposit to the bank representative.

09

Keep the acknowledgment slip provided by the bank as proof of your deposit.

Who needs Bank of India deposit?

01

Individuals who want to save money and earn interest on their savings.

02

Business owners who need a safe and reliable place to deposit their funds.

03

Non-resident Indians (NRIs) who want to maintain their finances in India.

04

Students who want to save their pocket money or part-time earnings.

05

Anyone looking for a secure way to store their money and potentially earn interest over time.

Fill bank of india cheque deposit slip pdf download : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out bank of india deposit?

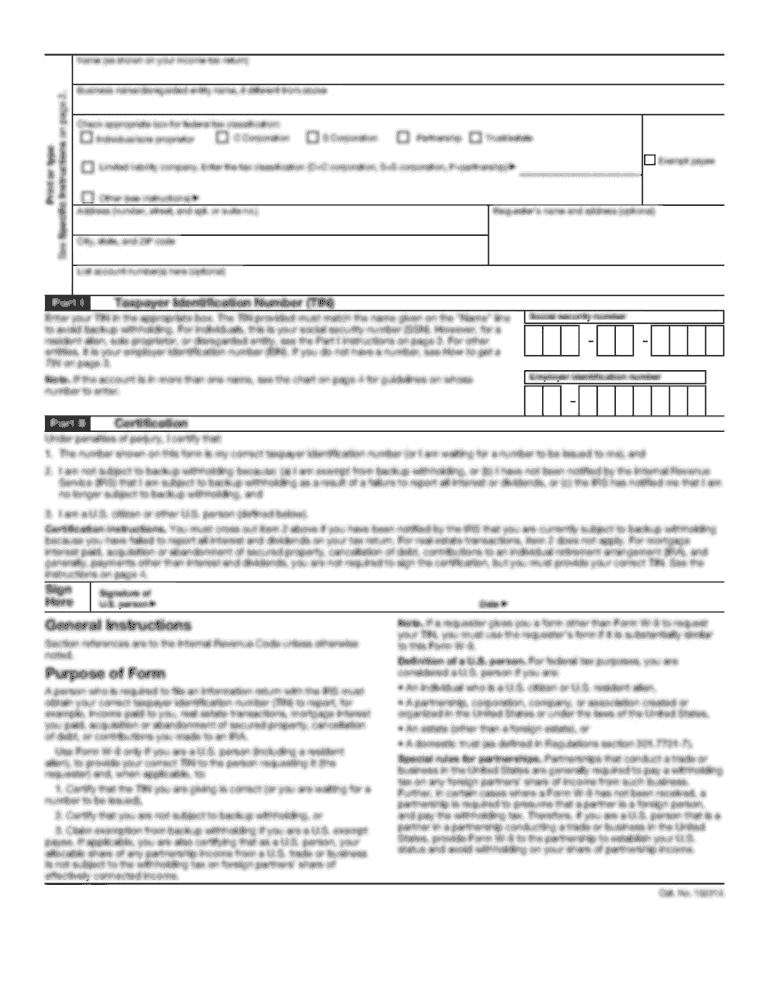

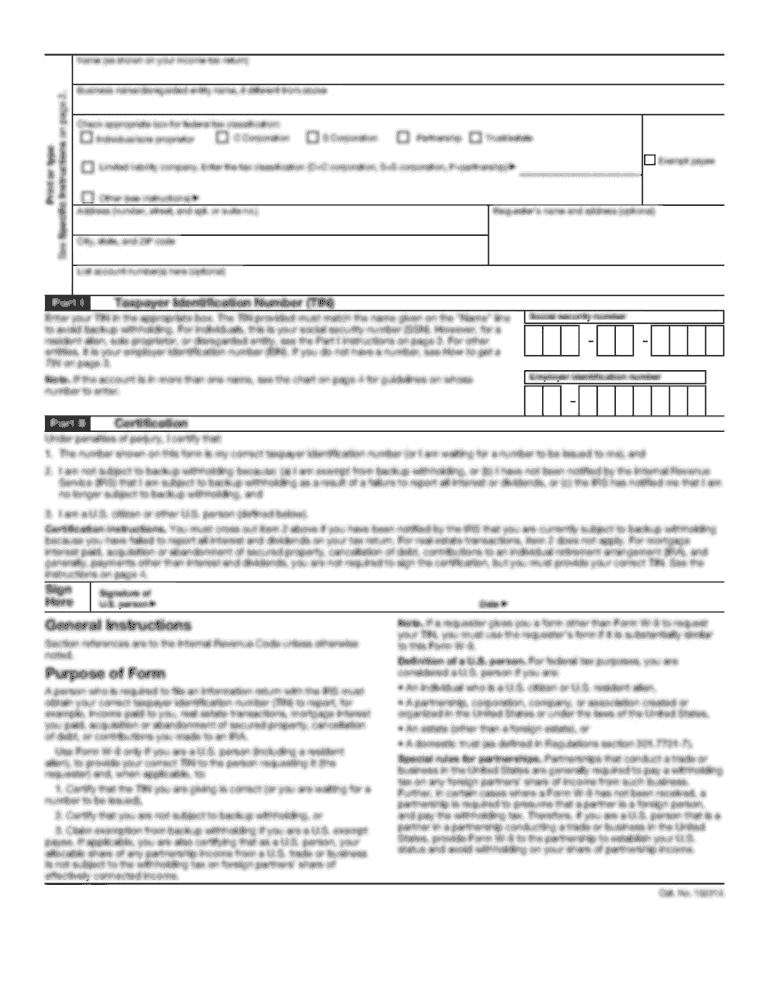

1. Fill out the deposit slip: Fill out the deposit slip, which is usually available from the bank's website. Include your name, address, and account number. Specify what type of deposit you are making (e.g. cash, check, etc.)

2. Provide identification: Present a valid photo ID such as a driver’s license, passport, or other government-issued ID.

3. Count and verify the deposit: Make sure the deposit amount is correct and matches the amount in the deposit slip.

4. Sign the deposit slip: Sign the deposit slip to confirm the deposit.

5. Get a receipt: Make a copy of the deposit slip and ask the bank teller for a receipt.

What is bank of india deposit?

Bank of India deposit refers to the amount of money that is kept in a Bank of India account by an individual or entity. It can be in the form of savings deposits, fixed deposits, recurring deposits, or any other deposit schemes offered by the bank. The deposited money earns interest over a specified period of time, and the depositor can withdraw or utilize the funds as per their requirements, subject to the terms and conditions set by the bank.

Who is required to file bank of india deposit?

Customers of Bank of India are required to file a deposit.

What is the purpose of bank of india deposit?

The purpose of a Bank of India deposit is to provide individuals or businesses with a safe and secure place to deposit their money. The bank offers a variety of deposit accounts, such as savings accounts, current accounts, term deposits, and fixed deposits, where customers can place their funds. These deposits not only provide a safe storage for money but also offer a source of interest income, helping customers grow their savings over time. Additionally, deposits with Bank of India allow customers to easily manage their finances, make transactions, receive loans, and access other banking services.

What information must be reported on bank of india deposit?

The information that must be reported on a Bank of India deposit includes:

1. Account Holder's Name: The full name of the individual or entity who holds the deposit account.

2. Account Number: The unique account number provided by Bank of India for identification purposes.

3. Deposit Amount: The amount of money deposited into the account.

4. Deposit Date: The date on which the deposit was made.

5. Source of Funds: Information about where the deposited funds originated from, such as salary, business income, or other sources.

6. Currency: The currency in which the deposit was made, such as INR (Indian Rupees) or a foreign currency.

7. Interest Rate (if applicable): If the deposit attracts any interest, the interest rate should be mentioned.

8. Term or Tenure: If the deposit is held for a fixed period, the duration of the term should be specified.

9. Maturity Date (if applicable): For fixed-term deposits, the date when the deposit will mature and the funds can be withdrawn.

10. Withdrawal Instructions: Whether the deposit allows for partial or full withdrawals during the term, and any associated penalties or fees.

11. Nomination Details: If the account holder has nominated another person to receive the account proceeds in case of their death, the nomination details should be recorded.

12. Mode of Operation: Information on whether the account has a single or joint account holder, and if joint, the mode of operation should be specified (either "Anyone or Survivor," "Jointly," or "Either or Survivor").

13. KYC (Know Your Customer) Documentation: Requisite information and documents, such as proof of identity, address, PAN (Permanent Account Number), etc., as required by Bank of India's KYC guidelines.

14. Any other specific details or instructions related to the deposit account.

It's important to note that specific reporting requirements may vary based on local regulations and Bank of India's internal policies. It is recommended to consult with the bank or refer to their official guidelines for accurate information.

What is the penalty for the late filing of bank of india deposit?

The penalty for the late filing of Bank of India deposits depends on the specific rules and regulations set by the bank. It is recommended to contact Bank of India directly or refer to their official website or documentation to obtain accurate and up-to-date information regarding the penalties for the late filing of deposits.

How do I execute bank of india deposit slip fillable online?

pdfFiller has made filling out and eSigning bank of india deposit slip in pdf form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make changes in bank of india deposit slip word format?

With pdfFiller, it's easy to make changes. Open your bank of india deposit slip pdf download in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I make edits in bank of india cheque deposit slip fillable without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing bank of india cash deposit slip pdf download form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Fill out your bank of india deposit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Of India Deposit Slip Word Format is not the form you're looking for?Search for another form here.

Keywords relevant to boi deposit slip form

Related to bank of india deposit slip excel format

If you believe that this page should be taken down, please follow our DMCA take down process

here

.