Who needs a Form ST 119.1?

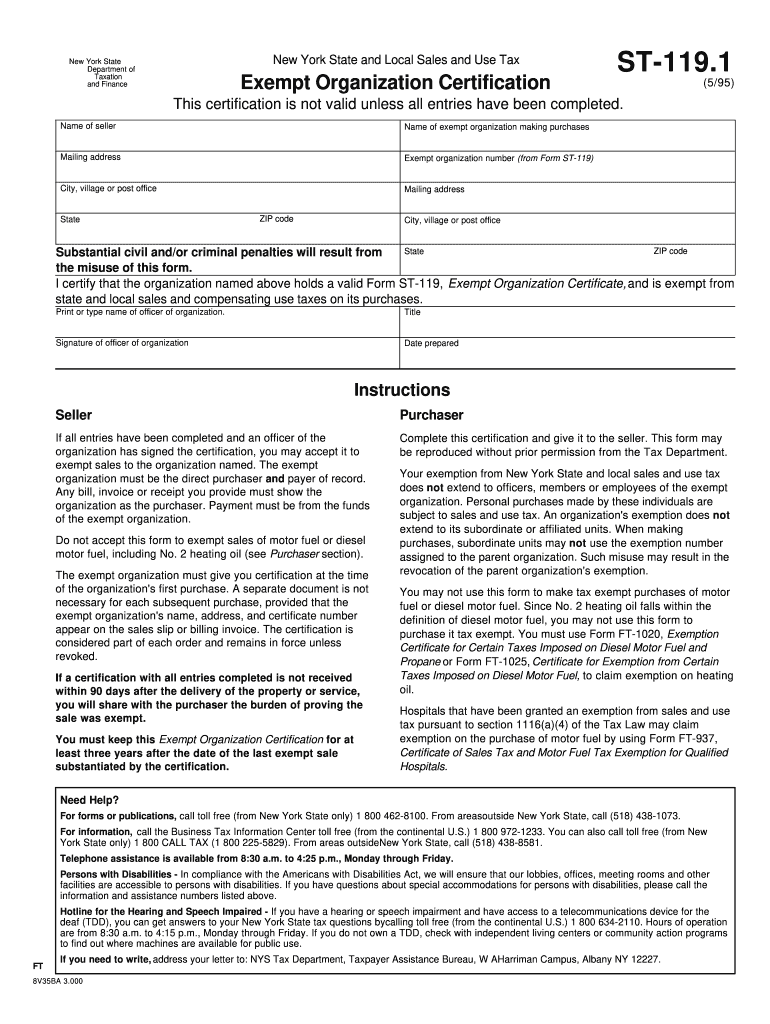

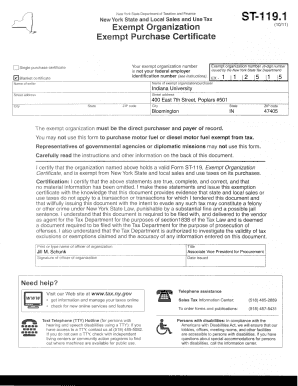

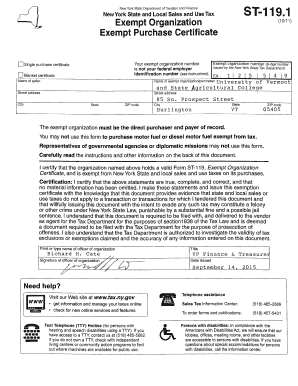

Form ST 119.1 is the Exempt Organization Exempt Purchase Certificate which was created by the New York State Department of Taxation and Finance. The given Certificate lets a buyer make tax-free purchases that would regularly be subject to sales tax. An exemption certificate may be used by an exempt organization purchaser whose intention is:

-

to resell the purchased property or service;

-

to use the property or a service for a purpose exempt from sales tax.

The third applicable case of the exemption certificate is when a buyer is making a purchase as an agent of a tax-exempt non-profit organization or the government entity.

What is NY Tax Exempt Certificate Form for?

The Exempt Purchase Certificate is necessary to record the purchase that is not supposed to be taxed because of the purchasing organization's exempt status.

Is ST 119.1 Tax Exempt Form accompanied by other forms?

In order for tax-exempt purchases to be made, the completed Form ST-119.1 must be present at the moment of purchase. If the buyer is the governmental (e.i. exempt) entity, they should present appropriate exemption document other than Form ST 119.1, or a governmental purchase order.

When is ST 119.1 Exempt Certificate due?

A buyer is supposed to give the seller the fully completed certificate within 90 days after the purchase has been made, but it is generally preferred that the ST 119.1 Form should be furnished at the moment of the sale.

How do I fill out Form ST-119.1?

In order to be properly completed, the Tax Exempt Form ST-119.1 must clearly state the following:

-

Information about the purchaser (exempt organization number, name and address)

-

Information about the seller (name and address)

-

Authorized organization officer’s name, title and signature

-

Date when it was prepared

What do I do with the completed Form ST 119.1?

The buyer should submit the completed NYS Form ST 119 1 to the seller and retain a copy for their financial records.