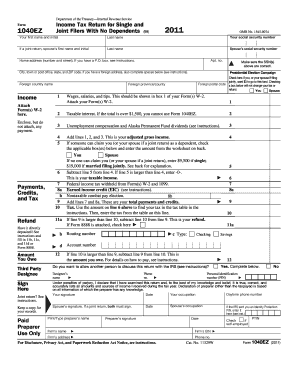

You must file the 2011 tax return even if you expect to be away from the United States during the entire year, or if you expect to be away from the United States during only part of the year, or if you have not yet filed for the 2011 tax year. To claim a deduction for state income tax paid to another state using Form 1040NR-EZ, you must complete and file the Form 1040NR-EZ for the other state, also known as Form 1040NR-EZ-EIN, with the IRS. This form must be filed no later than April 15. If you file Form 1040NR-EZ-EIN for the other state on or before April 15, check the box to indicate you received the Form 1040NR-EZ for the other state through electronic filing.

Form 1040NR-EZ Form 1040NR-EZ-EIN To claim a deduction for state income tax paid to another state using Form 1040NR-EZ, you must complete and file the Form 1040NR-EZ for the other state, also known as Form 1040NR-EZ-EIN. This form must be filed no later than April 15. If you file Form 1040NR-EZ-EIN for the other state on or before April 15, check the box to indicate you received the Form 1040NR-EZ for the other state through electronic filing. Instructions for Form 1040NR-EZ Section references are to the Internal Revenue Code unless otherwise noted. Department of the Treasury Internal Revenue Service Form 1040NR-EZ-EIN Section references are to the Internal Revenue Code unless otherwise noted. Department of the Treasury Form 1040NR-EZ-EIN Instructions for Form 1040NR-EZ-EIN Section references are to the Internal Revenue Code unless otherwise noted. Department of the Treasury Form 1040NR-EZ To claim a deduction for state income tax paid to another state using Form 1040NR-EZ, you must complete and file the Form 1040NR-EZ for the other state, also known as Form 1040NR-EZ-EIN, with the IRS. This form must be filed no later than April 15. If you file Form 1040NR-EZ-EIN for the other state on or before April 15, check the box to indicate you received the Form 1040NR-EZ for the other state through electronic filing.

Get the free If you generally must file Form 1040NR-EZ by April 15, the due date for your 2011 re...

Show details

2011 Instructions for Form 1040NR-EZ Section references are to the Internal Revenue Code unless otherwise noted. Department of the Treasury Internal Revenue Service U.S. Income Tax Return for Certain

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your if you generally must form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your if you generally must form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit if you generally must online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit if you generally must. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is if you generally must?

Generally, if you must refers to something that is mandatory or required.

Who is required to file if you generally must?

The individuals or entities that are required to file if you generally must are those who fall under the specified criteria set by the relevant authorities.

How to fill out if you generally must?

To fill out if you generally must, you need to follow the instructions provided by the relevant authorities or use the prescribed forms or online platforms.

What is the purpose of if you generally must?

The purpose of if you generally must depends on the specific context or regulation in which it is used. It could be for regulatory compliance, data collection, reporting, or other purposes.

What information must be reported on if you generally must?

The specific information that must be reported if you generally must depends on the applicable requirements or regulations. It could include personal or business details, financial information, statistics, or any other relevant data.

When is the deadline to file if you generally must in 2023?

The deadline to file if you generally must in 2023 may vary depending on the specific context or regulation. It is advisable to refer to the official guidelines or consult with the relevant authorities for the accurate deadline.

What is the penalty for the late filing of if you generally must?

The penalty for the late filing of if you generally must could vary depending on the applicable regulations or authorities. It may involve monetary fines, interest charges, or other consequences. The specific penalty details can be found in the relevant guidelines or regulations.

How do I edit if you generally must online?

With pdfFiller, it's easy to make changes. Open your if you generally must in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit if you generally must straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing if you generally must.

Can I edit if you generally must on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute if you generally must from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your if you generally must online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.