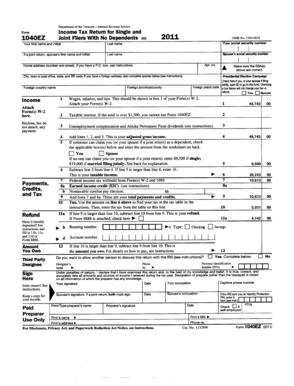

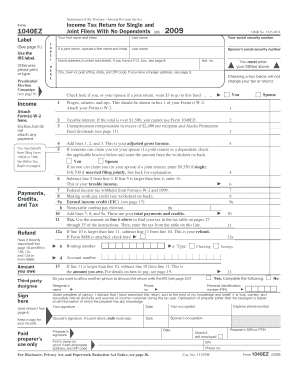

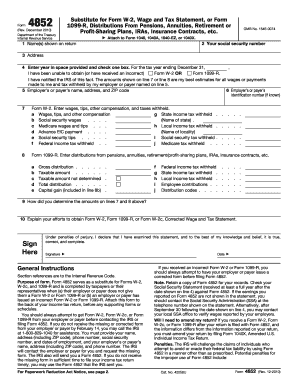

1040ez 2011

What is 1040ez 2011?

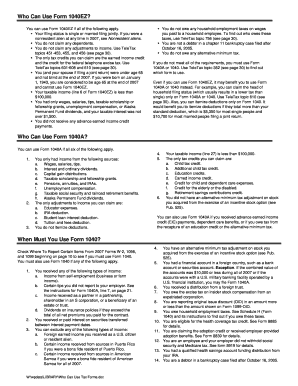

The 1040ez 2011 is a simplified tax form provided by the Internal Revenue Service (IRS) for individuals with straightforward tax situations. It is designed for people who have no dependents, file as Single or Married Filing Jointly, and do not claim any adjustments to income. This form is commonly used by taxpayers who have relatively simple financial affairs and want to quickly file their taxes.

What are the types of 1040ez 2011?

There are three types of 1040ez 2011 forms based on filing status:

How to complete 1040ez 2011

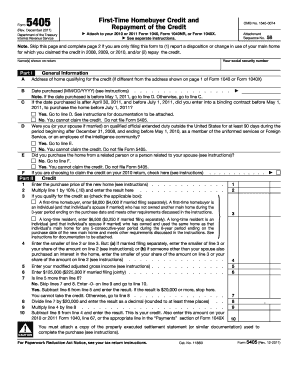

Completing the 1040ez 2011 is a straightforward process. Here are the steps you need to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.