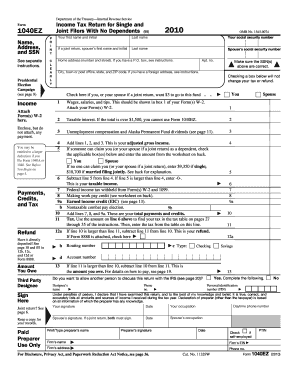

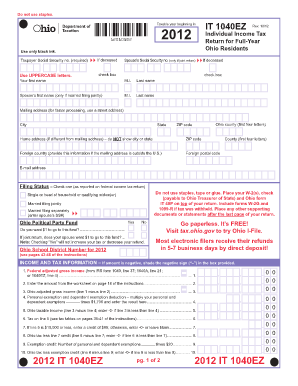

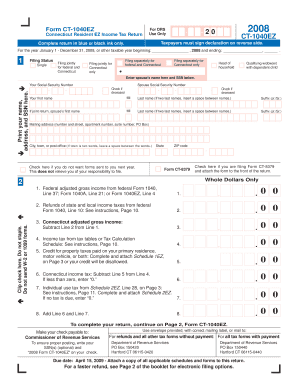

1040ez Form 2012

What is 1040ez Form 2012?

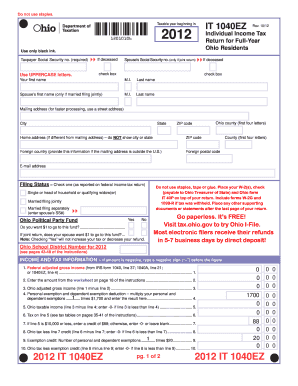

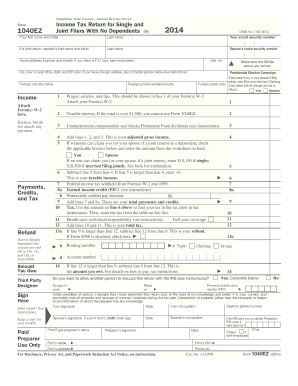

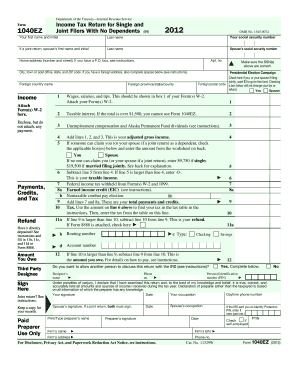

The 1040ez Form 2012 is a simplified tax form that was used in the year 2012. It is designed for individuals with straightforward tax situations, with income below a certain threshold and no dependents. This form allows taxpayers to easily report their income, claim deductions, and calculate their tax liability in a simple and efficient manner.

What are the types of 1040ez Form 2012?

There is only one type of 1040ez Form for the year 2012. The form is specifically for individuals filing their taxes for that year and is not applicable for other tax years. It is important to use the correct tax form for the corresponding tax year to ensure accurate reporting and calculation of taxes owed.

How to complete 1040ez Form 2012

Completing the 1040ez Form 2012 is a straightforward process. Here are the steps you need to follow:

By following these steps, you can easily complete and file your 1040ez Form 2012. However, if you need assistance or prefer a simpler and more convenient method, you can use pdfFiller. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.