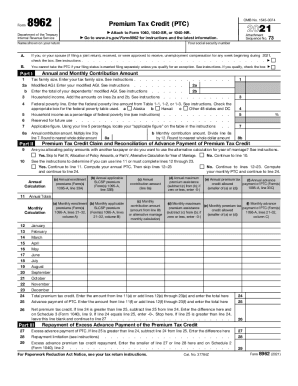

IRS Instructions 8962 2021 free printable template

Show details

The HCTC and the PTC are different tax credits that have different eligibility rules. If you think you may be eligible for the HCTC see Form 8885 and its instructions or visit IRS.gov/HCTC before completing Form 8962. B. No one can claim you as a dependent on a tax return for 2017. see Pub. 974 Premium Tax Credit. You also can visit IRS.gov and enter premium tax credit in the search box. Also see How To Avoid Common Mistakes in Completing Form 8962 at the end of these instructions. -2- health...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 8962

Edit your IRS Instructions 8962 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 8962 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Instructions 8962 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS Instructions 8962. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 8962 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instructions 8962

How to fill out IRS Instructions 8962

01

Gather all necessary documentation including Form 1095-A.

02

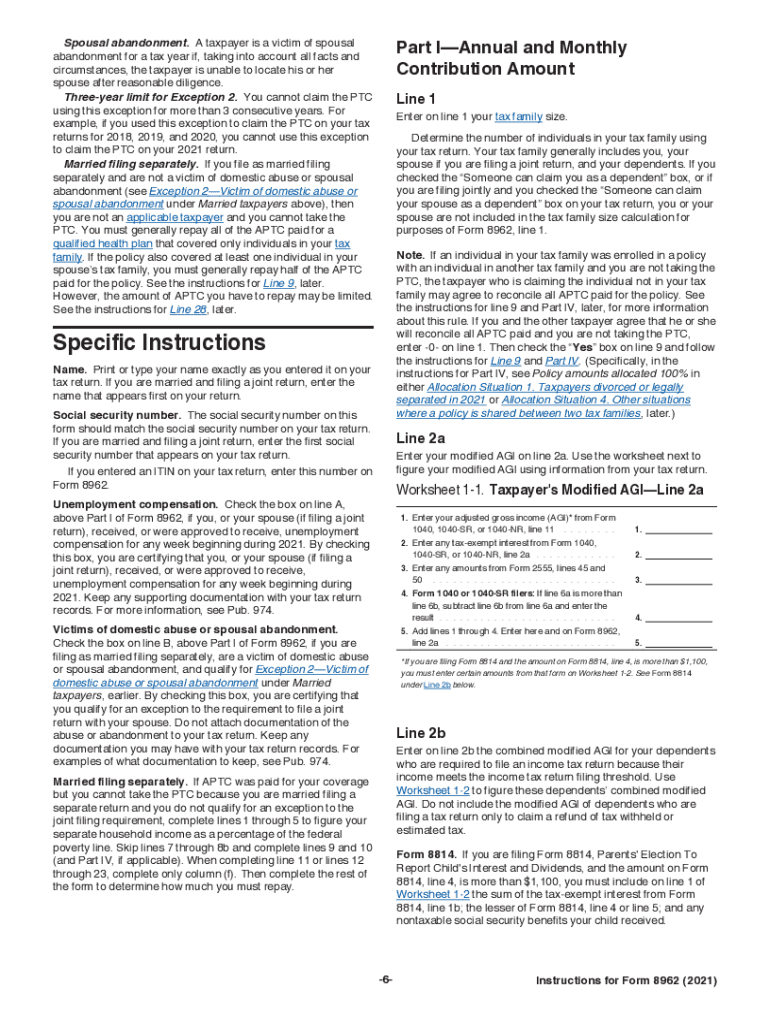

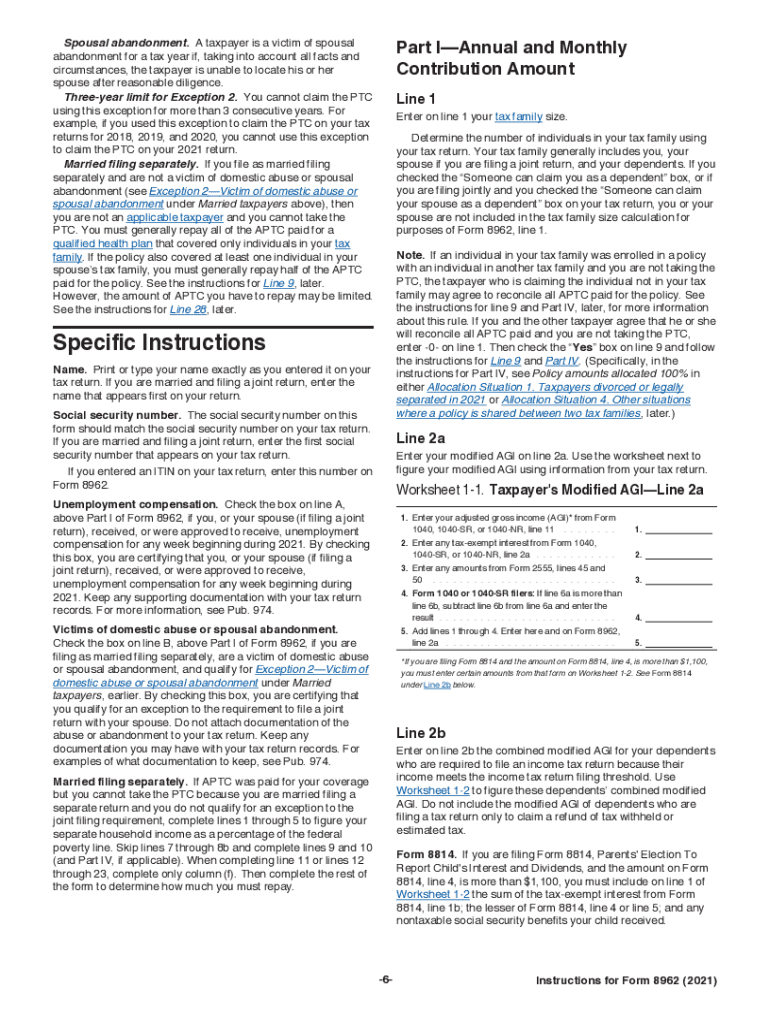

Start with Part I of Form 8962 to report your annual premium tax credit.

03

Enter your personal information, including your name and Social Security number.

04

Use the information from Form 1095-A to complete Table 1 in Part II.

05

Calculate your annual premium tax credit using the guidelines provided.

06

Complete Part III to reconcile any premium tax credit amounts with the amount you actually received.

07

Sign and date the form before submitting it with your tax return.

Who needs IRS Instructions 8962?

01

Individuals or families who received advance premium tax credits.

02

Taxpayers filing for a Health Insurance Marketplace plan.

03

Those who need to reconcile their premium tax credits with their actual income.

Fill

form

: Try Risk Free

People Also Ask about

What is form 8962 used to calculate?

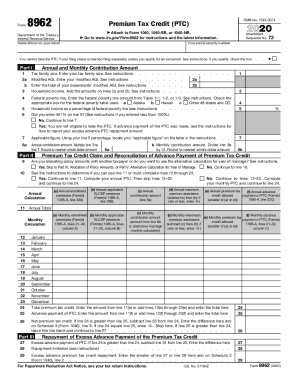

Purpose of Form Use Form 8962 to figure the amount of your premium tax credit (PTC) and reconcile it with advance payment of the premium tax credit (APTC).

What does the e file database indicates that Form 8962?

IRS implemented this check for taxpayers who received the Premium Tax Credit payments during the year, and must add form 8962 to the return to reconcile the payments received against the credit calculated and either pay back or get an additional refund.

Why is the IRS asking me for form 8962?

When the Health Insurance Marketplace pays advance payments of the premium tax credit on your behalf, you must file Form 8962 to reconcile the advance payments to the actual amount of the Premium Tax Credit that you are eligible for based on your actual household income and family size.

Where do I put 8962 on my 1040?

Enter your excess advance premium tax credit repayment on line 29. Write the smaller of either line 27 or line 28 on line 29, and on your Form 1040 or 1040NR. That's the amount you owe in repayment for getting more than your fair share in advance payment of the PTC.

What is Form 8862?

Taxpayers complete Form 8862 and attach it to their tax return if: Their earned income credit (EIC), child tax credit (CTC)/additional child tax credit (ACTC), credit for other dependents (ODC) or American opportunity credit (AOTC) was reduced or disallowed for any reason other than a math or clerical error.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the IRS Instructions 8962 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your IRS Instructions 8962 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the IRS Instructions 8962 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign IRS Instructions 8962 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit IRS Instructions 8962 on an Android device?

You can make any changes to PDF files, like IRS Instructions 8962, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is IRS Instructions 8962?

IRS Instructions 8962 provide guidance on how to complete Form 8962, which is used to calculate the Premium Tax Credit (PTC) for taxpayers who purchased health insurance through the Health Insurance Marketplace.

Who is required to file IRS Instructions 8962?

Taxpayers who received premium assistance through the Health Insurance Marketplace must file Form 8962 to claim the Premium Tax Credit or to reconcile advance payments of the Premium Tax Credit.

How to fill out IRS Instructions 8962?

To fill out Form 8962, taxpayers need to provide information about their income, family size, and coverage type, as well as the amount of premium tax credit they are eligible for and how much was paid in advance.

What is the purpose of IRS Instructions 8962?

The purpose of IRS Instructions 8962 is to assist taxpayers in understanding how to accurately calculate and claim the Premium Tax Credit, ensuring they meet the requirements set by the Affordable Care Act.

What information must be reported on IRS Instructions 8962?

Form 8962 requires reporting information such as the amount of premiums paid, the number of months coverage was in effect, household income, family size, and the amount of advance payments received for the Premium Tax Credit.

Fill out your IRS Instructions 8962 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 8962 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.