WI Claudia Traynor Daycare Income & Expense Worksheet 2014-2024 free printable template

Show details

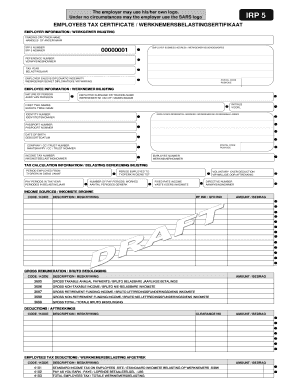

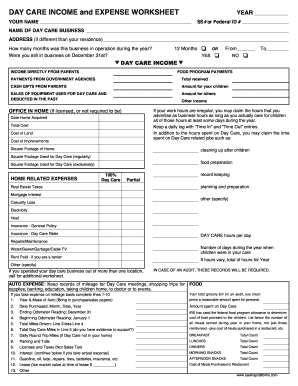

2014 DAYCARE INCOME & EXPENSE WORKSHEET Business Name Total Income $ Income from parents Government payments Food program payments Other income (cash gifts, sale of equipment, etc) SSN/Federal ID#

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your printable daycare income and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your printable daycare income and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit printable daycare income and expense worksheet online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit daycare income and expense worksheet form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out printable daycare income and

How to fill out printable daycare income and:

01

Gather all necessary information: Before starting to fill out the form, make sure you have all the required information at hand. This may include your personal details, such as your name, address, and contact information, as well as your daycare's information, such as the name, address, and Tax Identification Number.

02

Record the income sources: Next, carefully enter the various sources of income for your daycare. This can include the fees charged to parents or guardians, government subsidies or grants, and any other sources of income specific to your daycare business.

03

Calculate the total income: Once you have recorded all the income sources, add them up to calculate the total income for your daycare. Double-check your calculations to ensure accuracy.

04

Fill out any additional sections: Depending on the specific format of the form, there may be additional sections that require your attention. These sections could include expenses, deductions, or other financial information relevant to your daycare. Make sure to complete these sections accurately and thoroughly.

05

Review and proofread: Before submitting the form, take the time to review all the information you have entered, including your personal details and income figures. Check for any errors or inconsistencies and make necessary corrections. Proofread the form to ensure clarity and accuracy.

Who needs printable daycare income and:

01

Daycare providers: Printable daycare income forms are essential for daycare providers to accurately record and report their income. It helps maintain financial transparency and compliance with tax regulations.

02

Parents or guardians: Parents or guardians may also need printable daycare income forms to keep track of the childcare expenses they incur. These forms provide a record of the payments made to the daycare provider, which may be necessary for tax purposes or reimbursement from an employer.

03

Tax authorities or government agencies: Printable daycare income forms may be required by tax authorities or government agencies to verify income and ensure that appropriate taxes are being paid. These forms help in monitoring compliance and conducting audits if necessary.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file printable daycare income and?

Individuals who operate a daycare business or provide daycare services are required to file printable daycare income and expenses. This includes those who are self-employed or have a registered daycare business.

How to fill out printable daycare income and?

To fill out a printable daycare income form, follow these steps:

1. Download the printable daycare income form from a trusted website or daycare resource.

2. Gather all the necessary information and documents such as your business earnings, expenses, and tax identification number.

3. Start by filling out your daycare's name, address, and contact information at the top of the form.

4. Provide your tax identification number or social security number if required.

5. Begin documenting your income by listing each source of revenue separately. This may include parent payments, subsidies, government grants, or other types of income.

6. Enter the amount you received for each source of income next to the corresponding category. Ensure the amounts are accurate and clearly stated.

7. Add up the total income received from all sources and write the sum in the designated field.

8. If required, complete additional sections related to expenses, deductions, or credits. This may include listing operating costs like rent, utilities, toys, educational supplies, employee wages, or any other relevant expenses associated with running your daycare.

9. Calculate the total expenses and write the sum in the designated field.

10. Subtract the total expenses from the total income to determine your net income or profit.

11. Review the completed form to ensure accuracy and make any necessary adjustments.

12. Sign and date the form, indicating that the information provided is true and accurate.

Always consult with a tax professional or accountant if you have any specific questions or concerns about filling out a daycare income form or reporting your income accurately.

What is the purpose of printable daycare income and?

The purpose of printable daycare income and expenses is to keep track of the finances related to operating a daycare business. It allows daycare owners or operators to record their income and expenses accurately, which is essential for budget planning, tax purposes, and business analysis. By documenting all income sources and expenses associated with the daycare, it helps track the financial health of the business, identify areas of improvement, and ensure compliance with legal and regulatory requirements. Additionally, printable daycare income and expense sheets can be used to generate financial reports, assess profitability, and make informed business decisions.

What information must be reported on printable daycare income and?

The information that must be reported on a printable daycare income form typically includes the following:

1. Name and contact information of the daycare provider or business

2. The taxpayer identification number, such as Social Security Number (SSN) or Employer Identification Number (EIN)

3. Total income received during the tax year from daycare services, including payments from parents, government subsidies, and any other sources of income related to childcare

4. Any expenses directly related to operating the daycare, such as supplies, food, rent, utilities, and other relevant costs

5. Dependent care benefits received, if applicable

6. Any depreciation or other deductions related to the daycare facility or business equipment

7. Signature of the daycare provider certifying the accuracy of the information provided

8. Any additional relevant information or disclosures required by the tax authority in your jurisdiction.

It's important to consult with a tax professional or refer to the specific tax laws in your country to ensure you gather all the necessary information for accurate reporting.

When is the deadline to file printable daycare income and in 2023?

The deadline to file income tax returns for daycare income in 2023 will depend on the country or jurisdiction you reside in. Tax filing deadlines vary from one place to another. In the United States, for example, the deadline to file federal income tax returns is typically April 15th each year. However, it is advisable to consult with a tax professional or check the tax authority's website for the specific deadline in your location.

What is the penalty for the late filing of printable daycare income and?

The penalty for late filing of printable daycare income and depends on the specific tax regulations and policies of the jurisdiction in which the daycare operates. It is important to consult with a tax professional or relevant government agency to obtain accurate and up-to-date information on the penalties for late filing. Penalties can vary and may include monetary fines or interest charges on the unpaid taxes.

Where do I find printable daycare income and expense worksheet?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the daycare income and expense worksheet form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit daycare income and expense worksheet in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your printable daycare income and expense worksheet, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit home daycare income and expense worksheet on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing printable daycare income and expense worksheet right away.

Fill out your printable daycare income and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Daycare Income And Expense Worksheet is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.