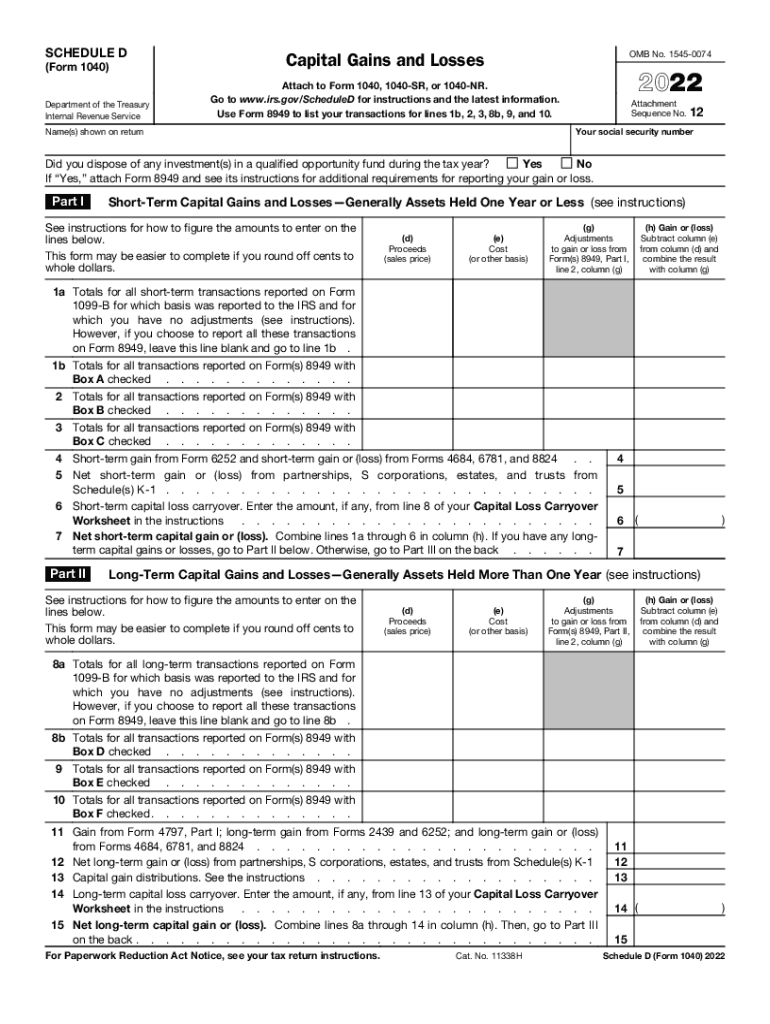

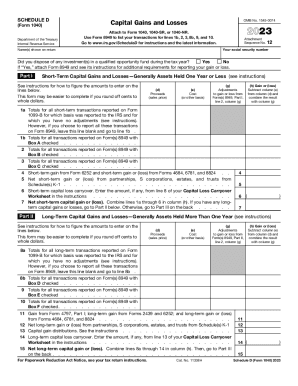

Who Needs Schedule D of for Form 1040?

Schedule D is designed for most people to report capital gains and losses that occur when they sell some property during the year. Note that capital assets are not only private property like a house or a car, but also stocks and bonds.

What is Schedule D of Form 1040 for?

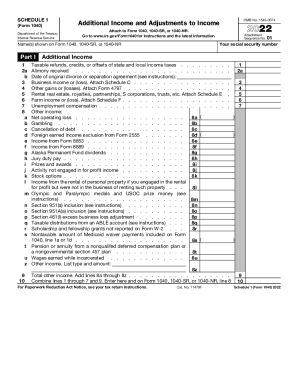

The schedule is used to report both long-term and short-term capital gains and losses from selling capital assets. All the money you get when you sell your property must be reported in Schedule D. Generally, you shouldn’t include the loss from the capital asset's sale, since only gain is subject to income tax. The capital gain is the difference between the amount you paid for the asset and the amount you received when selling the asset.

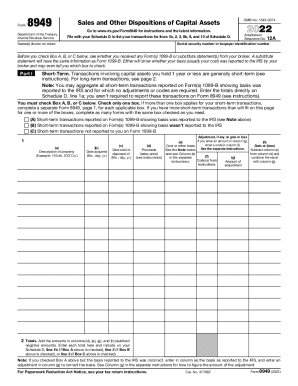

Is Schedule D of Form 1040 Accompanied by other Forms?

If there are no specific exceptions, Schedule D is accompanied by Form 8949 which includes capital asset transaction details.

When is Schedule D of Form 1040 Due?

Since Schedule D is a part of the individual income tax return 1040, it should be completed by April 18th, 2017.

How do I fill out Schedule D of Form 1040?

Schedule D is a two-page document that consists of three parts with some boxes in each.

- Part 1 accounts for short-term capital gains and losses. Assets that were held for a year or less go here. In this part you will have to check seven boxes.

- Part 2 accounts for long-term capital gains from assets held more than a year. Here you will have to check 9 boxes.

- Part 3 is a summary that serves to verify some information.

To make the calculations easier you are allowed to round off cents.

Where do I send Schedule D of Form 1040?

Completed Schedule D is submitted to the IRS.