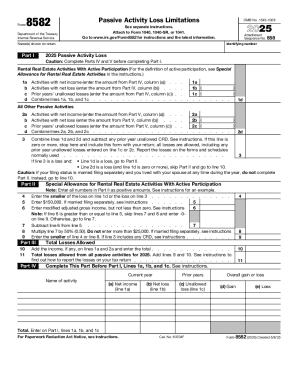

IRS 8582 2022 free printable template

Instructions and Help about IRS 8582

How to edit IRS 8582

How to fill out IRS 8582

About IRS 8 previous version

What is IRS 8582?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8582

What should I do if I realize I've made a mistake on my IRS 8582 after submission?

If you've made a mistake on your submitted IRS 8582, you should file an amended form. To correct the errors, use IRS Form 1040-X to amend your return, including the corrected IRS 8582 information. Always ensure that your amended claim reflects accurate data to avoid further complications.

How can I verify the status of my IRS 8582 submission?

You can check the status of your IRS 8582 by using the IRS 'Where's My Refund?' tool available on their website if you filed electronically. If you filed by mail, you may want to wait a few weeks before inquiring or trying to verify your submission status, as processing times can vary.

What should I do if my IRS 8582 was rejected during e-filing?

If your IRS 8582 is rejected during e-filing, you’ll receive a rejection notice detailing the reason. Address the issue as indicated and resubmit your form electronically after making the necessary corrections to proceed without delay.

Are there special considerations for filing IRS 8582 for foreign payees?

When dealing with foreign payees on IRS 8582, be mindful of the unique tax obligations that may apply. Ensure that appropriate forms are completed, like Form 1042-S for reporting amounts paid to foreign persons, alongside the IRS 8582 if applicable.

What steps should I take if I receive an IRS notice regarding my IRS 8582?

If you receive a notice related to your IRS 8582, read it carefully to understand the IRS's concerns. Gather any necessary documentation to support your response and ensure you reply within the time frame stated in the notice to prevent additional issues or penalties.

See what our users say