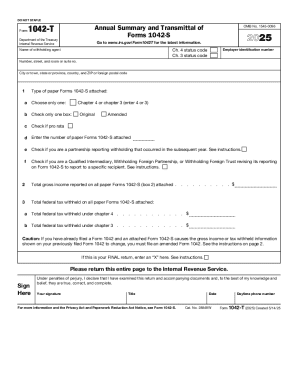

IRS 1042-T 2011 free printable template

Instructions and Help about IRS 1042-T

How to edit IRS 1042-T

How to fill out IRS 1042-T

About IRS 1042-T 2011 previous version

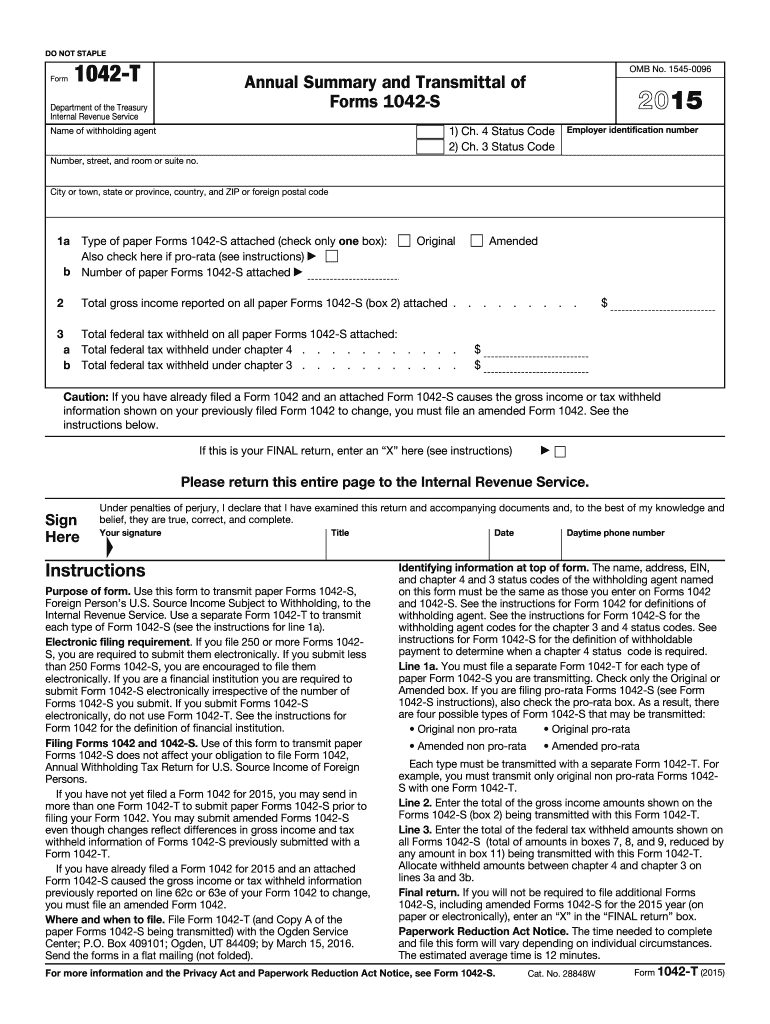

What is IRS 1042-T?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1042-T

What should I do if I realize I made an error on my filed 2014 form 1042-t annual?

If you discover a mistake on your filed 2014 form 1042-t annual, you must submit a corrected form as soon as possible. Ensure that you clearly indicate to the IRS that this is an amended return. Withdrawing the original form through submission of a corrected form is essential for proper processing.

How can I check the status of my 2014 form 1042-t annual submission?

To verify the receipt and processing status of your 2014 form 1042-t annual, you can contact the IRS directly or check their online tools if available. Always have your confirmation number handy if you e-filed to expedite inquiries.

Can I use an e-signature when filing my 2014 form 1042-t annual?

E-signatures are accepted for the 2014 form 1042-t annual when filing electronically, provided that the software you are using complies with IRS regulations. Be sure to confirm with your e-filing service for specific requirements regarding the use of electronic signatures.

What are common errors made when filing the 2014 form 1042-t annual and how can I avoid them?

Common mistakes when filing the 2014 form 1042-t annual include incorrect taxpayer identification numbers and failing to report all income. To avoid these errors, double-check all information against official documents and ensure that any reported income matches prior records.