Get the free form 8962

Show details

See Pub. 974, Premium Tax Credit. You can also visit www.irs.gov and enter premium tax credit in the search box.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 8962 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8962 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 8962 online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 8962. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

How to fill out form 8962

How to fill out form 8962:

01

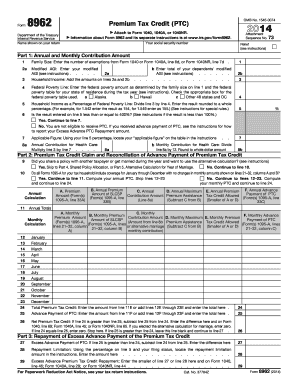

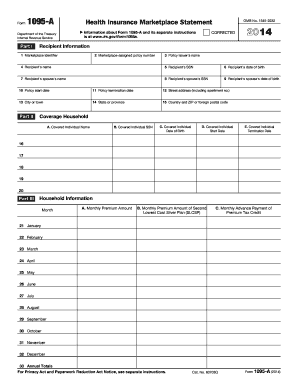

Gather the necessary information: Before filling out form 8962, make sure you have all the required documents and information handy. This includes your Form 1095-A, Health Insurance Marketplace Statement, as well as any information regarding premium tax credits, policy information, and household income.

02

Fill in personal details: Provide your name, social security number, and the name of the primary policyholder as it appears on the Form 1095-A.

03

Calculate your annual and monthly contributions: Using the information provided on Form 1095-A, calculate your annual and monthly contributions towards the health insurance plan. This includes the premiums paid and any advance premium tax credits received.

04

Determine your household income: Report your modified adjusted gross income (MAGI) and your household size. Make sure to include the income of all members in your tax household, even if they did not receive coverage through the Marketplace.

05

Complete Part II: In Part II of form 8962, you will reconcile any advance premium tax credits received with the amount you qualify for based on your income. Follow the instructions provided on the form to accurately fill out the required fields.

06

Provide necessary signatures: Ensure that both the primary policyholder and any spouse listed in Part IV of the form sign and date where required.

Who needs form 8962:

01

Individuals who received advanced premium tax credits (APTC) through the Health Insurance Marketplace to help pay for their insurance premiums need to file form 8962.

02

Those who purchased their insurance coverage through the Marketplace and received Form 1095-A need to fill out form 8962 to reconcile their APTC with their actual income.

03

People who had any changes in their household size, income, or eligibility for certain exemptions during the year need to complete form 8962.

Note: It is important to consult the official IRS guidelines and instructions when filling out form 8962 to ensure accuracy and compliance with the tax laws in your jurisdiction. Consider seeking professional assistance or contacting the IRS directly for any specific questions or concerns about your individual circumstances.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 8962?

Form 8962 is used to reconcile advance payments of the premium tax credit and to claim the premium tax credit on your tax return.

Who is required to file form 8962?

Individuals who have received advance payments of the premium tax credit or those who want to claim the premium tax credit on their tax return are required to file form 8962.

How to fill out form 8962?

Form 8962 requires you to provide information about your household income, the cost of health insurance premiums, and any advance payments received. You can fill out the form manually or use tax preparation software.

What is the purpose of form 8962?

The purpose of form 8962 is to reconcile the amount of premium tax credit you are eligible for based on your income and family size with the advance payments you received throughout the year.

What information must be reported on form 8962?

You must report your household income, the cost of health insurance premiums, any advance payments received, and the number of individuals covered by the policy on form 8962.

When is the deadline to file form 8962 in 2023?

The deadline to file form 8962 for tax year 2023 is April 15, 2024.

What is the penalty for the late filing of form 8962?

The penalty for late filing of form 8962 is $210 per month or fraction of a month that the form is late, up to a maximum of $2,520.

How do I complete form 8962 online?

pdfFiller has made it easy to fill out and sign form 8962. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit form 8962 in Chrome?

Install the pdfFiller Google Chrome Extension to edit form 8962 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the form 8962 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your form 8962 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your form 8962 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.