IRS 4768 2012 free printable template

Show details

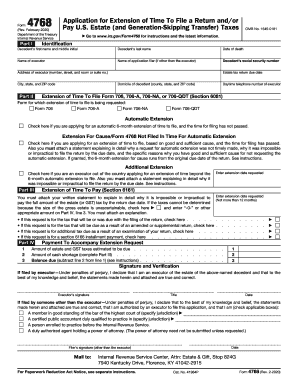

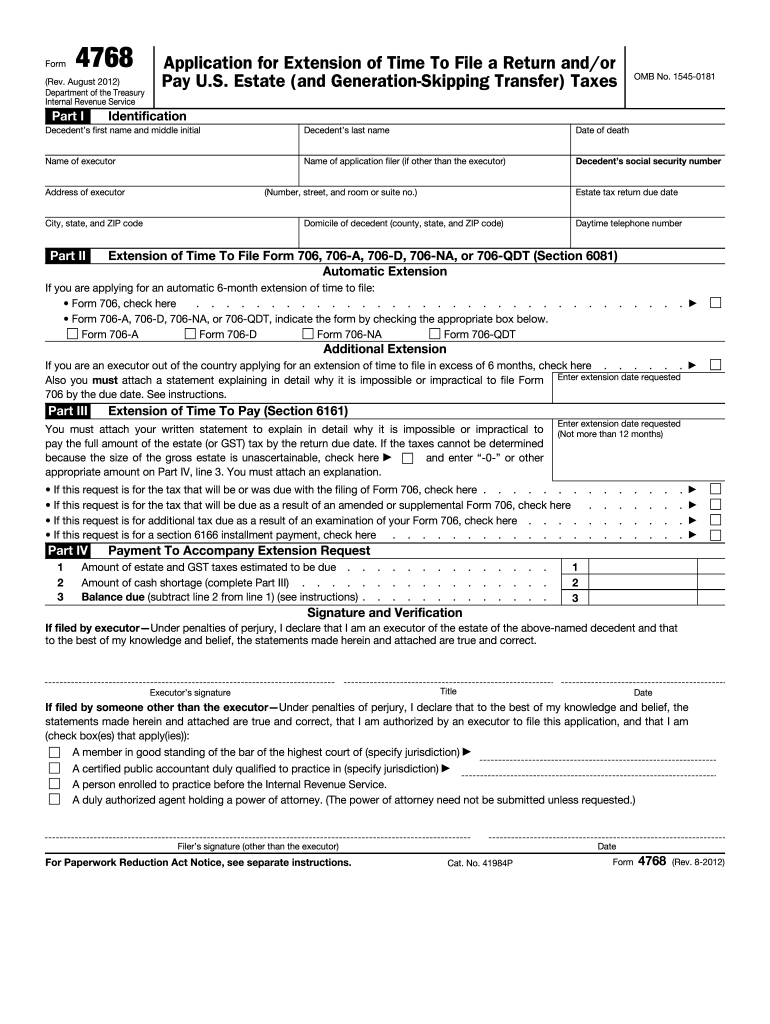

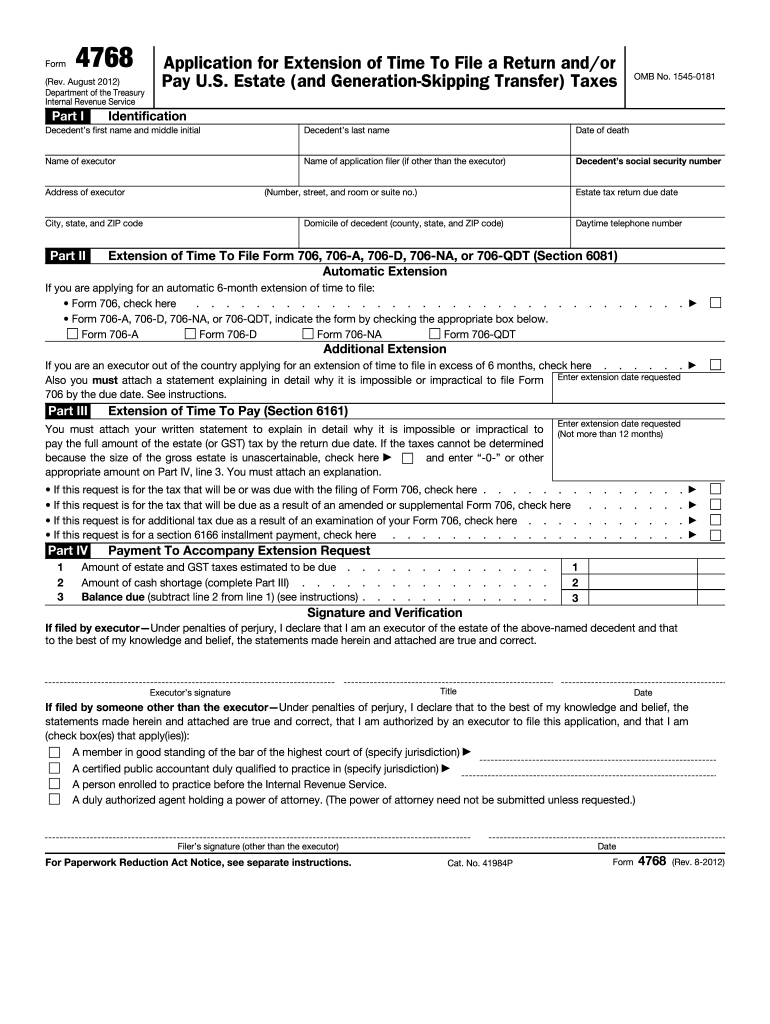

Cat. No. 41984P Rev. 8-2012 Form 4768 Rev. 8-2012 Part V Page Notice to Applicant To be completed by the Internal Revenue Service Note. Form Rev* August 2012 Department of the Treasury Internal Revenue Service Part I Application for Extension of Time To File a Return and/or Pay U*S* Estate and Generation-Skipping Transfer Taxes OMB No* 1545-0181 Identification Decedent s first name and middle initial Decedent s last name Date of death Name of executor Name of application filer if other than...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 4768

Edit your IRS 4768 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 4768 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 4768 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS 4768. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 4768 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 4768

How to fill out IRS 4768

01

Obtain Form IRS 4768 from the IRS website or local IRS office.

02

Fill in your name, address, and taxpayer identification number at the top of the form.

03

Provide information about the decedent, including their name, date of death, and social security number.

04

Indicate the type of return you are filing (e.g., estate tax return).

05

Calculate the required extension period and check the box for the request for extension.

06

If applicable, fill in details of any estate or gift tax that may be due.

07

Sign and date the form, and provide your contact information.

08

Submit the form to the appropriate IRS office before the due date.

Who needs IRS 4768?

01

Individuals responsible for filing an estate tax return for a deceased person.

02

Executors or personal representatives of an estate who require an extension to file the estate tax return.

03

Anyone who is filing Form 706 or Form 706-NA and needs additional time.

Fill

form

: Try Risk Free

People Also Ask about

What triggers an estate tax return?

An estate tax return (Form 706) must be filed if the gross estate of the decedent (who is a U.S. citizen or resident), increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the decedent's death, as shown in the table below.

Can form 4768 be electronically filed?

The form 4768 is not be able to efile. Additional Information: Para obtener la versión en español de este artículo de Knowledge Base, haga clic aquí: ¿Puedo presentar electrónicamente el formulario 4768 en declaración 706?

What is the purpose of form 4868?

A U.S. citizen or resident files this form to request an automatic extension of time to file a U.S. individual income tax return.

What is a 4768 tax form?

About Form 4768, Application for Extension of Time To File a Return and/or Pay U.S. Estate (and Generation-Skipping Transfer) Taxes.

Who is the form 4868 payable to?

Be sure to make your check or money order payable to the "United States Treasury." Write your social security number, daytime phone number, and "Form 4868" on your check or money order.

Do I need to file form 4868 if I don't owe taxes?

Do I need to file an extension if I don't owe? If you are due a refund, you do not need to file an extension; you have three years from the filing deadline to file the return and claim your refund.

Fill out your IRS 4768 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 4768 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.