What is form 14039?

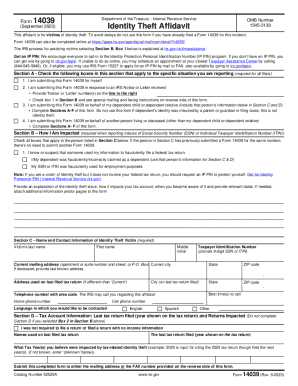

Form 14039 or Identity Theft Affidavit is used to provide a statement of the identity theft that affected your federal tax records or a statement of an event involving your personal information that may affect your federal tax records now or in the future. In any case, you will need to describe your problem, explaining the reasons for your apprehension. The IRS will review your appeal and take action based on the information you provided.

Who should file IRS form 14039?

Submit form 14039 if you have issues that you believe may result from identity theft. For example, if you can’t file your tax return electronically because a tax return with your SSN has already been filed. Before filing the form, make sure the problem is not associated with a transposed SSN or a dependent filing a separate tax return.

What information do you need when filing the 14039 form?

You will need to provide personal details, such as your name, taxpayer identification number, current mailing address, the address used on the last filed tax return, and further information explaining the identity theft issue. You will need to specify if someone used your information to file taxes.

If you file 14039 on someone else’s behalf, you must fill out Section E of the form.

How do I fill out form 14039?

This form consists of two pages. You will need to enter your personal information, indicate the reasons that prompted you to apply to the IRS, and indicate the person you represent if applicable.

Is 14039 accompanied by other forms?

You can submit the form together with your tax return, print it, and mail it to the IRS.

When is form 14039 due?

There is no deadline for submitting the form. You can file this affidavit whenever it is needed.

Where do I send form 14039?

File form 14039 with a paper tax return and mail them directly to the IRS. You may also submit the form by fax. Alternatively, you can submit it at the Federal Trade Commission. In this case, the FTC will transfer the form (but not the tax return) to the IRS. You may find instructions on where to send the 14039 on page 2 of the form.