Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

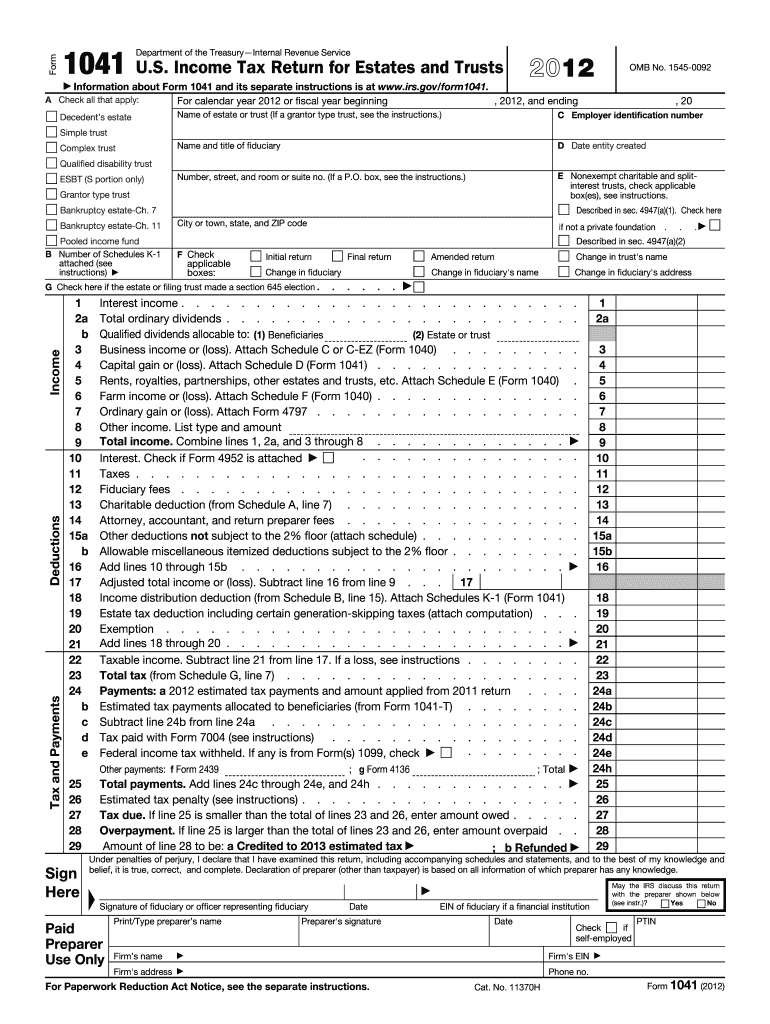

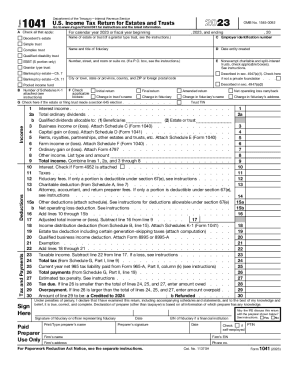

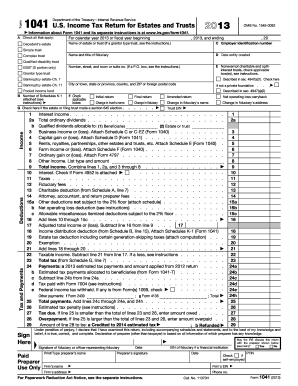

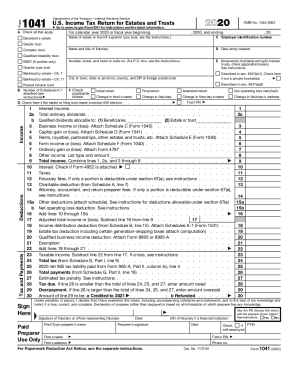

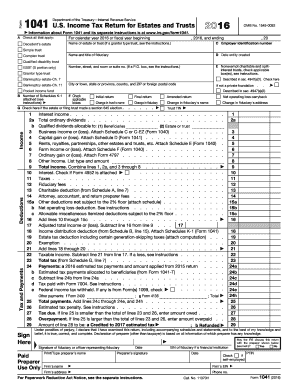

IRS Form 1041 is a tax form used for filing the income tax return for estates and trusts. Estate refers to the assets and liabilities left behind after an individual's death, while trust refers to a legal arrangement where a trustee holds and manages assets on behalf of beneficiaries. Form 1041 is used to report the income, deductions, and distributions of estates and trusts, and calculate the tax owed on that income. It is similar in structure to the individual income tax return (Form 1040) but tailored specifically for estates and trusts.

Who is required to file irs 1041 form?

An individual or a trust that is classified as an estate under the US tax code is required to file IRS Form 1041.

How to fill out irs 1041 form?

Filling out IRS Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts, can be a complex process. Here is a brief guide on how to fill out the form:

1. Gather required information: Collect all necessary documentation, including income statements (such as Schedule K-1), deductions, expenses, and supporting documents for the estate or trust.

2. Provide general information: In the first section of Form 1041, enter the estate or trust’s name, address, employer identification number (EIN), filing status, and the start and end dates of the tax year.

3. Determine the type of estate or trust: Select the appropriate box to indicate if the filing is for an estate, simple trust, complex trust, pooled income fund, or qualified funeral trust.

4. Complete schedules: Depending on the type of estate or trust, you may need to complete various schedules. For example, Schedule B provides detailed information about the estate's or trust's income, deductions, credits, and taxes paid.

5. Report income, deductions, and exemptions: Provide accurate information on income, deductions, and exemptions. Common types of income include interest, dividends, capital gains, rental income, and royalties. Deductions can include attorney fees, accounting fees, and charitable contributions.

6. Calculate tax liability: Use the applicable tax rates and instructions to calculate the estate's or trust's tax liability. Pay close attention to any special rules or conditions that may apply.

7. Complete beneficiary information: If applicable, provide information on the beneficiaries, including their social security numbers or EINs, share of the income, and any distributions made.

8. Sign and date the form: Make sure to include the signature and date of the fiduciary or trustee.

9. Mail the form: Attach any necessary schedules or supporting documents and mail the completed Form 1041 to the appropriate IRS address.

Note: It is always recommended to consult with a professional tax advisor or CPA for further assistance in filling out Form 1041, as individual circumstances can differ and tax laws are subject to change.

What is the purpose of irs 1041 form?

The purpose of the IRS 1041 form is to report the income, deductions, gains, losses, and tax liabilities of an estate or trust. This form is filed by the executor, administrator, or trustee of the estate or trust to report the income generated and distributed to the beneficiaries. It is used to calculate and pay the appropriate taxes owed by the estate or trust.

What information must be reported on irs 1041 form?

The IRS Form 1041, U.S. Income Tax Return for Estates and Trusts, requires the following information to be reported:

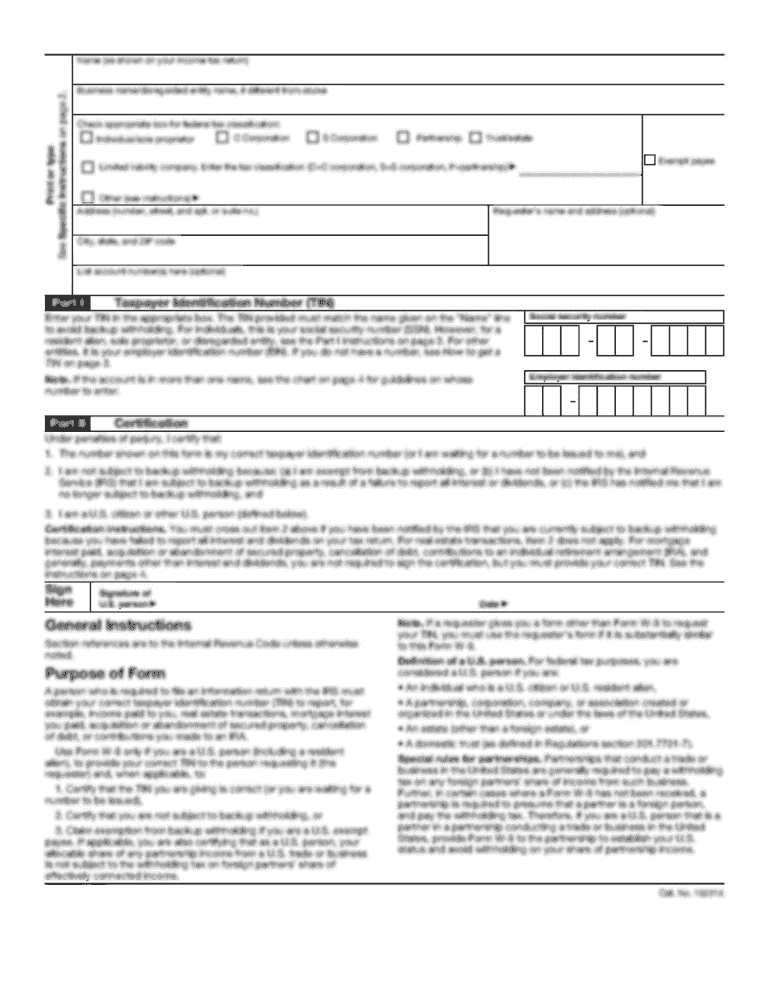

1. The estate or trust's identification details, including name, address, and taxpayer identification number (TIN).

2. Income earned by the estate or trust, including dividends, interest, rental income, and royalties. This income should be reported on Schedule B.

3. Deductions and expenses associated with the estate or trust, such as administrative expenses, attorney fees, and trustee fees. These should be reported on Schedule A.

4. Taxable income calculation, which is determined by subtracting the deductions from the income.

5. Tax rates and calculations. The tax rates applicable to estates and trusts are different from individual tax rates, and the tax liability should be computed based on those rates.

6. Estimated tax payments made throughout the year, if applicable.

7. Credit for certain taxes paid on behalf of the estate or trust, including estimated tax payments, withholding taxes, or taxes paid due to foreign investments.

8. Distribution of income and principal to beneficiaries, including details of the amounts and the beneficiaries' TINs. This information is reported on Schedule K-1.

9. Other additional schedules may be required to report specific types of income, deductions, or transactions, such as Schedule D (capital gains and losses), Schedule E (rental income), or Schedule G (certain transfers and distributions). The necessity of these schedules depends on the specific circumstances of the estate or trust.

It's important to note that this is a simplified summary, and the specific requirements of the Form 1041 can vary depending on the complexity of the estate or trust. Therefore, it is generally advisable to consult with a tax professional or review the official instructions provided by the IRS to ensure accurate reporting.

When is the deadline to file irs 1041 form in 2023?

The deadline to file IRS Form 1041 for the tax year 2022 (not 2023) is April 17, 2023. It is typically due on the 15th day of the fourth month following the close of the tax year, which is April 15th. However, if April 15th falls on a weekend or holiday, the deadline is moved to the next business day. Therefore, in 2023, the filing deadline is April 17th. Please note that tax deadlines can occasionally change, so it is always recommended to double-check with the IRS for any updates or changes.

What is the penalty for the late filing of irs 1041 form?

The penalty for late filing of IRS Form 1041 (U.S. Income Tax Return for Estates and Trusts) is generally 5% of the unpaid tax amount per month (or part of a month) up to a maximum of 25%. However, if the return is over 60 days late, the minimum penalty could be the lesser of $435 or the amount of tax due. It is important to note that these penalties can vary depending on the circumstances and the IRS's discretion.

Can I sign the 2012 irs 1041 form electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your 2012 irs 1041 form in seconds.

Can I create an eSignature for the 2012 irs 1041 form in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your 2012 irs 1041 form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the 2012 irs 1041 form form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign 2012 irs 1041 form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.