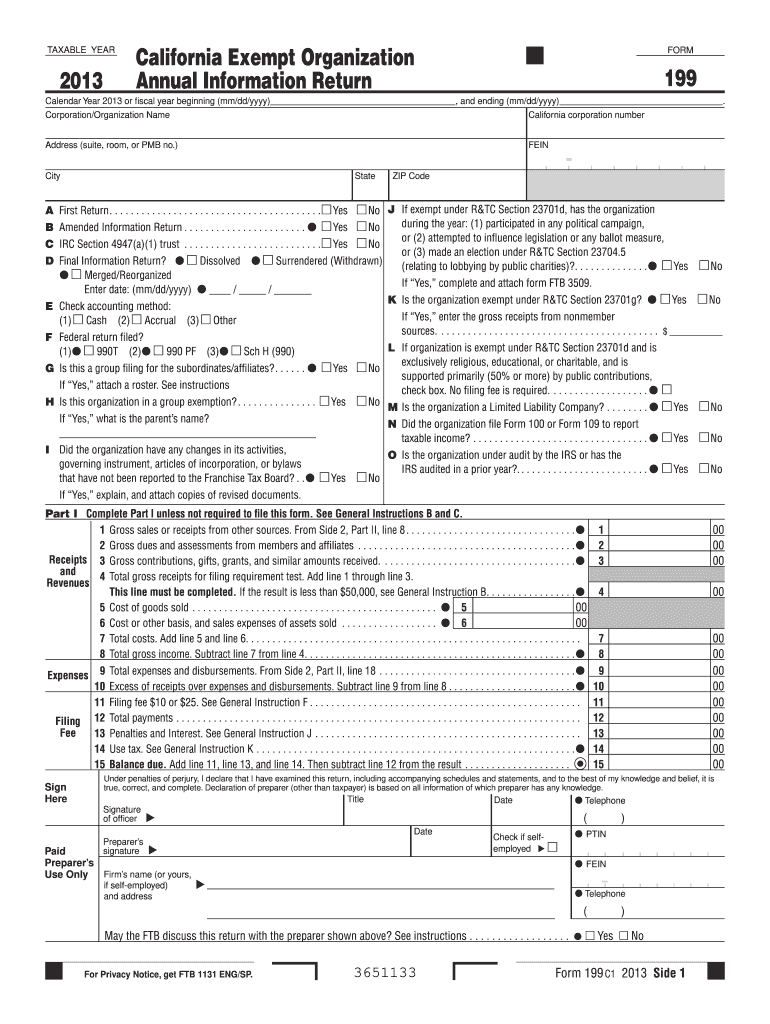

Who needs form CA 199 Form?

CA 199 Form is the Internal Revenue Service Form that must be filed by most tax-exempt organizations doing business in the State of California. In Fact, the CA Form 199 must be submitted by private foundations, nonexempt charitable trusts established by Internal Revenue Code (IRC) Section 4947(a)(1) on the annual basis.

What is the purpose of CA 199 Form?

The CA 199 Form is called “California Exempt Organization Annual Information Return”, therefore it must be submitted in order to inform the local IRS of the financial condition of a tax-exempt organization.

When is the California Exempt Organization Annual Information Return due?

The form must be filed on a yearly basis. The 199 Form is due on the 15th day of the 5th month after the end of the taxable year which is very likely to coincide with a calendar year. Normally, the deadline for the submission of CA 199s is May 15th. Yet it may be extended if the 15th day falls on weekend or a state holiday.

How do I fill out the CA 199 Form?

Prior to submission, the filer should make sure whether all the information is indicated properly:

-

Reporting period

-

Name of the organization/corporation and its number

-

Address

-

Federal Employer identification number (VEIN)

The rest of the form is divided into two parts, a balance sheet (Schedule L) and Schedule M-1.

Part 1 consisting of receipts and revenues, expenses and fee payment details.

Part 2 must provide the following details: receipts from other sources, and expenses and disbursements.

Where to submit the Form CA 199?

The completed form must be directed to the California Franchise Tax Board, which is situated in Sacramento. However, depending on whether the payment of the fee is required and how it is paid the form may be directed to one of the addresses which can be found here: https://www.ftb.ca.gov/forms/2014/14_199ins.pdf