Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

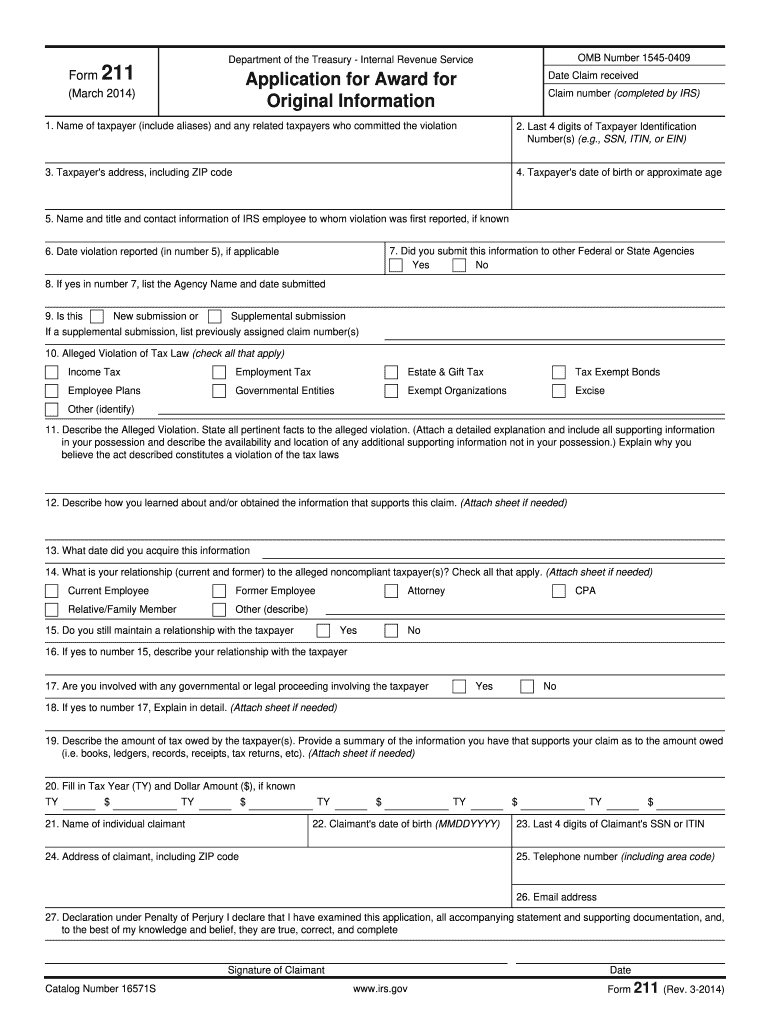

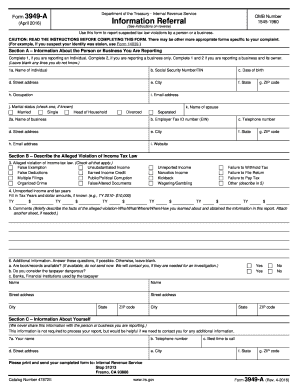

IRS Form 211 is a form used to report a potential violation of tax laws, specifically those related to tax fraud, by an individual or organization. It is meant to provide a way for individuals to report information to the Internal Revenue Service (IRS) about someone they think may be evading taxes or improperly applying tax laws.

Form 211 is a confidential disclosure form that is submitted to the IRS Whistleblower Office. It requires detailed information about the alleged tax evasion or fraud, such as the name and address of the alleged violator, their social security number or Employer Identification Number (EIN), and any supporting evidence or documentation.

If the information provided on Form 211 leads to the recovery of taxes owed, the whistleblower may be eligible for a reward of up to 30% of the total amount collected by the IRS. However, the amount and eligibility for a reward are subject to certain criteria and limitations outlined by the IRS.

It is important to note that Form 211 should only be used to report credible information about a potential tax violation. False reports or malicious intent can lead to legal consequences.

Who is required to file irs form 211?

Individuals who wish to report information about a person or organization that has committed tax fraud or underpaid taxes can file the IRS Form 211, also known as the Application for Award for Original Information. It is commonly filed by whistleblowers or informants who have substantial and credible information regarding substantial tax non-compliance, exceeding $2 million in taxes, penalties, and interest, for individuals, and $200,000 for corporations. This form is used to request an award from the IRS for providing information leading to the collection of unpaid taxes.

How to fill out irs form 211?

The IRS Form 211 is used to request a whistleblower award after reporting tax fraud or misconduct by an individual or organization. Here are the steps to fill out the form:

1. Obtain the latest version of Form 211: You can download the form from the IRS website or visit a local IRS office to obtain a copy.

2. Read the instructions: Before filling out the form, carefully read the instructions provided with the form. It will help you understand the requirements and properly complete the form.

3. Provide your information: Fill out the personal information section, including your name, address, phone number, social security number (SSN), and taxpayer identification number (TIN) if applicable.

4. Provide information about the reported tax fraud/misconduct: In this section, include details about the individual or organization you reported, such as their name, address, and identifying information, along with a description of the tax fraud or misconduct.

5. Provide supporting documentation: Attach any relevant documents or evidence that support your claim. This may include records, financial statements, correspondence, or any other evidence related to the reported tax fraud.

6. Sign and date the form: Review the completed form and ensure all required fields are filled. Sign and date the form at the designated area.

7. Submit the form: Mail the signed and completed Form 211 to the IRS Whistleblower Office at the address provided in the form's instructions. Ensure that you keep a copy of the filled form for your records.

It is important to note that the IRS treats the information provided on Form 211 as confidential, and there may be potential financial rewards if the reported tax fraud leads to a successful tax collection. However, it is recommended to consult with a tax professional or attorney for guidance on how to complete the form accurately.

What is the purpose of irs form 211?

IRS Form 211, also known as the Application for Award for Original Information, is used to report potential violations of tax laws or underpayment of taxes. The purpose of Form 211 is for individuals to submit information about a taxpayer who may be involved in illegal activities related to taxes, such as tax evasion or fraud. The form is primarily used by whistleblowers who wish to report potential tax violations to the Internal Revenue Service (IRS). If the information provided leads to the recovery of taxes, the whistleblower may be eligible for an award or reward based on a percentage of the collected proceeds.

What information must be reported on irs form 211?

IRS Form 211 is used to report information on a person who has knowledge of tax evasion or non-compliance and is seeking a whistleblower reward. The following information must be reported on Form 211:

1. Whistleblower Information: The form starts with providing your personal details such as name, address, SSN or TIN, and contact information.

2. Information about Violator: You need to provide detailed information about the individual, business, or entity that you are reporting. This includes their name, address, and taxpayer identification number (TIN) if available.

3. Alleged Tax Violations: You must provide specific details about the alleged tax evasion or non-compliance. Descriptions should include the type of tax involved, the approximate amounts involved, and any evidence that supports the claim.

4. Supporting Documentation: You are required to provide any supporting documentation that helps establish the claim of tax evasion or non-compliance. This may include receipts, invoices, financial statements, bank records, or any other relevant evidence.

5. Additional Information: In this section, you can provide additional information that may be helpful in substantiating your claim. This can include details about witnesses, accomplices, or any other relevant information that can assist the IRS in investigating the alleged violations.

6. Claim for Whistleblower Award: If you are seeking a whistleblower reward, you must provide details on how you learned about the violations and information about any intermediary, attorney, or other representative involved in submitting the claim.

It is important to carefully review the instructions for Form 211 and provide as much accurate and detailed information as possible to support your claim.

When is the deadline to file irs form 211 in 2023?

The specific deadline for filing IRS Form 211 in 2023 has not been announced yet. The deadline for filing Form 211 typically coincides with the tax year in question. Therefore, it is typically due on April 15th of the year following the tax year in question. However, it is always recommended to confirm the deadlines with the IRS or a qualified tax professional closer to the date.

What is the penalty for the late filing of irs form 211?

The penalty for the late filing of IRS Form 211 depends on the circumstances. Form 211 is used to report information on individuals or businesses that are potentially involved in illegal activities and may be eligible for a whistleblower reward.

If someone is required to file Form 211 but fails to do so, they may face penalties, including potential civil and criminal charges. The specific penalties and consequences can vary based on the nature and severity of the violation.

It is recommended that individuals consult a tax professional or legal advisor for specific guidance and information regarding penalties related to Form 211.

How can I send irs form 211 2014 to be eSigned by others?

When your irs form 211 2014 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get irs form 211 2014?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the irs form 211 2014 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete irs form 211 2014 online?

Completing and signing irs form 211 2014 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.