NM TRD FID-1 2014 free printable template

Show details

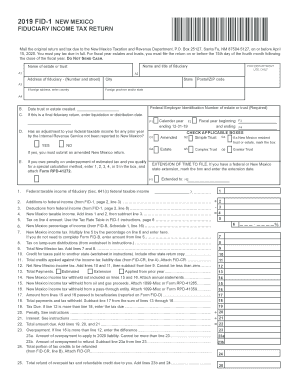

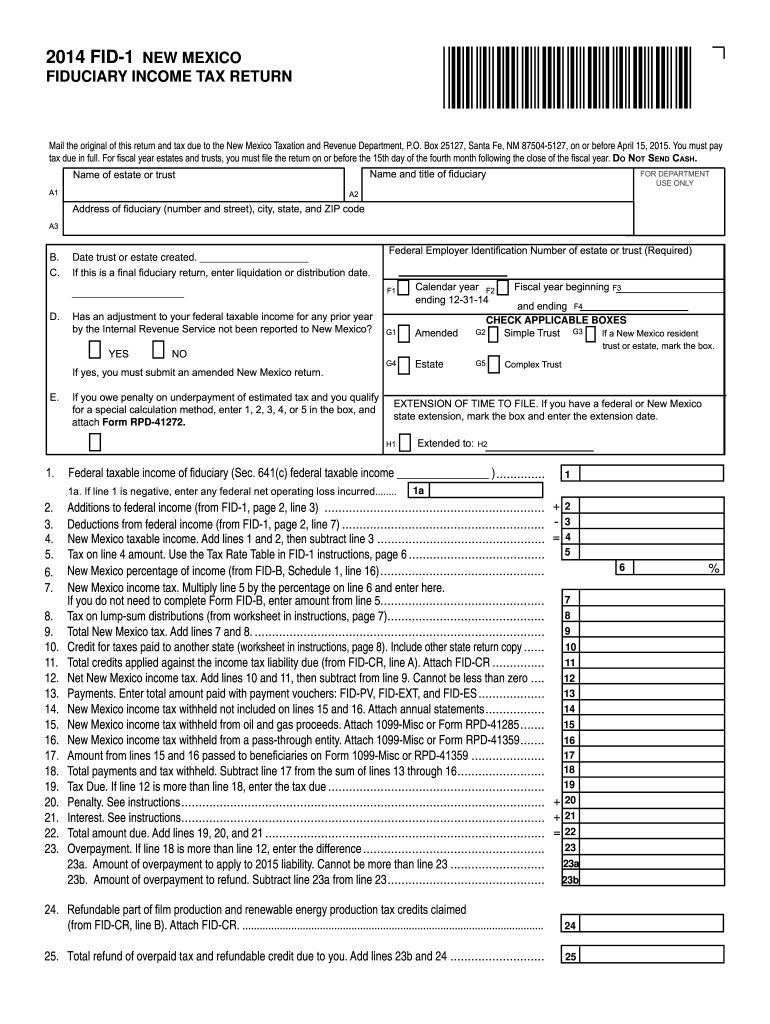

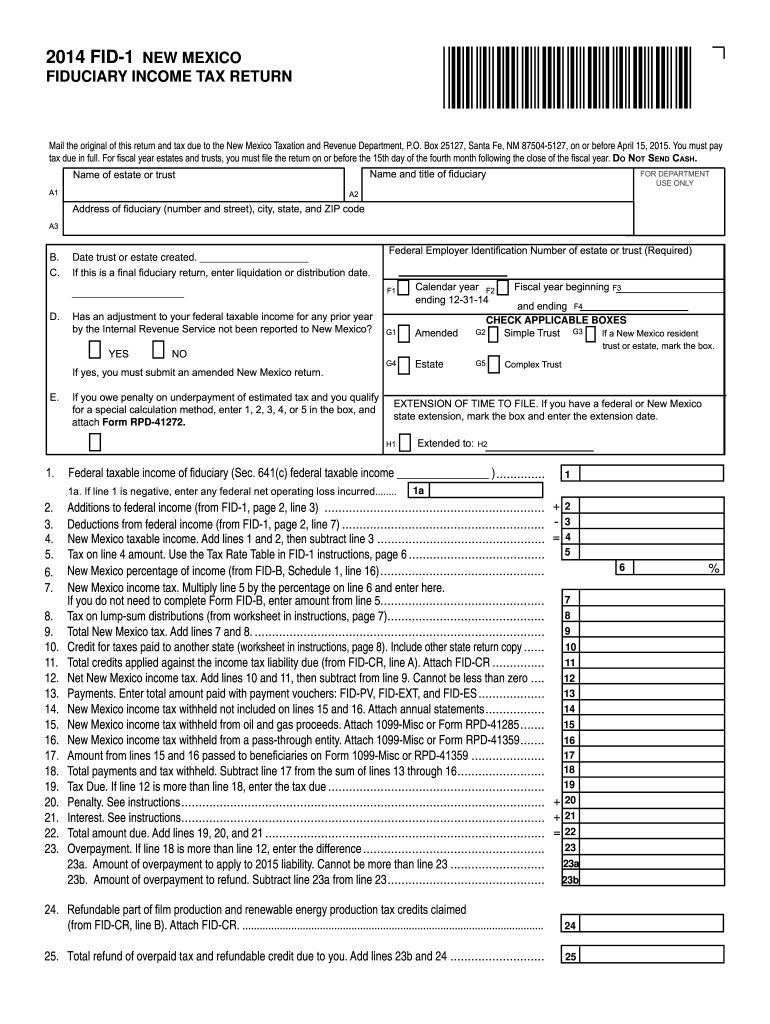

671-4 a is NOT required to file this Form FID-1 New Mexico Fiduciary Income Tax Return. REFUND EXPRESS 4. 3. Deductions from federal income from FID-1 page 2 line 7. 4. New Mexico taxable income. Add lines 1 and 2 then subtract line 3. 5. Tax on line 4 amount. Use the Tax Rate Table in FID-1 instructions page 6. 6. New Mexico percentage of income from FID-B Schedule 1 line 16. 2014 FID-1 page 2 NEW MEXICO FIDUCIARY INCOME TAX RETURN FEIN of estate or trust ADDITIONS TO FEDERAL INCOME FOR...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD FID-1

Edit your NM TRD FID-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD FID-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NM TRD FID-1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NM TRD FID-1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD FID-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD FID-1

How to fill out NM TRD FID-1

01

Obtain a copy of the NM TRD FID-1 form from the New Mexico Taxation and Revenue Department's website.

02

Fill in your taxpayer identification information, including your name, address, and Social Security Number or Employer Identification Number.

03

Indicate the type of business entity you are operating (e.g., sole proprietorship, partnership, corporation).

04

Provide information about your business start date and the nature of your business.

05

Complete the sections regarding ownership, including the names and addresses of all owners or partners.

06

If applicable, provide information about any previous tax identification numbers you may have had.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form to the appropriate department as indicated in the instructions.

Who needs NM TRD FID-1?

01

Any business entity operating in New Mexico that requires a new tax identification number must fill out the NM TRD FID-1 form.

02

New sole proprietors, partnerships, LLCs, and corporations need to file the FID-1 to register for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file a NM tax return?

If you are a New Mexico resident, you must file if you meet any of the following conditions: You file a federal return; You want to claim a refund of any New Mexico state income tax withheld from your pay, or. You want to claim any New Mexico rebates or credits.

Does New Mexico require state income tax?

New Mexico has a graduated individual income tax, with rates ranging from 1.70 percent to 5.90 percent. New Mexico also has a 4.8 percent to 5.9 percent corporate income tax rate.

Can I file my tax return by myself?

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It's safe, easy and no cost to you for a federal return.

Where can I get NM state tax forms?

You can also find printed forms: At your local District Office. See the CONTACT US link at the top of this page. At your local library. Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or. You can call 1-866-285-2996 to order forms to be mailed.

Do I have to file a state tax return in New Mexico?

New Mexico's law says every person who has income from New Mexico sources and who is required to file a federal income tax return must file a personal income tax return in New Mexico.

How much do you have to make to file taxes in New Mexico?

For single filers, anyone earning $36,667 or less may claim this exemption. For married persons filing separately, the cutoff is $27,500. For married persons filing jointly or heads of household, the cutoff is $55,000.Income Tax Brackets. Married, Jointly FilingNew Mexico Taxable IncomeRate$315,000+5.90%4 more rows • Jan 1, 2021

How do I file gross receipts tax in New Mexico?

If you need assistance, call 1-866-809-2335. Once you're online filing your return, you can also pay online. For no additional charge, you may pay using an electronic check that authorizes the Department to debit your checking account in the amount and on the date you specify.

How do I file my gross receipts tax in New Mexico?

If you need assistance, call 1-866-809-2335. Once you're online filing your return, you can also pay online. For no additional charge, you may pay using an electronic check that authorizes the Department to debit your checking account in the amount and on the date you specify.

Can you buy tax forms?

You can order the tax forms, instructions and publications you need to complete your 2021 tax return here. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2022.

How do I report gross receipts?

If you operate your business as a Sole Proprietorship or a single-member Limited Liability Company (LLC), gross receipts go on Schedule C of your IRS Form 1040.

Do I have to file a Mexico tax return?

Tax returns All residents receiving income during the calendar year are required to file an annual tax return no later than 30 April of the succeeding year, except in certain cases. When an individual earns Mexican bank interest only, and it is less than MXN 100,000 per year, no tax return filing is required.

Do I have to file a New Mexico state tax return?

New Mexico's law says every person who has income from New Mexico sources and who is required to file a federal income tax return must file a personal income tax return in New Mexico. You must also file a New Mexico return if you want to claim: a refund of New Mexico state income tax withheld from your pay, or.

Who must file a NM tax return?

If you are a New Mexico resident, you must file if you meet any of the following conditions: You file a federal return; You want to claim a refund of any New Mexico state income tax withheld from your pay, or. You want to claim any New Mexico rebates or credits.

Is New Mexico gross receipts tax deductible?

(Available July 1, 2018 until July 1,2022). Gross receipts are taxable, exempt, or deductible. If your receipts do not fall under any exemption or deduction, those receipts are taxable.

When can I file my New Mexico state taxes?

New Mexico State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a NM state return). Attention: The New Mexico tax filing and tax payment deadline is April 18, 2023.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NM TRD FID-1 to be eSigned by others?

Once your NM TRD FID-1 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get NM TRD FID-1?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the NM TRD FID-1 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make edits in NM TRD FID-1 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your NM TRD FID-1, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is NM TRD FID-1?

NM TRD FID-1 is a tax form used for reporting certain financial information to the New Mexico Taxation and Revenue Department.

Who is required to file NM TRD FID-1?

Individuals or entities that engage in certain business activities in New Mexico and are required to report their financial information must file NM TRD FID-1.

How to fill out NM TRD FID-1?

To fill out NM TRD FID-1, gather the necessary financial information, complete the form with the accurate data as required, and submit it according to the provided instructions.

What is the purpose of NM TRD FID-1?

The purpose of NM TRD FID-1 is to provide the state with information needed for tax assessment, compliance, and record-keeping for business activities conducted within New Mexico.

What information must be reported on NM TRD FID-1?

NM TRD FID-1 requires reporting various financial details such as income, expenses, deductions, and any other relevant information pertaining to the taxpayer's financial activities in New Mexico.

Fill out your NM TRD FID-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD FID-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.