Who needs Form W-4P?

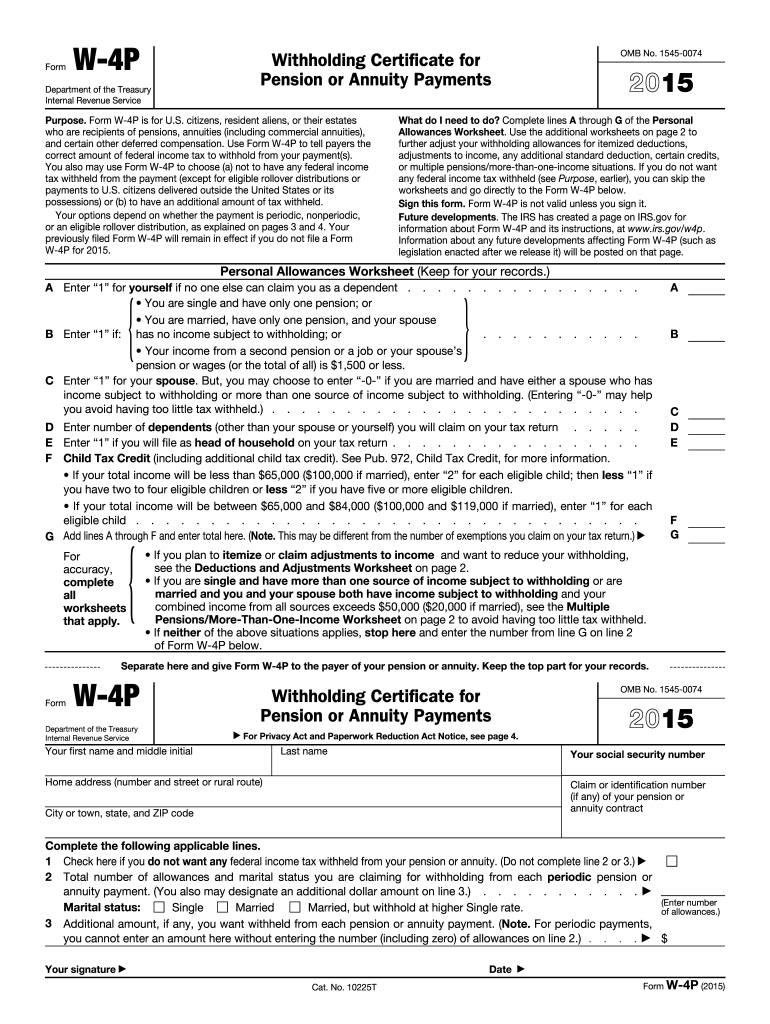

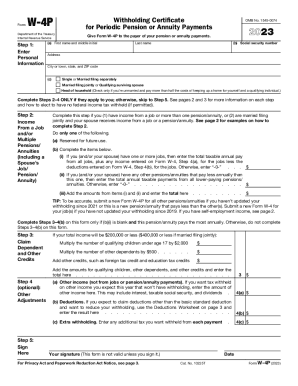

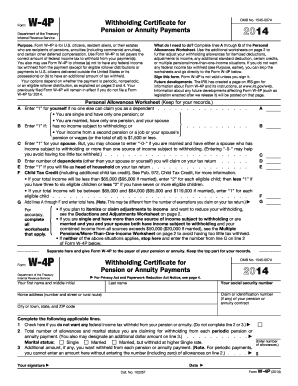

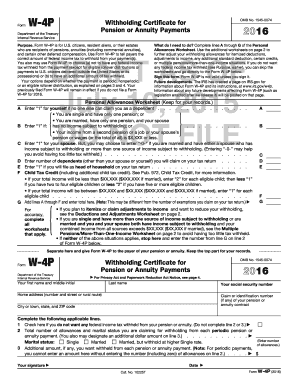

The W-4P form is the US Internal Revenue Service form also called the Withholding Certificate for Pension or Annuity Payments. The form is to be submitted by the U.S. citizens, resident aliens, or their estates who are recipients of pensions, annuities, and certain other deferred compensation and to inform their employer about the amount that must be withheld to cover the employee’s federal tax bill.

What is the purpose of the Withholding Certificate W-4P form?

The information the eligible employee provides on their completed form W-4P will be used by the employer to calculate how much to withhold for the employee’s federal income taxes for the regular payments.

When is the W-4P form due?

The form does have a defined due date for submission. However, the employer expects an eligible employee to fill out it and return it to them as soon as possible to prepare the W-2 form for the employees and pay the due taxes within established deadlines.

Is the W-4P form accompanied by any other documents?

The form is one of the versions and supplements of W-4 form, which is the Employee's Withholding Allowance Certificate. The information provided on W-4 must be adjusted to the data indicated on W-4P.

How do I fill out the form?

The employee must cover the following details on Personal Allowances Worksheet:

-

The household dependent;

-

Number of defendants;

-

Child Tax Credit details.

This form’s part must be retained for the filer’s records.

The next part of the form is the Withholding Certificate for Pension or Annuity Payments itself.

It requests the following data:

-

Full name and SSN of the employee;

-

Address;

-

Total number of allowance;

-

Marital status;

-

Deductions and adjustments;

-

Information about Multiple Pensions (or More-Than-One-Income).

For the filer’s assistance, there are also comprehensive instructions at the end of the form.

Where to send the filled out form W-4P?

It must be directed to the employer upon completion.