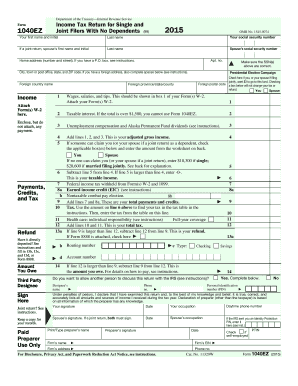

IRS Instruction 1040-EZ 2015 free printable template

Get, Create, Make and Sign

How to edit 2015 1040ez form online

IRS Instruction 1040-EZ Form Versions

How to fill out 2015 1040ez form

How to fill out 2015 1040ez form:

Who needs 2015 1040ez form:

Instructions and Help about 2015 1040ez form

Okay welcome to this video tutorial on how to complete a basic form 1040 for the 2021 tax year now I'm going to be going through this tutorial using the drake tax software platform now obviously if you're watching this you don't need to have drake tag software to follow along here whether you're using turbo tax Hubert any kind of free file program or you're just filling the forms out by hand you're still going to be able to get a lot of utility out of this because what I'm going to do is as I enter the information we're going to explain all the information, and then I'm going to always flip back to the forms, so you can see how the data is being transferred to the return itself so as you're preparing this in your own software platform if you go back and look at the form itself to make sure that everything is lining up the way it should be then you're then you'll be good to go, so again I've got drake tax software in front of us this is the forum view we're going to work with our taxpayer here john q uh doe...

Fill form : Try Risk Free

People Also Ask about 2015 1040ez form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 2015 1040ez form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.