2013 1040ez

What is 2013 1040ez?

The 2013 1040ez is a simplified form for individual taxpayers to report their income, claim deductions, and calculate their federal tax liability for the year 2013. It is designed for taxpayers who have straightforward financial situations and meet certain eligibility criteria. With the 2013 1040ez form, taxpayers can quickly and easily file their taxes without dealing with complicated calculations or extensive documentation.

What are the types of 2013 1040ez?

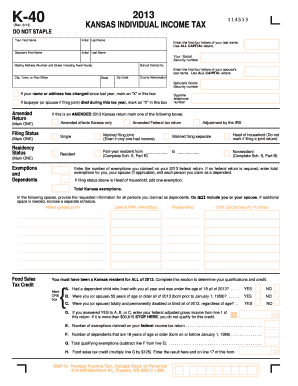

There are three types of 2013 1040ez that taxpayers can choose based on their specific circumstances: 1. Single and Joint Filers With No Dependents: This type is for individuals who are filing as single or married filing jointly without any dependents. It is suitable for taxpayers who do not have any qualifying children or dependents. 2. Head of Household: This type is for taxpayers who qualify as head of household and have dependents. It provides additional tax benefits for individuals who financially support a household. 3. Qualifying Widow(er) with Dependent Child: This type is for individuals who have lost their spouse and meet certain conditions to be considered a qualifying widow or widower. It allows them to file as a head of household and claim additional tax benefits.

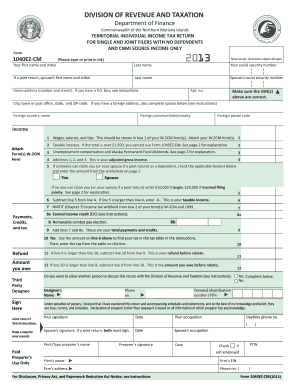

How to complete 2013 1040ez

Completing the 2013 1040ez form is a straightforward process. Here are the steps you need to follow: 1. Gather your financial information: Collect all the necessary documents, such as your W-2 forms, 1099 forms, and any other income or deduction-related documents. 2. Provide personal information: Fill in your name, address, Social Security number, and other personal details as required. 3. Fill in your income: Enter your income from wages, salaries, tips, and other sources as specified in the form. 4. Claim deductions: If you qualify for any deductions, such as student loan interest or IRA contributions, make sure to accurately report them. 5. Calculate your tax liability: The 2013 1040ez form provides a simplified tax calculation table. Follow the instructions to determine your federal tax liability based on your income. 6. Double-check and sign: Review all the information you have entered to ensure its accuracy. Sign and date the form before sending it to the appropriate tax authority.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.