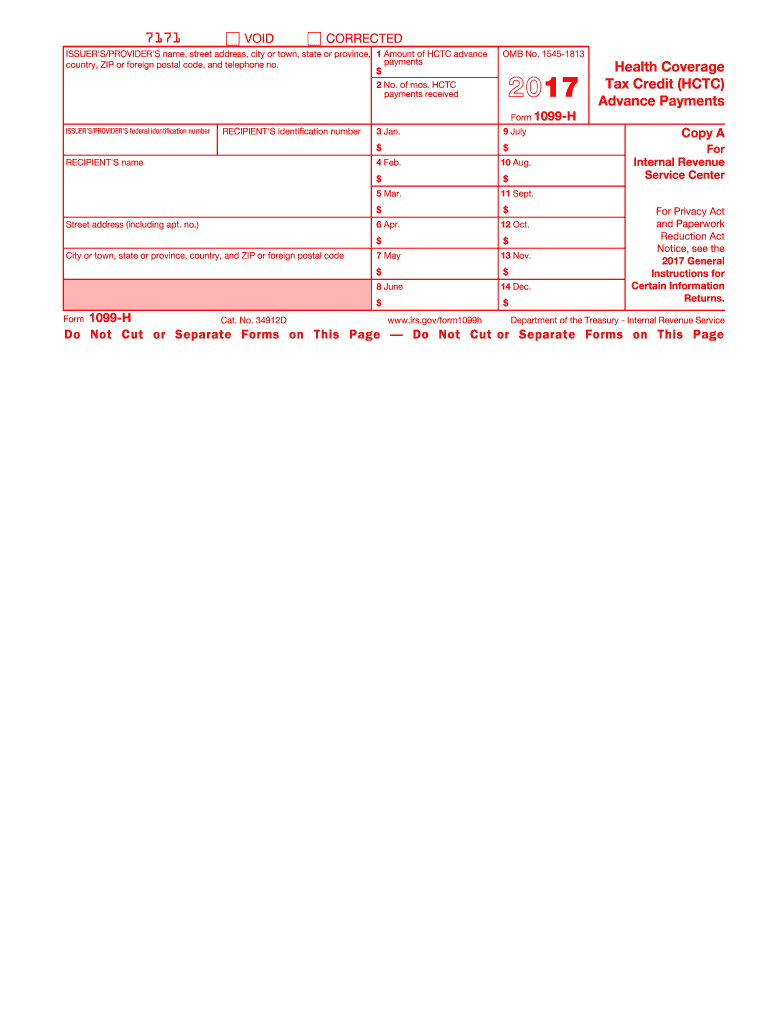

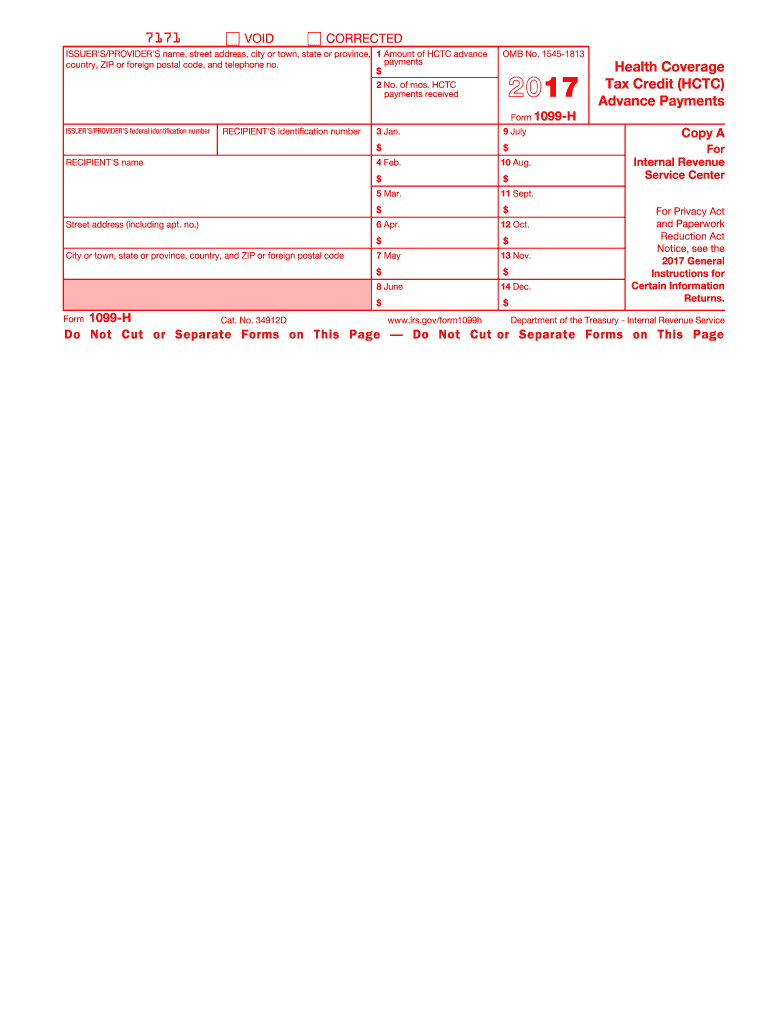

IRS 1099-H 2017 free printable template

Get, Create, Make and Sign

Editing issuersproviders federal identification number online

IRS 1099-H Form Versions

How to fill out issuersproviders federal identification number

Who needs the issuers/providers federal identification number?

Instructions and Help about issuersproviders federal identification number

Today I want to take a look at a brand-new form for small business for all businesses it's called the 1099 NEC the non-employee compensation again it's a new form, and it's taken part of the information we were reporting on the 1099 miscellaneous and moving it to the NEC, but before we just jump into the form and how it's changed probably just a little of history of why you know it's one thing to say here's the form, but I think the other thing i kind of always want to know why so if I go back over 35 years ago there was actually a 1099 NEC an unemployed compensation and there were several other 1099s so as when we look back at that time they were looking at possibly electronics they were looking at trying to get all the information they could on one form, so they started aggregating it together as time moved on and that eliminated the 1099 NEC back again over 35 years ago, so this is an old form brought back to life, so today our focus is looking at what happened how is this created, so number one is that...

Fill form : Try Risk Free

People Also Ask about issuersproviders federal identification number

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your issuersproviders federal identification number online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.