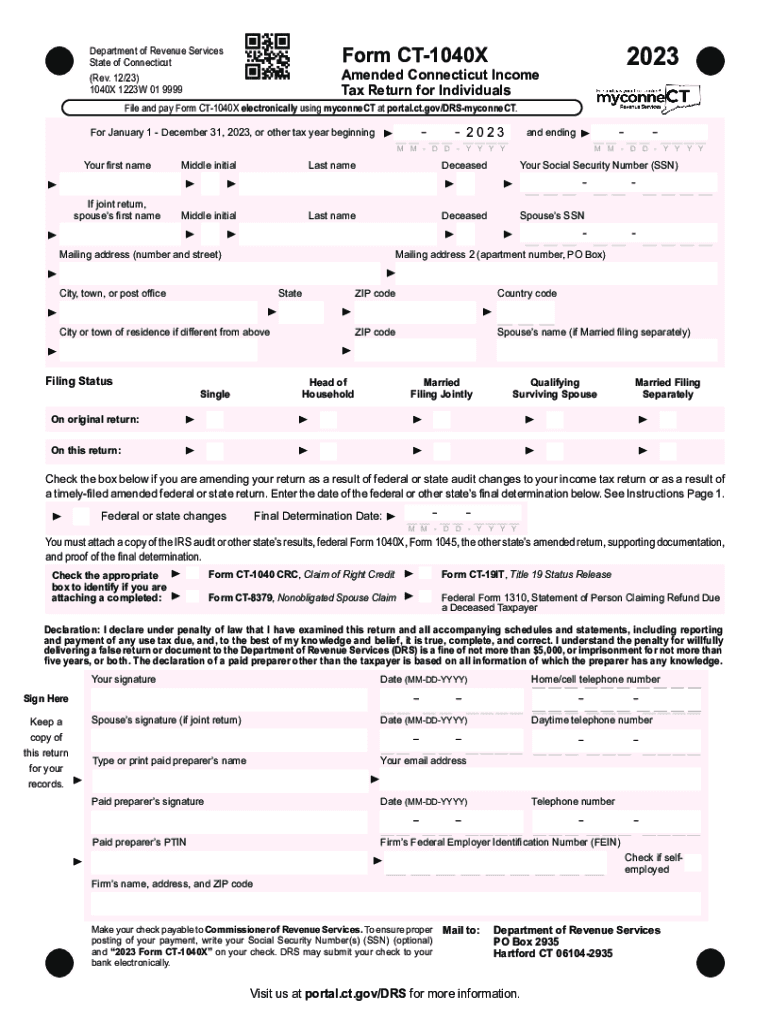

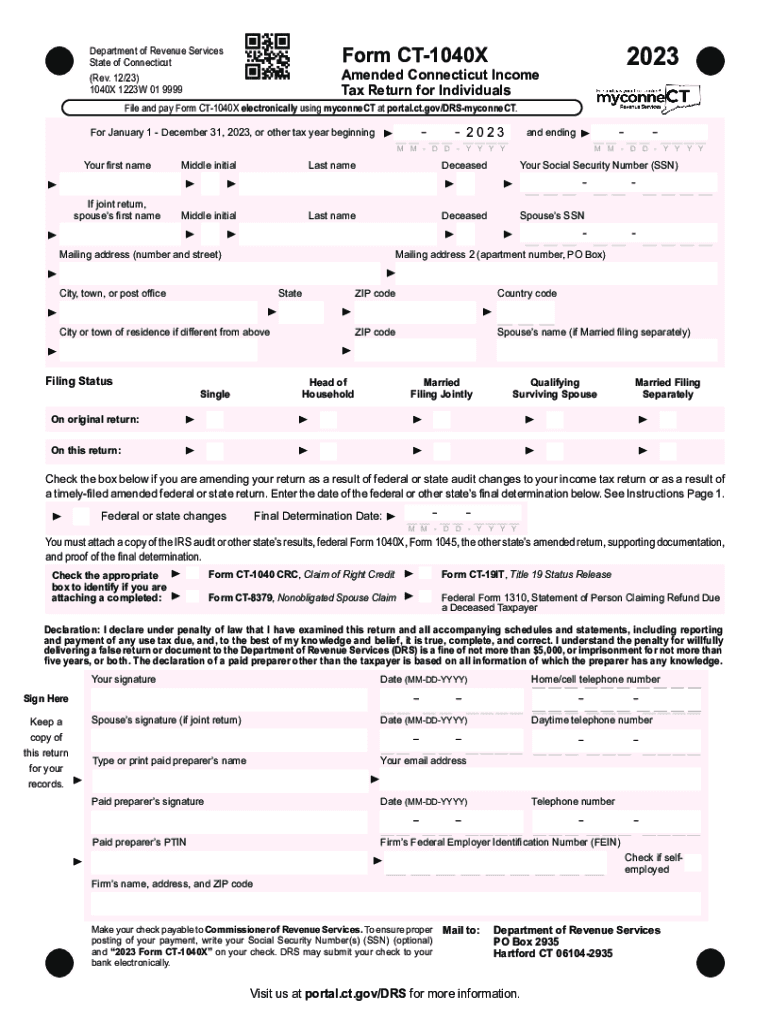

CT DRS CT-1040X 2023-2024 free printable template

Get, Create, Make and Sign

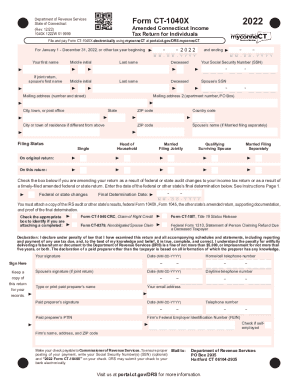

How to edit ct 2022 online

CT DRS CT-1040X Form Versions

How to fill out ct 2023-2024 form

How to fill out fill out and sign

Who needs fill out and sign?

Video instructions and help with filling out and completing ct 2022

Instructions and Help about you amended ct form

Laws calm legal forms guide farm CT dash 1040x amended Connecticut income tax return for individuals Connecticut full year and part your residents and non-residents use a form CT 1040x to amend and initially filed state income tax return this document is obtained from the website of the government of the state of Connecticut step 1 if you filed on a fiscal rather than calendar year basis enter its beginning and ending date to the top of the form step 2 and to your name and social security number provide the same information for your spouse if filing jointly step 3 give your mailing address if your city town and zip code of residence is different to enter it below provide your telephone number as well step 4 indicate your filing status on both your original return and thus amended return with checkmarks check the box where indicated if you are filing this amended return as a result of federal adjustments or adjustments made by another state check the applicable boxes of filing a form CT dash 1040 CRC or CT 83-79 step 5 lines one through 23 require you to complete three columns in column an enter the originally reported or last adjusted amount in column B and to the net increase or decrease between the original and corrected figures in column C and to the corrected figures enter your federal adjusted gross income on line one step 6 if you have any additions complete lines 31 through 39 and schedule one on the second page transfer the value from line 39 to line two on the front page add lines one and two and enter the sum on line three if you have any subtractions complete lines 40 through 50 in schedule 1 transfer the value from line 42 line for on the first page subtract line for from line 3 and into the difference on line 5 step 7 only non-residents and part year residents should complete line 6 through 9 all filers must compute their tax liability on lines 10 through 30 and explain the reasons for filing an amended return on the second page to watch more videos please make sure to visit laws calm

Fill ct 1040x form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ct 2023-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.