Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

An amended ct could refer to an amended court document or an amended court proceeding. In both cases, the term "amended" indicates that changes or modifications have been made to the original document or proceeding.

Who is required to file amended ct?

The individual or entity who needs to make changes or corrections to a previously filed income tax return is typically required to file an amended tax return. This includes individuals, businesses, and other entities such as partnerships or estates.

How to fill out amended ct?

To fill out an amended CT (Connecticut) state tax return, you can follow these steps:

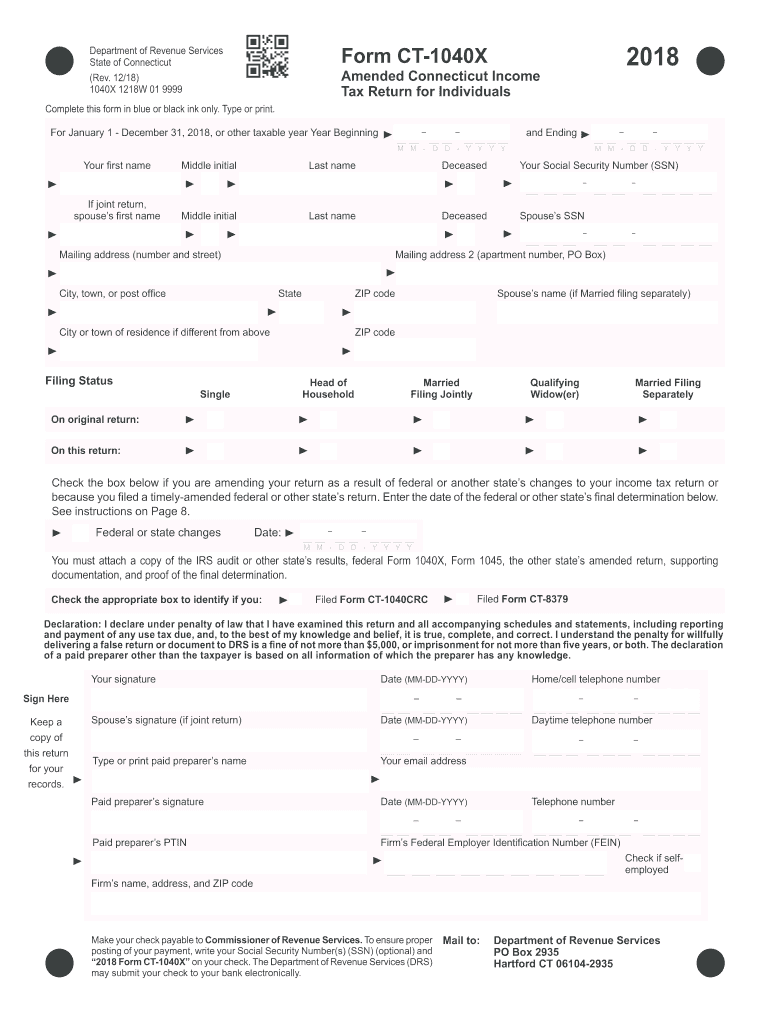

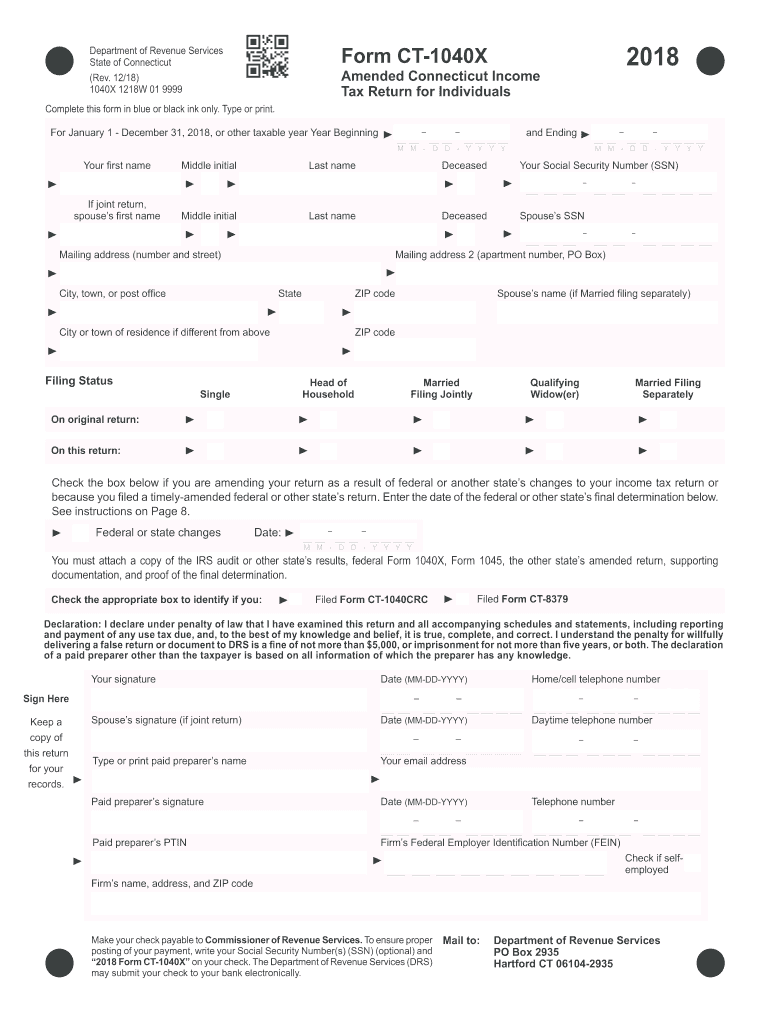

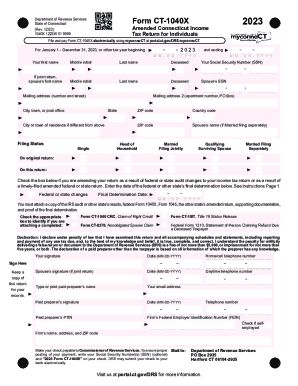

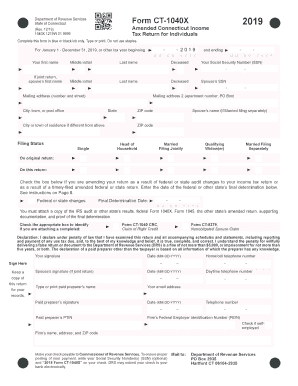

1. Obtain the necessary forms: To amend your CT state tax return, you will need to obtain the correct form, which is Form CT-1040X. You can download the form from the Connecticut Department of Revenue Services website.

2. Gather supporting documentation: Collect all the necessary supporting documentation, including any new or corrected tax forms, schedules, and any additional documentation that supports the changes you are making. This may include W-2s, 1099s, and other income or deduction documentation.

3. Complete the Form CT-1040X: Fill out the Form CT-1040X following the instructions provided on the form. Make sure to enter your personal information, such as name, address, Social Security number, filing status, and tax year you are amending.

4. Explain the changes: On the Form CT-1040X, there is a section where you have to explain the changes you are making and the reasons for amending your return. Use this space to clearly and concisely explain the adjustments you are making and provide the necessary details.

5. Calculate the new tax liability: Determine the new tax liability based on your corrected information. This may result in a refund or a balance due. Use the instructions provided on the Form CT-1040X to calculate the correct tax amount.

6. Submit the amended return: After completing the Form CT-1040X, make sure to sign and date it. Include all supporting documentation and a copy of your original tax return. Mail the completed amended return to the Connecticut Department of Revenue Services at the address provided on the form.

7. Keep copies for your records: Before mailing, make copies of all the documents you are submitting for your own records. This includes a copy of the amended return, supporting documentation, and your original tax return.

Please note that these steps are a general guide, and it is recommended to consult the specific instructions provided on the Form CT-1040X and the Connecticut Department of Revenue Services website for any additional requirements or changes in the process.

What is the purpose of amended ct?

The purpose of an amended CT, or amended complaint, is to correct or modify the original complaint filed in a lawsuit. It allows the plaintiff to address any errors, omissions, or new information that was not included in the initial complaint. The amended CT is usually filed after the defendant has responded to the original complaint and serves to update the court and parties involved on the revised claims or allegations.

What information must be reported on amended ct?

When filing an amended tax return (Form 1040X), you must include the following information:

1. Your personal information: Full name, Social Security number, and mailing address.

2. Filing status: Indicate your correct filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er)).

3. Tax year: Specify the year for which you are making the amendment (e.g., "Amended return for tax year 2020").

4. Explanation for the amendment: Provide a clear and detailed explanation of why you are amending your return. This could include changes to your income, deductions, credits, or corrections to errors made on the original return.

5. Income adjustments: Clearly state the specific changes you are making to your reported income, such as additional income received or income previously reported incorrectly.

6. Deductions and credits: Accurately report any changes to your deductions and credits. This may include adjustments to itemized deductions, education credits, retirement savings contributions, or other applicable tax breaks.

7. Supporting documentation: Attach any necessary supporting documentation to validate the changes made on the amended return. This might include W-2s, 1099s, receipts, or other relevant documents.

8. Tax calculation: Recalculate your tax liability based on the changes made to income, deductions, and credits. Provide a summary of the recalculated amounts, including any additional tax owed or overpayment to be refunded.

9. Signature: Sign and date the amended return to certify its accuracy. If the return is filed jointly, both spouses must sign.

Remember that every amendment is unique, and the required information may vary based on your specific circumstances. It's always advisable to consult with a tax professional or refer to the IRS instructions for Form 1040X for detailed guidance.

What is the penalty for the late filing of amended ct?

The penalty for the late filing of an amended CT (corrected tax) return can vary depending on the jurisdiction and the specific circumstances. Generally, late filing penalties can involve fines or interest charges. It is advisable to consult the specific tax laws and regulations of your jurisdiction to determine the exact penalty for late filing of an amended CT return. Additionally, consulting a tax professional or contacting the relevant tax authority could provide more accurate and specific information regarding penalties for late filing.

How do I edit amended ct straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit ct 1040x form.

How do I complete ct 1040x on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your amended ct form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I complete ct 1040x instructions on an Android device?

Use the pdfFiller Android app to finish your ct form 1040x and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.