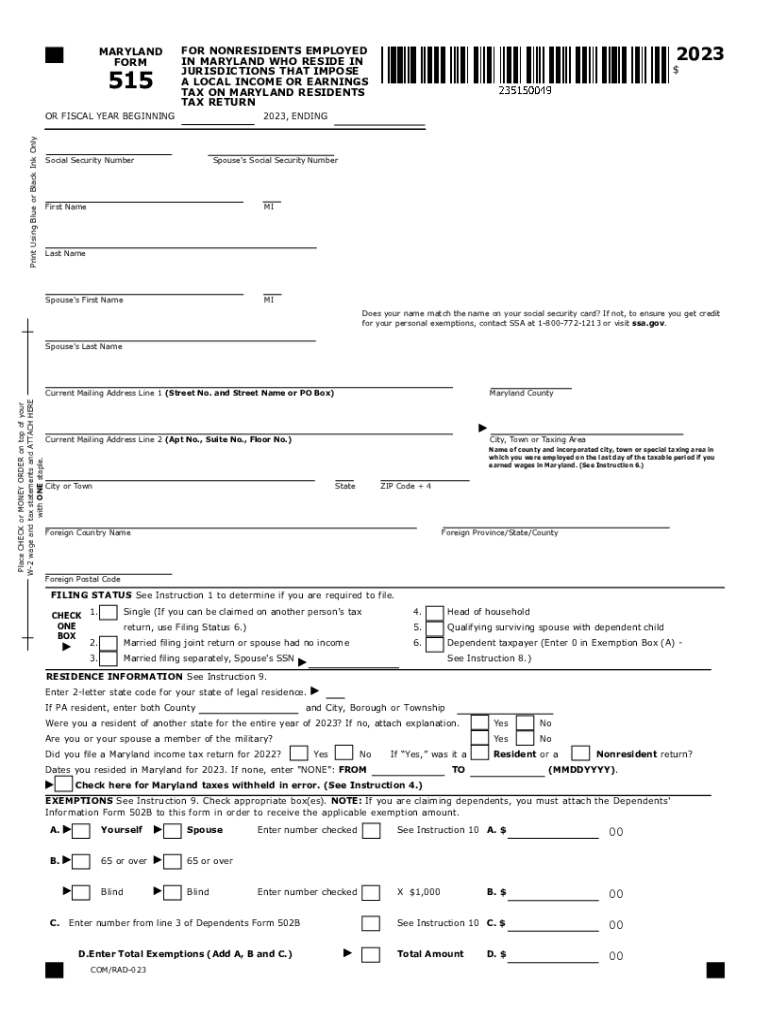

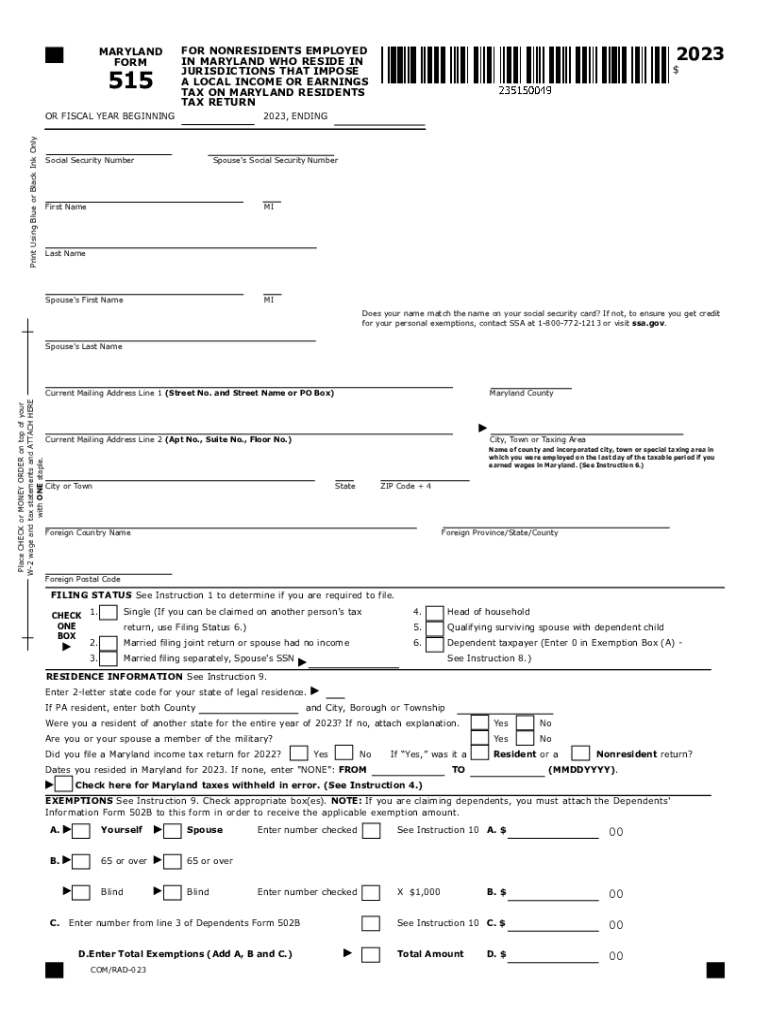

MD Comptroller 515 2023-2024 free printable template

Get, Create, Make and Sign

Editing local md 505 online

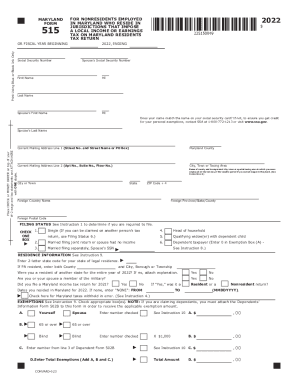

MD Comptroller 515 Form Versions

How to fill out local md 505 2023-2024

How to fill out 2023 maryland form 515

Who needs 2023 maryland form 515?

Video instructions and help with filling out and completing local md 505

Instructions and Help about tax md 515 form

In this training video we're going to be reviewing how to update your tax information in sage employee self-service as a reminder before we get started please remember that all hr forms must be done on a laptop computer or tablet hr forms are not compatible when using a mobile device such as a cell phone the first step is to log into sage employee self-service by entering your username and password and clicking log on remember if you've ever forgotten your username or password please use the username or password help link right here on the sign on page the home screen of your employees self-service page will look different depending on your role within the organization to find forms or any hr related paperwork you're going to use the left-hand menu bar find the section that says my menus and find hr forms and click whenever you would like to change information you're going to find the actions section and click the link that says start an action that applies to me from this screen you can find any of the hr forms that are currently available to you use the drop-down menu to select...

Fill tax maryland 515 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your local md 505 2023-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.