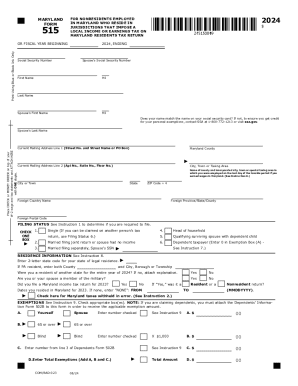

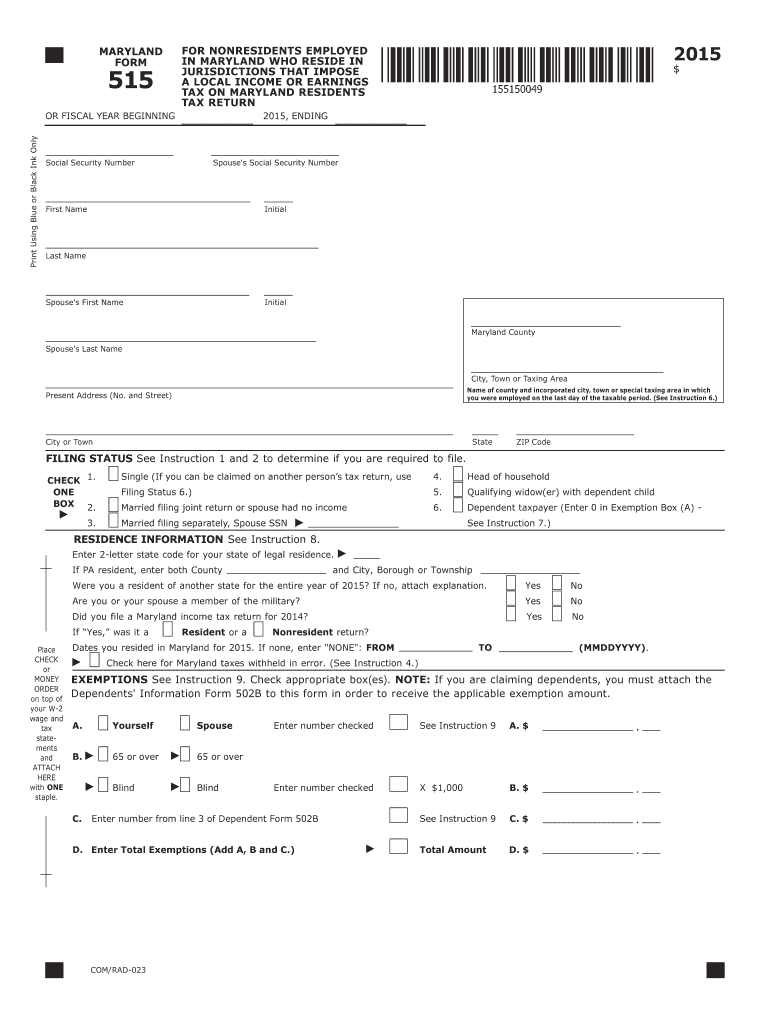

MD Comptroller 515 2015 free printable template

FAQ about MD Comptroller 515

What should I do if I need to correct mistakes on my MD Form 515 2015?

If you've realized there are mistakes on your MD Form 515 2015 after filing, you can submit an amended form. It’s crucial to indicate that it’s an amendment and to provide the corrected information clearly. Ensure you retain copies for your records and note the date of submission to maintain accurate tracking.

How can I verify the status of my MD Form 515 2015 filing?

To verify the receipt and processing of your MD Form 515 2015, check the e-filing portal if you submitted electronically, as it may provide real-time status updates. If you received a submission confirmation, keep that safe, as it serves as proof of your filing.

What are common errors when filing MD Form 515 2015 and how can I avoid them?

Common errors when filing MD Form 515 2015 include incorrect taxpayer identification numbers and mismatches between filed amounts and reported transactions. To avoid these, double-check all entries, cross-reference with supporting documents, and possibly consult a tax professional before submission.

What should I do if I receive a notice regarding my MD Form 515 2015?

If you receive a notice or letter concerning your MD Form 515 2015, carefully read the document for instructions. You may need to provide additional documentation or clarify information. Respond promptly to avoid further complications. Ensure you keep copies of all correspondence for your records.