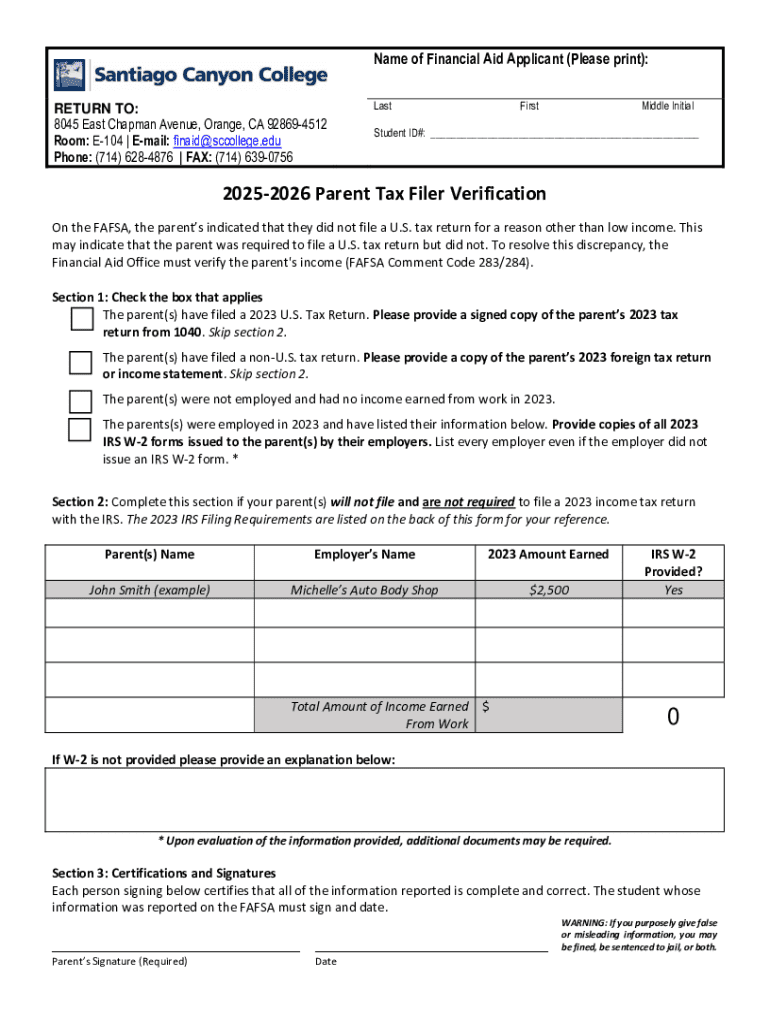

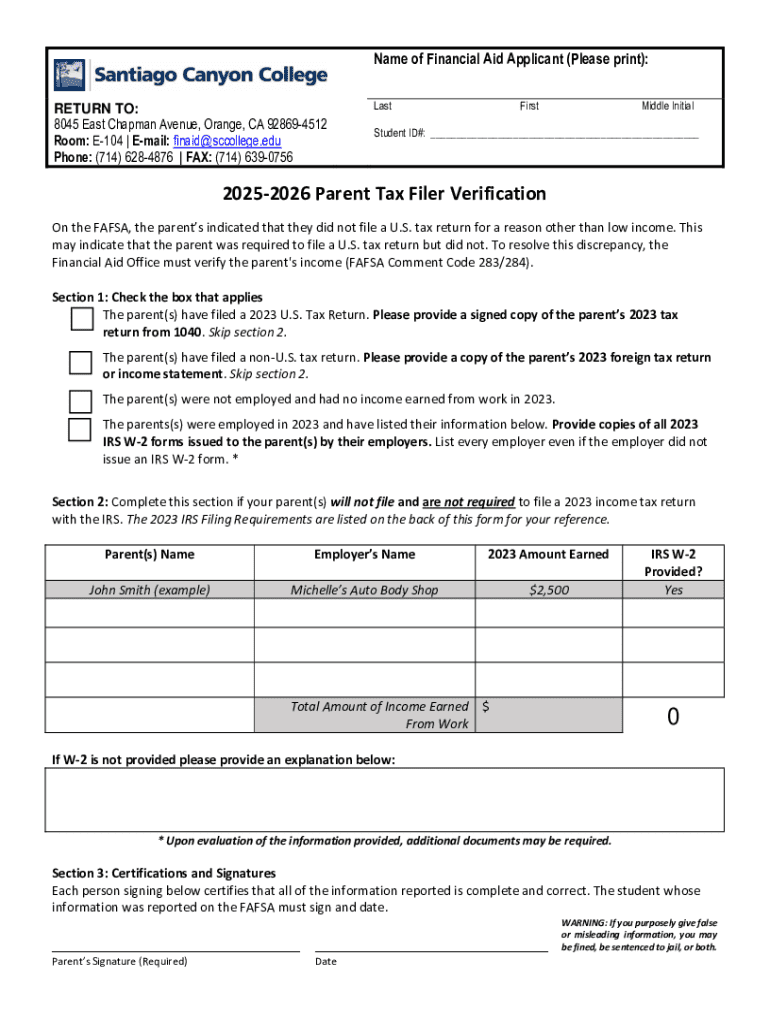

Get the free 2025-2026 Parent Tax Filer Verification

Get, Create, Make and Sign 2025-2026 parent tax filer

How to edit 2025-2026 parent tax filer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 parent tax filer

How to fill out 2025-2026 parent tax filer

Who needs 2025-2026 parent tax filer?

2 Parent Tax Filer Form: A Comprehensive Guide

Understanding the importance of the 2 parent tax filer form

The 2 parent tax filer form is more than just an official document; it plays a crucial role in determining tax implications and financial aid opportunities for families. It's imperative for parents to understand its significance, especially in managing family finances effectively. Filing correctly can influence eligibility for various aid programs and tax credits designed to support dependent children.

Parents need this form to claim dependents and manage their tax obligations faster and more efficiently. A well-prepared filing can also positively affect a child's financial aid applications for college, as many institutions consider the family's financial situation based on the information reported in the tax forms.

Who should file?

Eligibility to file the 2 parent tax filer form primarily depends on whether you are legally responsible for a child who qualifies as a dependent. If parents are living together and fulfilling the criteria, it’s essential that both parents actively participate in filing to maximize benefits. Additionally, the parent(s) filing can greatly influence whether the child receives available tax credits, such as the Child Tax Credit.

It's essential for parents to discuss residency statuses and whether any children are considered independent. Understanding these classifications can mitigate complications and errors during the filing process.

Key components of the 2 parent tax filer form

When preparing your 2 parent tax filer form, you'll encounter specific required information that ensures accuracy. Each parent must include their personal details—like name, Social Security number, and address—to authenticate their identity before processing. Furthermore, accurate reporting of dependent information including names, dates of birth, and their relationship to the parents is essential. This data establishes the legitimacy of claims and potential entitlements.

Another vital aspect of this form is income reporting. Parents need a breakdown of various types of income that are applicable to their tax situation. Depending on your employment or investment status, differences arise for parents, particularly those with varied income sources such as salaries, self-employment income, or investments.

Preparing to fill out the 2 parent tax filer form

Before diving into the preparation of your 2 parent tax filer form, assembling necessary documentation is crucial. Documents such as W-2 forms from employers, 1099 forms for additional freelance or investment income, and any other relevant financial statements will streamline the process of filling out personal and income information.

Reviewing the previous year’s tax filings is a smart practice as it helps identify any recurring deductions or credits, and it can provide a solid foundation for anticipating changes in tax situations. Make notes of any significant financial changes that could influence the current filing.

Step-by-step instructions for completing the form

Filling out the 2 parent tax filer form can feel daunting, but it can be broken down into manageable steps. Start with the personal details section, ensuring that names, Social Security numbers, and addresses are written clearly and correctly. Moving on to the income section is equally vital; accurately enter the types of income received, such as salaries and passive income sources. Make sure to provide the total income, as any inconsistencies can delay processing.

Deductions and credits available for parents should be explored in depth. Common deductions include the Child Tax Credit and the Earned Income Tax Credit. Avoid common mistakes during this stage—double-check entries, ensure all necessary fields are filled out, and consider using tax software that can automatically verify data accuracy to prevent errors.

Special circumstances and considerations

For parents living or earning income outside of the U.S., unique filing requirements come into play. In addition to reporting domestic income, foreign income must also be disclosed. This may involve additional forms such as the Foreign Earned Income Exclusion, which requires careful attention to avoid hurting one's financial standing.

Furthermore, for parents with multiple residency statuses – such as those residing in U.S. territories – the filing process can become more complex. Clarifying these details with tax professionals or utilizing tax guidance resources can save time and prevent costly mistakes, particularly when handling non-traditional income generated through gig economy channels.

Submitting the 2 parent tax filer form

Once your form is completed, the next step is submission. Parents have options regarding how to submit the 2 parent tax filer form—both electronic and paper filing methods are available. Electronic submission often comes with benefits such as immediate processing, reduced chances of errors, and easier tracking. Many software applications can assist in compiling and submitting forms with ease.

After submitting, tracking your submission is vital. Most electronic platforms provide confirmation of submission, but it's wise to keep copies of all created forms and documents. If any issues arise after filing, promptly address them by contacting the IRS or utilizing pdfFiller's document management solutions to easily access your submissions.

Post-submission considerations

After submitting the 2 parent tax filer form, families should understand the typical IRS responses. Generally, taxpayers can expect confirmation or a notice if any additional information is needed. It's essential to keep your contact information updated and monitor incoming mail for any necessary follow-ups or queries from the IRS.

In case you receive inquiries post-filing, respond promptly to maintain good standing with the IRS. pdfFiller can significantly ease document management by allowing users to organize tax documents in specified folders. Utilize eSigning capabilities to facilitate the process of collaboration among family members concerned about tax filings, making it easier to share insights and manage information effectively.

FAQs related to the 2 parent tax filer form

Navigating the specifics of the 2 parent tax filer form can lead to many questions. Commonly, parents inquire how to amend the form if mistakes are discovered post-filing. Generally, the procedure is straightforward; it involves submitting Form 1040-X to amend your tax returns. Ensure all corrections address previously reported inaccuracies.

Clarifications regarding specific tax terms or sections of the form can also arise. Do not hesitate to reach out for assistance through IRS resources or tax professionals. Many users benefit from online forums where common queries are discussed and resolved, contributing to improved understanding and reduced filing errors.

Interactive tools and resources

By leveraging pdfFiller's interactive tools, parents can streamline the form-filling process to ensure accuracy and efficient submissions. Utilize features that allow users to create and edit necessary forms, collaborating seamlessly with family members on completing tax documents, significantly easing the burdens of tax preparation.

The step-by-step walkthrough of the interactive features can offer guidance on creating customized documents and navigating templates specific to the 2 parent tax filer form. This real-time assistance is indispensable for those looking to avoid the common pitfalls associated with tax filings while empowering users to manage finances more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025-2026 parent tax filer to be eSigned by others?

Can I sign the 2025-2026 parent tax filer electronically in Chrome?

How do I edit 2025-2026 parent tax filer on an Android device?

What is 2025-2026 parent tax filer?

Who is required to file 2025-2026 parent tax filer?

How to fill out 2025-2026 parent tax filer?

What is the purpose of 2025-2026 parent tax filer?

What information must be reported on 2025-2026 parent tax filer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.