Last updated on

Jan 19, 2026

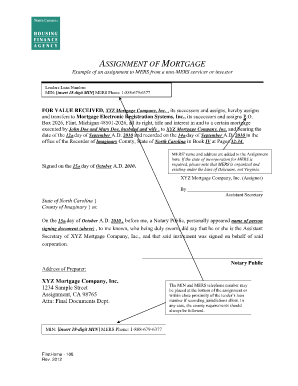

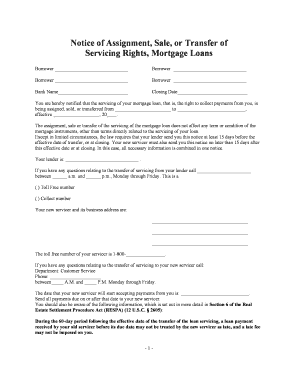

Customize and complete your essential Assignment Of Mortgage template

Prepare to streamline document creation using our fillable Assignment Of Mortgage template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

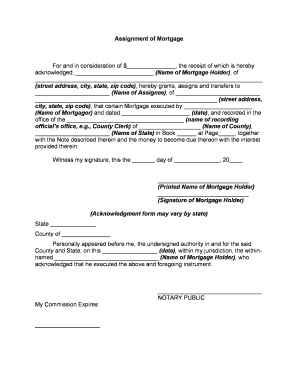

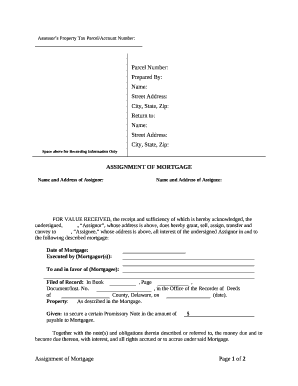

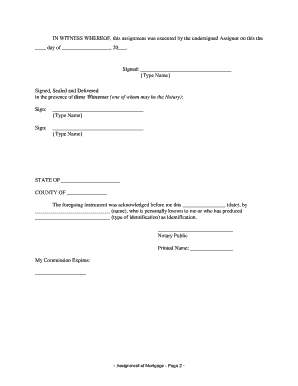

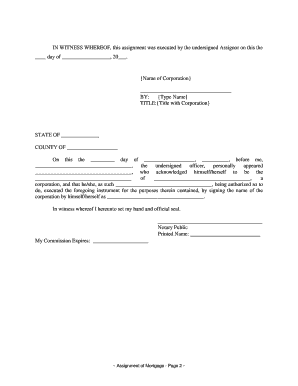

Customize Your Assignment Of Mortgage Template

Our Assignment Of Mortgage template is designed to meet your specific needs. You can easily customize it to ensure it fits your financial situation and legal requirements. This feature saves you time and reduces stress during the mortgage process.

Key Features

Fully customizable fields to fill in personal and financial details

User-friendly interface for easy navigation and editing

Guidance on legal requirements and best practices

Downloadable in multiple formats including PDF and Word

Secure online storage for your documents

Potential Use Cases and Benefits

Ideal for homeowners looking to transfer a mortgage

Useful for real estate professionals managing multiple properties

Valuable for legal advisors drafting mortgage agreements

Streamlines the process of mortgage refinancing or assumptions

Provides peace of mind knowing your documents are accurate and complete

This customizable Assignment Of Mortgage template resolves the common challenge of creating legal documents from scratch. By providing a structured and clear framework, it empowers you to efficiently draft your mortgage assignment. You maintain control over the information, avoiding the potential pitfalls of incomplete or incorrect documents.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to create a Assignment Of Mortgage

Creating a Assignment Of Mortgage has never been so easy with pdfFiller. Whether you need a professional document for business or individual use, pdfFiller provides an instinctive solution to build, customize, and handle your paperwork effectively. Utilize our versatile and fillable web templates that align with your specific requirements.

Bid farewell to the hassle of formatting and manual editing. Utilize pdfFiller to smoothly create accurate documents with a simple click. Begin your journey by using our comprehensive guidelines.

How to create and complete your Assignment Of Mortgage:

01

Create your account. Access pdfFiller by signing in to your account.

02

Search for your template. Browse our complete collection of document templates.

03

Open the PDF editor. Once you have the form you need, open it in the editor and utilize the editing tools at the top of the screen or on the left-hand sidebar.

04

Place fillable fields. You can pick from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Adjust your form. Include text, highlight information, add images, and make any required modifications. The intuitive interface ensures the process remains easy.

06

Save your edits. Once you are satisfied with your edits, click the “Done” button to save them.

07

Share or store your document. You can deliver it to others to sign, download, or securely store it in the cloud.

To summarize, creating your documents with pdfFiller templates is a straightforward process that saves you time and guarantees accuracy. Start using pdfFiller today to benefit from its robust capabilities and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

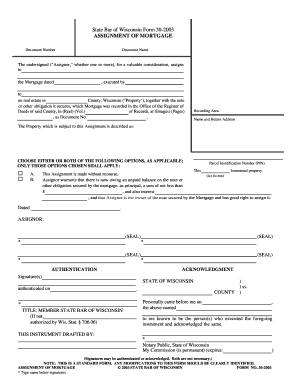

What happens if an assignment of a mortgage is not recorded?

Where a mortgage is involved, if there is no proper record that indicates who is the current holder of the note that gives the power to sell the property, a purchaser is at risk of purchasing an encumbered title.

What happens when a loan is assigned?

A loan assignment is a process undertaken by an institution to assign its rights relating to a borrower's loan to another entity. The institution relinquishes its rights to any share of payments collected for that loan after the loan has been successfully accepted and assigned.

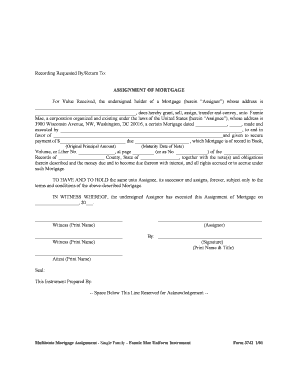

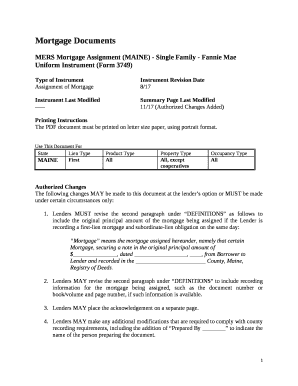

Who prepares the assignment of a mortgage?

The seller also prepares an assignment of mortgage to the new entity and, usually, records the assignment in the county records. An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

How do I release an assignment of a mortgage?

A recorded mortgage must be discharged by a certificate signed by the mortgagee, his personal representatives or assigns, acknowledged or proved and certified as prescribed by the chapter on “recording transfers,” stating that the mortgage has been paid, satisfied, or discharged.

Who can assign a mortgage?

Home mortgages are often assigned by their original lenders to other companies. Assignment usually doesn't change much for the borrower, except that the payments will go to a different address.

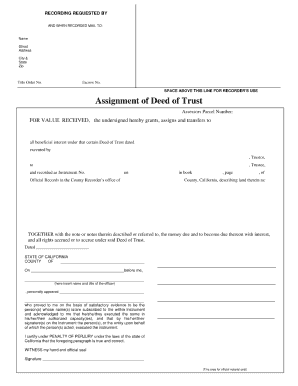

How does a mortgage assignment work?

An "assignment" is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded, and the promissory note is endorsed (signed over) to the new bank.

Does an assignment of a mortgage have to be recorded?

Civil Code section 2932.5, which mandates that an assignee of a mortgagee must record the assignment before exercising a power to sell the real property, only applies to mortgages and does not apply to deeds of trust. (Haynes v. EMC Mortgage Corporation (— Cal.

What does assignment mortgage mean?

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.

What is an assignable mortgage?

An assumable mortgage is an arrangement in which an outstanding mortgage and its terms are transferred from the current owner to a buyer. When interest rates rise, an assumable mortgage is attractive to a buyer who takes on an existing loan with a lower rate.

What is the purpose of an assignment of mortgage?

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.