Last updated on

Jan 19, 2026

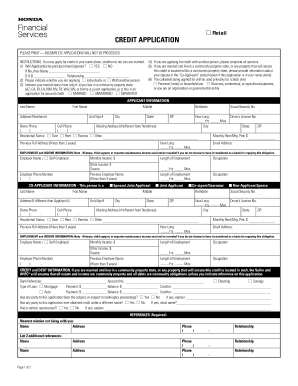

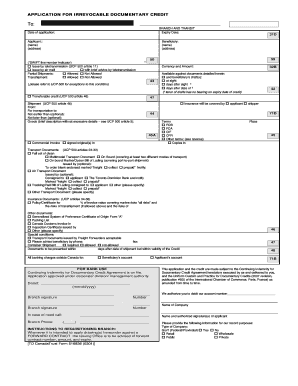

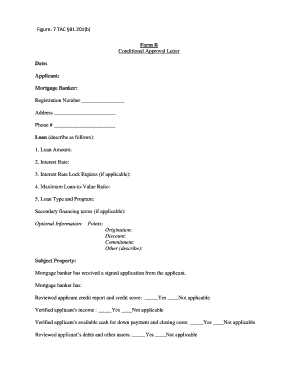

Customize and complete your essential Letter Approving Credit Application template

Prepare to streamline document creation using our fillable Letter Approving Credit Application template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

Customize Your Letter Approving Credit Application Template

Streamline your approval process with our easy-to-use Letter Approving Credit Application template. This tool allows you to personalize communications with applicants, ensuring clarity and professionalism in your message.

Key Features

Fully customizable templates to meet your specific needs

User-friendly interface for easy editing

Option to save and reuse previous letters for efficiency

Compatibility with various document formats

Guidance on necessary legal wording to include

Potential Use Cases and Benefits

Ideal for businesses issuing credit approvals or denials

Useful for financial institutions to maintain clear communication

Great for internal processes within organizations when handling credit applications

Helps establish trust with applicants through formal communication

This template directly addresses your need for a consistent and professional way to communicate credit decisions. By using our customizable features, you can ensure that your message aligns with your company’s tone and procedures. This not only enhances your reputation but also simplifies your work, allowing you to focus on other important tasks.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to create a Letter Approving Credit Application

Crafting a Letter Approving Credit Application has never been simpler with pdfFiller. Whether you need a professional document for business or individual use, pdfFiller provides an instinctive platform to generate, edit, and handle your documents efficiently. Use our versatile and editable web templates that line up with your specific requirements.

Bid farewell to the hassle of formatting and manual customization. Utilize pdfFiller to smoothly craft polished forms with a simple click. your journey by following our comprehensive guidelines.

How to create and complete your Letter Approving Credit Application:

01

Register your account. Access pdfFiller by logging in to your profile.

02

Search for your template. Browse our complete library of document templates.

03

Open the PDF editor. When you have the form you need, open it in the editor and utilize the editing instruments at the top of the screen or on the left-hand sidebar.

04

Add fillable fields. You can pick from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Adjust your form. Add text, highlight information, add images, and make any needed modifications. The intuitive interface ensures the procedure remains easy.

06

Save your edits. When you are happy with your edits, click the “Done” button to save them.

07

Share or store your document. You can send it to others to sign, download, or securely store it in the cloud.

To conclude, crafting your documents with pdfFiller templates is a smooth process that saves you efforts and guarantees accuracy. Start using pdfFiller today to benefit from its robust capabilities and effortless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

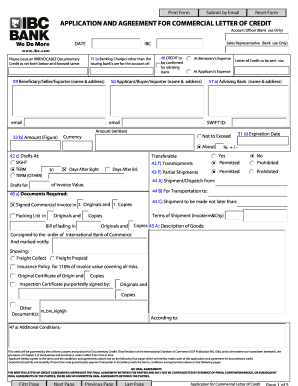

What is letter of credit Authorisation?

What is a Letter of Credit? A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.

How do I write a credit application letter?

The letter should be well-written, concise, and clearly articulate the reasons why you need the credit account, how you intend to use the credit, and how you plan to pay it back. A poorly written letter can undermine your credibility and decrease your chances of being approved for a credit account.

What is the approval basis of a letter of credit?

Definition: Approval basis is a letter of credit term used in situations where the beneficiary could not prepare the documents ing to the letter of credit terms and asks the presenting bank to send the documents to the issuing bank as it is by indicating each discrepancy.

What is an example of a customer approval letter?

I am pleased to confirm that your application has been approved, in ance with the agreed trading terms of our commercial Credit application, which has been handed to you. Your Account Number is 123456, and all future purchase order/payments/correspondence would quote this number to clearly identify your account.

What is the approval of letter of credit?

Generally, the whole loan approval process takes around 10-15 working days or even more in getting a letter of credit approved by the bank. Rest, it also depends on the buyer's relationship with the bank and nature of business along with business volume and types of goods.

How to write a credit approval letter?

I am happy to inform you that your line of credit has been approved. I am pleased to report that you qualify for our credit card. Your references reported favorably, and we are delighted to approve your application for a credit line. It is our pleasure to extend credit privileges to you.

What is letter of credit acceptance?

An acceptance credit is a type of letter of credit that is paid by a time draft authorizing payment on or after a specific date, if the terms of the letter of credit have been complied with. The bank "accepts" bills of exchange drawn on the bank by the debtor, discounts them and agrees to pay for them when they mature.

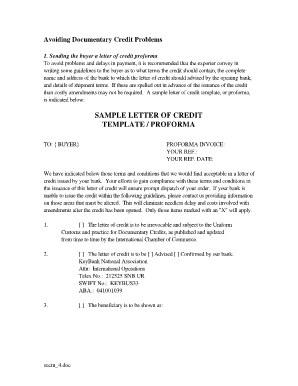

What makes a letter of credit confirmed?

What Is a Confirmed Letter of Credit? The term confirmed letter of credit refers to an additional guarantee to an original letter of credit obtained by a borrower from a second bank. It guarantees that the second bank will pay the seller in a transaction if the first bank fails to do so.

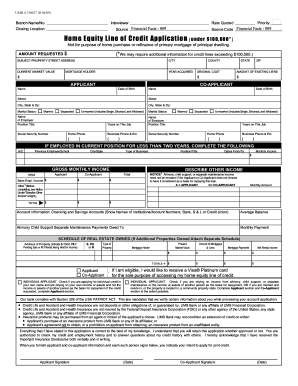

How to conduct a credit application?

The steps of the credit application process typically include submission of application, verification of information, credit analysis, decision-making, approval or denial, and establishment of credit terms.

How do you write a credit letter step by step?

How to Write a Letter of Credit Prepare the letter of credit documents, including the credit application, bank instructions, and the credit agreement. Make sure all documents are signed, dated, and include all necessary information. Submit documents to the issuing bank. Confirm that the bank has accepted the documents.

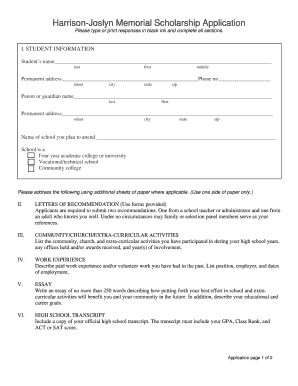

What is an example of application letter for credit officer?

[Hiring Manager's Name], I came across the job opening of a Credit Officer at XYZ Bank Ltd. As an experienced Credit Officer for two years at ABC Bank Inc., I believe that the combination of my academics, skills, and work experience are well-aligned with the qualities you're seeking for the particular role.

How do you write a credit letter explanation?

Letter of Explanation Template Provide all details the best you can, including correct dates and dollar amounts. Explain how and when all situations were resolved. If they are not resolved, explain that as well. Detail why problems won't happen again.

What is a credit approval letter?

Save. Copy. Credit Approval Letter means the letter addressed to the Customer from the Seller which confirms the Seller has opened a Credit Account and confirms the Maximum Limit.

How do I write an approval letter?

How to Write an Approval Letter The writing style should be friendly and relaxed - it can still be in a formal style for some types of approval letters, but the general tone should be warm. Open with the confirmation of the approval, and also give the reasons for the approval if it is appropriate for the context.